Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

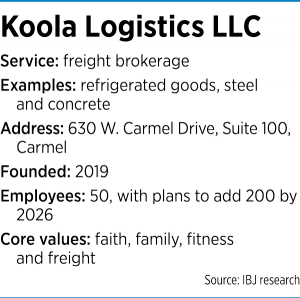

The name that husband-and-wife business partners Steve and Nancy Paliska selected for their Carmel-based freight brokerage company, Koola Logistics LLC, was created not by them, but by happenstance. When the couple’s four kids were very young, they watched a TV show whose name they routinely mispronounced as “Koola.”

“When we founded the company and were trying to find something catchy to call it, there were all sorts of thing we could have done,” said Steve Paliska, Koola’s president. “We decided to go with the kids’ made-up word.”

It seems appropriate, given the couple’s choice of livelihood. Because, while literally no one knows what Koola means, almost no one outside of the logistics industry understands what Koola does, either. The fact is, “freight brokerage” is on no one’s list of familiar, well-understood professions.

But its business case is easily explained.

“It’s simply a trucking company that has no trucks,” said Cliff Abbott, special correspondent for the trade publication Trucker Media Group. “Their customers have loads to transport, and they have to contract out the trucking part to an existing carrier somewhere. They handle the orders and arrange for transportation, but they don’t actually move the product themselves.”

Right now, Koola’s 50 or so employees reside in roughly 16,000 square feet of space in a nondescript Carmel office building, working the phones as they match an endless array of truck cargoes with willing drivers. But that’s just the beginning for the company, which was established by the Paliskas in 2019 after they moved to Hamilton County from California. Last March, they received approval from the Indiana Economic Development Corp. for $4.25 million in conditional EDGE tax credits to expand their payroll to 250 by the end of 2026.

According to the contract, Koola plans to spend $8.1 million on an expansion and will qualify for incentives if it reaches 250 employees. The company seems to be off to a fast start, growing its revenue 234% from 2020 to 2022, when it reported $24.5 million in revenue.

Steve and Nancy, who went to school together at Purdue University (Nancy is a Batesville native) moved to Steve’s home state of California after marrying, where he worked for a large corporate logistics company, then went into real estate with his brother. Growing tired of the Golden State, they decided to relocate to Carmel. Since their kids were still quite young at the time, Nancy mostly stayed home. Steve established Koola and became its first (and for a while, its only) employee, working alone in a tiny, rented space that he describes as “a closet.”

“We put four desks in it, and I just started picking up the phone and calling people,” he said. “Probably about five months in, we hired our first employee. And then three months after that, our second. Since then, all of our growth has been exponential and organic.”

“We put four desks in it, and I just started picking up the phone and calling people,” he said. “Probably about five months in, we hired our first employee. And then three months after that, our second. Since then, all of our growth has been exponential and organic.”

Nancy has morphed from a pretty much full-time, stay-at-home mom to Koola’s chief financial officer, supervising vendor payments and most other back-office functions.

“The first year or two years, I worked from home,” she said. “But we’ve grown so much that I have to be in here every day. I’m so thankful to have this opportunity and to be a part of it. What better world could you live in where you get to work with your husband every day?”

The Paliskas—who say the company is based on the core values of faith, family, fitness and freight—are less interested in hiring people with experience in freight brokering (though they certainly will) and more in finding people who fit in with the company’s ethos. If new employees have the proper mentality, the company’s training program can bring them up to speed.

“When they start out, they work with an established person in the industry while they learn the business,” Steve said.

After a few months under the wing of another staffer, newbies gradually grow their own roster of customers. Entry-level salaries fall in the $45,000 to $65,000 range, plus commissions. Fresh hires, as they gain experience, might develop a particular “specialty,” be it handling refrigerated trucks, flatbed trucks or van trailers.

“If it’s not an equipment type, it will be a region,” Steve said. “If you started out working with an established broker who did a lot of business out of Indiana, you’re going to start there. Each person here has their own individual book of clients. Some have niches, some people touch it all.”

The company itself certainly touches it all. It handles a lot of refrigerated food but also materials like steel and concrete, which are typically moved on flatbeds. And on any given week, Koola could be brokering loads across the continental United States.

The company certainly doesn’t have the field to itself. According to the Federal Motor Carrier Safety Administration, 27,033 brokers are registered to operate in North America, and the research firm Mordor Intelligence predicts they will produce $18 billion in revenue in 2024—a number it believes will increase to $26.8 billion by 2029. The size of the myriad companies offering brokering services varies wildly, from one-man operations operating out of someone’s basement to multinational corporations such as CH Robinson Worldwide ($15.9 billion in 2023 revenue) and Total, Quality Logistics ($8.7 billion).

Bona fide trucking companies and delivery services are also developing in-house brokerage services. For instance, Coyote Logistics ($5.2 billion in 2023 revenue) was recently acquired by UPS. The reasons are pretty clear. If a trucking or delivery firm can’t give a client a ride on its own vehicles, then at least it has the wherewithal to place them on a third-party truck.

“When you’re talking about somebody like a Quaker Oats or some other very large company, you don’t ever want to say no to them because they’ll stop calling you,” said Abbott at Trucker Media Group. “If a company gets loads that don’t fit into their usual system or aren’t profitable for them, they can turn it over to their logistics company, which can find somebody else to run it.”

Being a pure logistics company does have some distinct advantages, however. For instance, when you don’t have to buy trucks or a dock facility, the barrier to entry drops through the floor.

“If you have a desk and a phone, you could start yourself off as a broker,” Abbott said. “In fact, there are courses that will teach you how to do just that. And then you can affiliate yourself with one of the established brokers or brokerage companies or start your own.”

Not that it’s a particularly low-stress job. Indeed, you’re a middleman promising an on-time delivery on behalf of a third-party trucker you’ve likely never seen. And if something goes wrong, the broker gets to field the angry phone calls and, often, take the financial hit.

“It can be a very frustrating job when you promise a customer that their load is going to be delivered and then the trucker gets sick or his truck breaks down, or he’s just not very good at his job and doesn’t get the load there on time,” Abbott said. “You’re going to be in the middle of these disputes all the time and be on the phone all day long, having unpleasant conversations.”

In such cases, being with a large (or large-ish) brokerage company has its advantages, including the ability to do credit checks on shippers, access to lots of industry contacts and enough scale to earn you some gravitas with big shippers.

“A lot of the very large companies don’t want to deal with one- or two-broker outfits,” Abbott said. “They want to talk to the big guys.”

Though there are a few behemoths in the industry with around 10,000 employees on the payroll, Steve reckons his company is still comfortably midsized.

“I would say that, by the time we fulfill what we’re shooting for in the next five years, we’ll land among the top 100,” he said. “I believe our advantage for growth is our focus on hiring entry-level people and having the right training to teach them this industry from scratch.”

Koola’s other secret sauce is a willingness to both talk with people on the phone and sit down for face-to-face meetings with potential clients. And in an era when many companies seem to bar customers from reaching them via phone, Koola publishes its phone number on the landing page of its website, which is answered by an actual receptionist, not a robot.

“We don’t have voicemails here,” Steve said. “We want to make sure that we’re ethical to the trucking companies, and we want there to be a way for them to get ahold of us. If we’re in a situation where we hired a trucking company and things change from our original contract, instead of having our client be responsible for making sure a truck driver is taken care of, we’re going to do the right thing and make sure we work out a deal between the two of them.”

Though Koola services clients throughout the United States, it plans to keep its headquarters in the Carmel area—though in the coming years, the company is going to need a bigger building. Perhaps something in the 15,000- to 20,000-square-foot range.

“It’s one of the things I’m actively working on,” Steve said. “We’d like to buy or build somewhere in Carmel.”•

Please enable JavaScript to view this content.