Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIt’s boom times at Anthem Inc. and other large health insurers, which are racking up record profits while thousands of other businesses, from restaurants to airlines, are struggling to stay afloat.

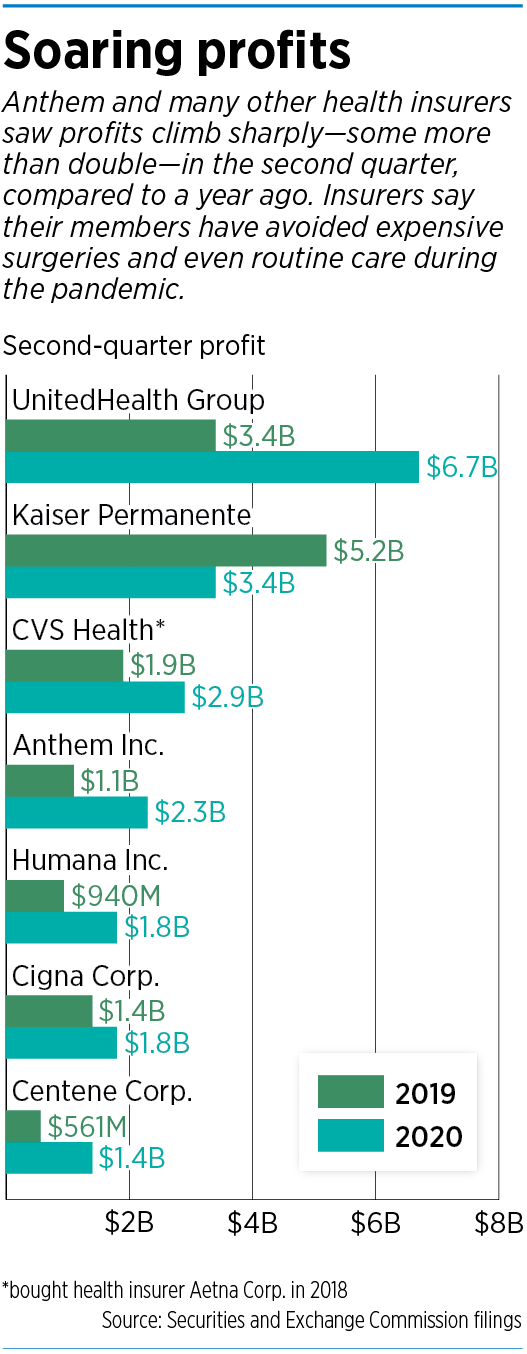

Many health insurers are reporting second-quarter earnings double what they were a year ago, as Americans are putting off expensive surgeries and even routine office visits during the pandemic.

The windfalls are raising protests from doctors, hospitals and patients, who say much of the country is financially drained after months of restrictions and countless bankruptcies and layoffs. They say the insurance industry should be using its billions of dollars in extra profits to help ordinary Americans during a health and economic crisis.

Already, Congress is stepping in to examine how health insurers are pulling in enormous profits. This month, the U.S. House Energy and Commerce Committee opened a probe of the industry and sent letters to Anthem, Cigna, CVS Health, Humana and UnitedHealth Group, demanding a swath of financial information.

Together, those five companies racked up $15.5 billion in profit during the second quarter, or 77% more than a year ago. Anthem alone posted profit of $2.3 billion, more than double the $1.1 billion amount from a year ago.

And the issue could take a big bounce during an election year, as some push for reforms in the health care system, including Medicare for all and other forms of single-payer coverage. The Biden-Harris presidential campaign calls for giving Americans the choice to buy a health insurance option like Medicare, which it says will reduce costs for patients by negotiating lower prices from hospitals and other providers, while covering primary care without co-payments. Such a move, if successful, could take a big bite out of the revenue and profits of the for-profit health insurance sector.

Some industry observers say the issue is revealing the U.S. health care system’s fragmentation. During the pandemic, some weaker hospitals have struggled to keep their doors open, and millions of Americans have lost their health insurance along with their jobs, while other players have seen profits pile up.

“The irony is that, while one part of the health care industry is in great profit, other parts, particularly smaller or rural facilities or even some primary care physicians, are facing very hard times,” said Nicolas P. Terry, executive director of the Center for Law and Health at the Indiana University Robert H. McKinney School of Law. “Indeed, many health care providers have furloughed staff. COVID-19 has, once again, exposed major structural flaws in our health care system.”

“That is not a good system,” Andy Slavitt, a health official in Barack Obama’s administration, tweeted on Aug. 6. “It’s a system designed for & by insurance companies & pharma companies. Not us. Not doctors and nurses.”

An aberration

The insurers, meanwhile, say the pandemic is a temporary event that caused an unexpected swelling of profit. Several, including Indianapolis-based Anthem, say they are working to put money back in the pockets of customers, communities and health care partners.

Anthem pointed out that it has waived all cost-sharing for COVID-19 diagnostic tests and treatment through Dec. 31, and waived cost-sharing for telehealth and phone visits through Sept. 30. In addition, it recently pledged $50 million over five years to focus on health disparities, racial inequalities, and other health challenges in Indiana, including food insecurity, mental health and housing. It announced a partnership with Gleaners Food Bank to provide more than 10 million meals as part of a $1 million matching gift.

“Over the past several months, Anthem has continued to take bold steps to directly support those who need our help,” Anthem CEO Gail Boudreaux told analysts during a conference call on July 29, the day the company announced its record profits.

UnitedHealthcare, the largest player in the $1.2 trillion-a-year industry, also said it has waived cost-sharing for COVID-19 testing and treatment, while investing more than $100 million in community-based philanthropic efforts. It said it has accelerated $2 billion in payments to providers.

UnitedHealthcare, the largest player in the $1.2 trillion-a-year industry, also said it has waived cost-sharing for COVID-19 testing and treatment, while investing more than $100 million in community-based philanthropic efforts. It said it has accelerated $2 billion in payments to providers.

“As we stated previously, any financial impact to us is temporary, as we already are seeing more people seek more care in the second half of 2020,” said Anthony Marusic, a spokesman for the suburban-Minneapolis company. “We remain committed to correcting any imbalances that may continue in the months to come, and to providing additional rebates to customers and members as appropriate.”

Industry association America’s Health Insurance Plans said the cushion private insurers are now sitting on is likely to be temporary, as costs eventually swell into the billions of dollars to treat COVID-19 patients.

The Washington, D.C.-based group, which spent more than $100 million in 2008 and 2009 in an unsuccessful effort to prevent passage of President Barack Obama’s Affordable Care Act, said insurers will need the money in coming years to pay big claims.

“While much is still to be learned, initial numbers are staggering, as the estimated treatment costs for COVID-19 range from $30 [billion] to $547 billion over a two-year time period,” the group said in an Aug. 7 blog post on its website.

Some analysts point out that insurers are losing hundreds of thousands of customers during the pandemic, as companies go out of business or lay off workers, ending employer-based health benefits. Anthem, for one, saw membership in its commercial sector drop by 290,000, or about 2%, in the second quarter. At the same time, membership in its Medicaid plans climbed about 7%, and Medicare plans rose 1.4%.

“Anthem is performing well on key strategic goals, including … more diversified medical enrollment,” Jefferies analyst David Windley wrote to clients on July 29.

Regulatory compliance

It’s not just up to insurers to decide how much to give to members. Under the Affordable Care Act, insurers are required to spend 80 cents of every dollar they collect on health care claims (or 85 cents if an organization has more than 100 employees). If the insurer falls short for any reason, it must give members a credit at the end of the plan year.

In the second quarter, Anthem paid only 78 cents for every dollar collected, down from 87 cents in the same period a year ago. It blamed much of the decrease on customers deferring expensive surgeries and other procedures during the pandemic. In many states, including Indiana, governors ordered hospitals to suspend elective procedures for several months to save resources for a possible huge influx of COVID-19 patients.

UnitedHealthcare and Aetna spent just 70 cents of every dollar on claims in the quarter. The figure, when expressed as a percentage, is known as medical-loss ratio, one of the closest-watched figures in the industry.

To make up for the shortfall, Anthem said, it provided a one-month premium credit to members enrolled in certain individual plans and fully insured employer group customers, in amounts ranging from 10% to 15% of monthly premiums. It also provided a one-month, 50% premium credit to individuals in stand-alone and group dental plans. However, many employer groups buy self-insured plans and thus haven’t qualified for credits.

“While much remains uncertain, we are guided by our values and are firmly committed to rectifying further imbalances for the benefit of our consumers,” Anthem Chief Financial Officer John Gallina told investors last month.

Some health-benefits administrators in Indiana say Anthem, UnitedHealthcare and other big health insurers are starting to give credits to employers in the middle of the plan year.

“It’s a goodwill gesture. It’s a ‘help-our-clients gesture,’” said Paul Ashley, senior vice president at FirstPerson Advisors in Indianapolis. “It’s also a ‘get-ahead-of-the-rebate’ gesture.

“Because if they don’t do it now, they’re going to have to do it at the end of the year [because of] medical-loss ratio rules.”

He pointed out that the money, when refunded to employers, often trickles down to employees in the form of payroll contribution holidays.

Sharing the wealth

Yet some influential players in the Indiana health care scene say Anthem and other insurers need to do more. The Indiana State Medical Association, which represents more than 8,500 physicians and medical students, says many of its members are struggling and could use help as patients are staying home or forgoing elaborate procedures.

Some Indiana doctors saw patient visits drop as much as 90% during the height of the health crisis. The association is asking for “relief”—a financial booster shot—to help doctors weather the storm.

“We look forward to working together with payers, including Anthem, to ensure medical practices have the relief and revenue flow necessary to keep their doors open,” said Julie Reed, executive vice president of the Indianapolis-based association.

“Hoosiers need to know their doctors will be there for them to treat their everyday health concerns that may have been neglected due to the pandemic.”

The Indiana Hospital Association, which represents hundreds of hospitals across the state, seconded the notion that Hoosiers need relief. It said health insurers are in a position to throw customers a lifeline during a time many employers and workers are struggling with growing bills and declining income.

“When we look at the level of these profits, there’s clearly an opportunity for the insurers to deliver some relief to average Hoosiers and to businesses,” said Brian Tabor, the hospital association’s president. “So I think it’s something that definitely bears real scrutiny.”

He pointed to a study the hospital association recently commissioned that shows many Hoosiers think health insurers make too much profit.

When asked which sector of the U.S. health care industry contributes “a great deal” to rising health care costs, 68% said insurance companies make too much money, compared with just 38% who said the same about hospitals. (The top answer was drug companies, at 75%.)

By the same token, 82% of people said hospitals responded well to the pandemic, versus 45% for drug companies and 43% for health insurers. The survey was conducted Aug. 13-16 by Bellwether Research and Consulting, based in Alexandria, Virginia.

Time for change?

Some patient advocates say the for-profit health insurance sector is overdue for reform, and the huge profits could be the catalyst that pushes it front and center for public discussion in an election year.

“At a time when governments, employers and workers are all struggling at a historic level, an industry dependent on subsidies from those same government, employers and workers is somehow raking in huge profits—by not providing care,” said Fran Quigley, director of the Health and Human Rights Clinic at the IU McKinney School of Law.

“Maybe this will finally be the tipping point when the U.S. follows the global lead of taking the profiteering out of health coverage and embraces Medicare for all.”

But that could depend on how hard political leaders push the issue. While the Biden-Harris campaign is promoting a public option for those who choose, similar to Medicare, it is not advocating the transformation of the trillion-dollar private industry to government control, as some other Democratic candidates had suggested during the primary campaign.

And some investors say they are not worried that such a transformation would happen under a Biden administration, should the Democrats prevail over Republican President Donald Trump.

“I looked at the Democrats’ platform. It’s very generic,” said Les Funtleyder, health care portfolio manager at E squared, a hedge fund based in New York City that owns shares of UnitedHealth Group.

The party is “having a hard time even getting a public option on the discussion, let alone anything else. … So I think that’s sort of off the table for the time being.”

Yet some state political leaders, such as John Zody, chairman of the Indiana Democratic Party, say they will continue to fight for more affordable coverage.

“We are acutely aware that many are struggling as a result of lack of access to adequate care. However, many more would be struggling if Republicans in Indiana and Washington had their way,” he said, pointing out that some Republican office-holders and candidates favor abolishing the Affordable Care Act, which expanded access to health insurance to hundreds of thousands of low-income Hoosiers.

The Indiana Republican Party declined to comment.

In the meantime, Anthem and other private insurers are reeling from a barrage of headlines about their financial gains in the second quarter.

The New York Times wrote Aug. 5 that big insurers “are experiencing an embarrassment of profits.” The New York Post wrote Aug. 14 that insurance giants “doubled their profits as the coronavirus pandemic killed thousands of Americans.”

Some observers say insurers are just trying to keep their heads down and hoping the moment will pass.

Insurers “do not want to be seen as ‘unjustly’ profiting while consumers, other businesses and state governments struggle,” Matt Borsch, an analyst with BMO Capital Markets in New York City, wrote to clients on July 31, “particularly going into the November elections.”•

Please enable JavaScript to view this content.

Wait, a for-profit business has made money, and everyone is up in arms. The first paragraph tells you why. Expensive surgeries were put off. When they resume, they will then pay their share. I pay an enormous amount of insurance premiums, but I don’t like that every time someone makes money, they are supposed to give it back. The other side is, Anthem is a HUGE contributor and supporter of our community, as well as communities across the country.

Doctors offices inefficiencies, hospitals overspending and inefficiencies and the overall spending should be what everyone is looking at. Why does it take me 3 months to get a physical at IU Health from my Dr.? I pay the same if I see a NP or my Dr, so I want to see my Dr.