Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

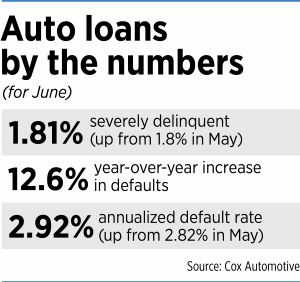

Of all the people working in auto-related businesses in Indianapolis, Steve Brown might have been the least surprised by Cox Automotive’s report last week that car repossessions nationwide are up 23% over last year and 14% compared with the first half of 2019.

Brown owns Lenders Recovery Service LLC, one of the biggest repossession companies in Indiana, and he said the national numbers mirror what he’s seen locally.

“For probably the last year, our number of cars repo’d was up almost 30% over last year,” he said. “The volume has stayed pretty much the same. Generally, there is a downturn around tax season because people get their tax checks, pay their loan back—and then we repo them again three months later. We didn’t even really see much of a dip this year. We just didn’t.”

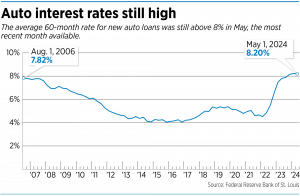

As of last week, Lenders had received orders from auto lenders to repossess about 1,550 vehicles across Indiana and into Kentucky. That number is up from roughly 1,200 a year earlier as consumers grapple with inflation and high interest rates.

But while Brown was happy to talk about his business—the rewards as well as the dangers—repossessions can be a touchy subject for financial institutions. Several banks and credit unions declined to be interviewed for this story.

“They’ve made a bad loan, and they don’t want that to be known,” Brown said. “They don’t want to have the light shine on the ways that they fail.”

Some banks, though, said their experience has gone against the national trend. Old National Bank, for example, reports that its repo numbers are down significantly this quarter.

“Our losses stay relatively low versus our peers as our auto portfolio contains a majority of clients with excellent credit,” the Evansville-based bank said in a statement. “We also attempt to work with borrowers prior to the final step of repossession.”

The impact of rising prices

Cox’s repossession figures are based on the volume of repos that Atlanta-based Manheim—the largest wholesale auto-auction operation in the United States—has handled nationwide, so they’re not the definitive number of repos in the market.

The Indiana Bankers Association asked its members and found that in the more metropolitan areas of the state, banks aren’t seeing an increase in delinquencies or repossessions. But banks in smaller cities and towns are starting to notice an uptick in auto repossessions as well as other areas of consumer delinquency, like credit cards and home equity loans.

“The rise appears to trace back to the increased cost of goods across nearly every area of Hoosiers’ lives, including basic expenses like groceries, coupled with Americans no longer receiving federal stimulus checks as they were when they took out these loans,” said Evan Hoffmeyer, vice president of communications for the bankers association.

“The combination of higher expenses and lower household income is leaving Hoosiers without enough money after paying for necessities to still make the payments on these debts. Our banks do not believe consumers are currently borrowing more than they can afford; this is the result of borrowers not being in as strong of a financial position as they were when they qualified for their loans.”

Banks have a standard practice of repossession after 90 days of delinquency. Hoffmeyer advised that Hoosiers who fear their car may be at risk of repossession should reach out to their lender.

“If you stay in regular contact with them and make partial payments or other efforts to get current, lenders are, in most cases, more than happy to work with you,” he said.

Lawyers who deal with clients who’ve had their auto repossessed also have had mixed experiences.

Zach Brock opened his firm Brock Legal about a year ago, so he couldn’t make year-over-year comparisons. But repossessions “are definitely prevalent in my client workload.”

“I got into this business for a lot of economic reasons, and it has very much to do with the fact that I kind of saw this kind of writing on the wall, that the repossessions were going to be up,” he said. “Collections cases in general are definitely increasing with this economy, with inflation, with a lot of the moratoriums that existed—whether it be with repossessions or collections cases prior to COVID, or during COVID. Those moratoriums all ended, and there’s been tons of cases—repossessions, evictions cases, collections cases—that are having people consider bankruptcy.”

Brock said he tries to convey to his clients facing repossession that an auto lender has no obligation to announce it’s going to repossess. He warns clients that if they don’t have a plan to get their loan current quickly, they could find their vehicle towed away. Brock said banks typically give customers a chance to get their loans current and often wait 80-90 days before beginning repossession procedures because they’d rather have the money than the car.

Growing business

When a loan isn’t paid, companies like Lenders Recovery Service step in.

When a loan isn’t paid, companies like Lenders Recovery Service step in.

Brown bought Lenders after working for the auto auction company Adesa for more than 20 years. In the seven years since, the company has tripled in size, he said. At any given time, he has as many as 10 tow trucks on the road—eight in central Indiana and one each around the branch offices in Evansville and Fort Wayne—looking for the occasional unpaid-for Maserati or Porsche “and a lot of 2003 Kias, too.”

In addition, he employs spotters who try to find the autos they’ve been hired to repossess and verify the vehicle identification number before they call a tow truck.

Brown said Lenders’ customers include General Motors, Ford and Chase Bank.

“They’re all terrific customers, and they send work directly to us, and we have a pretty good pickup percentage with those,” he said. “I also have a good number of credit unions that we do work for, local credit unions, and they send work directly to us, and we have really good luck with them.”

The company also gets business from forwarding companies—the middlemen hired by the banks and other companies that make loans. Lenders’ repossession agents and spotters work from a computerized map that shows the suspected location of the vehicles they’re trying to find. Red triangles signify new accounts; blue triangles represent vehicles that have been searched for at least once; yellow is a place of employment for a car owner whose loan is in arrears.

Spotters are paid hourly rates and commissions for every car brought in, and their pay can add up fast. Brown said that, two years ago, he was Lenders’ seventh-highest-paid employee.

“And I was happy for it,” he said. “That was fine.”

But the work is also dangerous. On July 15, a repossession agent in Mishawaka was shot in the hand while trying to repossess a car.

“I tell every one of them, ‘You’ve got one job tonight and that’s to come home safely to your family,’” Brown said. “If you sense any danger, drop the car, get the hell out of there. We’ll come back and get it later, or we won’t. We’ve got 1,549 other accounts we can go after.”

Robert Duff, founder of the Indiana Consumer Law Group, said he hasn’t seen an increase in clients dealing with repossession, but he also isn’t surprised by the news that repos are rising.

“I can totally see that from the economic circumstances that we’re in right now,” he said. “You know, the kind of post-COVID money, where the government dumped all that money into people’s hands, and people went out and bought cars and things that they have now come on hard times and can’t afford.”

As for the future, Jeremy Robb, Cox’s senior director of economic and industry insights, said he expects repo growth for the industry to be up nearly 10% in 2024 and then level out for several years.

“High interest rates have really hurt loan demand and loan originations, and that has kept the loan base from growing,” he said. Most repossessions occur from the sixth month to the 18th month in the life of a loan, “so it’s difficult to see large increases in repossessions if the loan base isn’t growing—unless we get some shock to the economy.”•

Please enable JavaScript to view this content.