Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

It was an era of quick deals and easy money, with investors pouring billions of dollars into newly formed shell companies in hopes of a big payday.

Now, the boom is over, nearly as quickly as it started.

Around Indiana and the nation in recent weeks, special purpose acquisition companies, or SPACs, are shutting down and returning money to investors. In other cases, investors are taking a bath.

SPACs are publicly traded shell companies that don’t have operations or revenue; they exist only to raise funds and take other companies public in a reverse merger. Investors hand over millions of dollars to a SPAC, hoping it will find a high-growth enterprise to merge with, thus boosting the stock price of the combined companies.

But it hasn’t been that easy. With hundreds of billions of dollars’ worth of SPACs all chasing what they hoped would be the next Google or Amazon, the best deals were snapped up quickly. Other opportunities began to evaporate in an overheated market.

And with interest rates soaring and share prices falling, the market for SPAC deals has all but crashed, experts say.

“When the sun was shining, everything was great with the SPAC market,” said Jay Ritter, a finance professor and SPAC expert at the University of Florida. “But now, winter has set in.”

That’s true for Monument Circle Acquisition Corp., a SPAC set up by executives at Emmis Communications Corp., the Indianapolis-based media conglomerate.

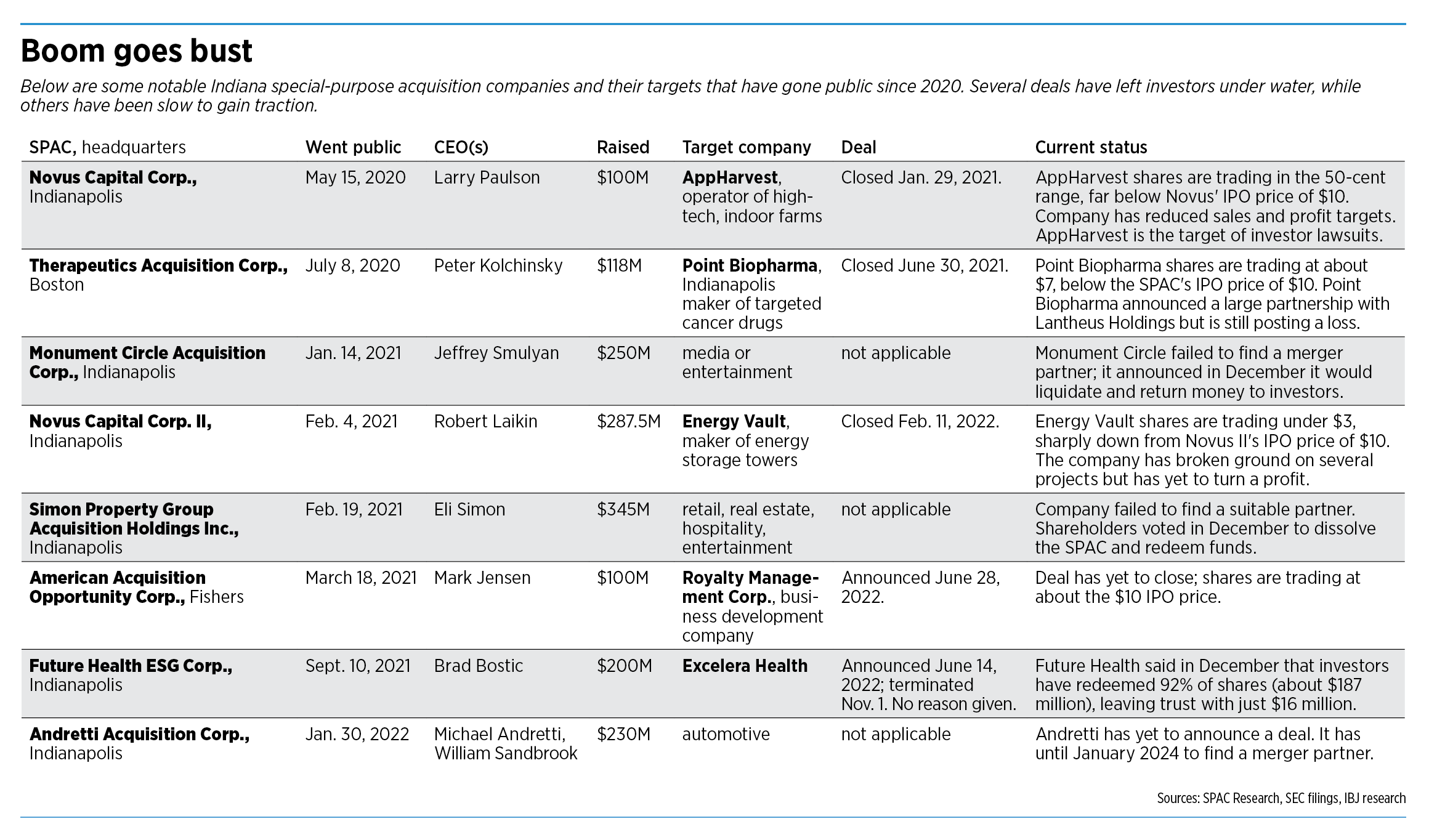

Two weeks ago, Monument Circle announced it was dissolving without making a single purchase, even though it was flush with $250 million from investors.

The company said it would return funds to investors but did not say what percentage of the total investments it expected to return after costs to set up the SPAC and take it public. Monument Circle said it was unable to close any deals before its two-year deadline was due to expire on Jan. 19.

“The pendulum has certainly shifted,” Jeff Smulyan, CEO of Monument Circle and Emmis Communications, told IBJ. “It’s one of the most remarkable swings I’ve ever seen.”

Also shutting down without making a purchase was a SPAC launched by Simon Property Group, the Indianapolis-based shopping mall giant. The SPAC, with $345 million, had been looking for a company “with the potential to disrupt various aspects” of established players in retail, real estate, hospitality or entertainment. But unable to find a suitable company in time, shareholders agreed last month to liquidate the operation.

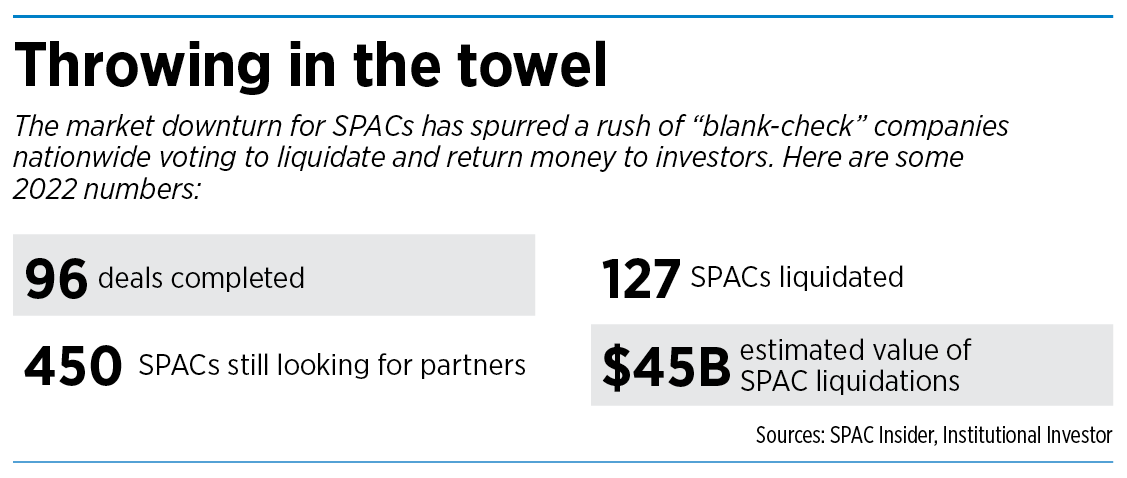

Last year, more than 100 SPACs around the country gave up trying to find a private company to take public in a reverse merger. By year end, almost $45 billion worth of SPAC investment was liquidated, according to SPAC Insider, an industry tracker.

The headlines in December summed up the situation in a grim way.

“SPAC Boom Ends in a Frenzy of Liquidation,” The Wall Street Journal said.

“SPACs Are Giving Up on Finding Deals,” said Institution Investor, a financial news site.

“Great SPAC Crash of 2022 Deepens as Investors Cash Out in Droves,” said a Bloomberg News story.

Even when SPACs were able to find a deal, the result was not great for investors. People who bought shares in SPACs that merged with private companies since 2015 have suffered losses of 37%, on average, a year after the merger, according to a report in the journal Review of Financial Studies, as reported in MarketWatch.

The cooldown

Now, the pressure is turning ever greater on SPACs and their sponsors, the people who form the companies and raise funds from investors.

The Securities and Exchange Commission is proposing new rules to make SPACs disclose much more information, including conflicts of interest and sponsor compensation, which SPACs are not now required to disclose.

And President Biden’s Inflation Reduction Act of 2022 will impose a 1% excise levy this year on SPACs that return cash to investors.

Both have added to the sudden strain of SPACs, which had been on a tear. In 2021, investors poured $144 billion into SPACs, nearly double from $75 billion a year earlier, according to research from the University of Florida.

That has decidedly cooled, observers say.

“My sense is, SPAC sponsors are not aggressively pursuing more investment,” said Jim Birge, a partner in the Indianapolis office of law firm Faegre Drinker Biddle & Reath LLP who specializes in corporate transactions. “They see a real chill.”

In the Indianapolis area, at least seven SPACs popped up over the past three years during the bubble, raising an estimated $1.5 billion.

The money was coming in from almost every direction to players who had limited experience in the SPAC market, though several were experienced business executives in other industries.

The market got so hot that even a motorsports veteran, Michael Andretti, jumped into the game, raising $230 million in January 2022 with the goal of taking a high-growth startup in the automotive sector public through a reverse merger. As of press time, the Andretti Acquisition Corp. had yet to announce a purchase.

But even though plenty of people jumped into the SPAC game in Indiana, many have seen their investment swoon, an IBJ review found.

Two of the SPACs did reverse mergers with unseasoned, young companies in deals that provided plenty of capital to the enterprises, but in both cases, the share prices of the combined companies are trading far below the initial public offering prices of $10, wiping out millions of dollars in equity.

That’s a sharp reversal from the early days of the SPAC mergers, when investors earned substantial paper profits in ensuing years as the stock market roared.

Other Indiana-based SPACs have not closed deals or are in the process of liquidating. One is paying back millions of dollars to investors while continuing operations.

“Two years ago, everyone wanted to buy,” said Roger Lee, senior research analyst at Columbus-based Kirr Marbaugh & Co. LLC. “This year, everyone got obliterated.”

‘A good growth story’

Perhaps no SPAC better illustrates the reversal of fortunes than Novus Capital Corp., formed almost three years ago by a group of Indianapolis business leaders.

Even though they had little experience in the blank-check market, they quickly raised $100 million, went public at $10 a share, and began searching for a young, promising enterprise to take public. With so many other SPACs sprouting around the nation, it seemed to be an easy formula for riches.

“We’re looking to identify a company that has a good growth story in an exciting industry,” Robert Laikin, chairman of Novus Capital Corp., told IBJ in June 2020. “We’re looking for a good Wall Street story.”

If Novus could find a high-growth company on the verge of shaking up an entire industry and posting big profits, the founders and investors stood to make huge returns.

Within a few months, the Novus group found what appeared to be an up-and-coming business in need of a cash infusion and willing to go public in a reverse merger.

The company was AppHarvest, a Kentucky operator of large-scale, indoor farms.

The 3-year-old farming operation had an audacious goal of revolutionizing agriculture by building high-productivity, high-technology greenhouses to supply produce to grocery stores around the nation. The company had built acres of greenhouses across Kentucky, with a plan for rolling out more greenhouses and hiring more workers if they could find the cash.

AppHarvest had an all-star group of backers, including Rupert Murdoch’s son James, legendary investor Jeff Ubben, AOL founder Steve Case, Martha Stewart and best-selling author (and now U.S. senator from Ohio) J.D. Vance.

On its face, the deal seemed to be a win-win. The transaction provided nearly a half-billion dollars in gross proceeds to AppHarvest, money needed to build more indoor farms and hire more workers.

The funds included $100 million raised in Novus’ initial public offering, along with $375 million in fully committed common stock known as PIPE (private investment in public equity), which is additional capital to help a business grow.

The merger closed in January 2021, with the combined companies taking the AppHarvest name.

Shares in the combined companies climbed 44% in the first day of trading to $35.85, a sign of investors’ confidence in the operation.

“It’s a big day for AppHarvest and Novus Capital Corporation! Let’s Grow!!!” tweeted Brad Bostic, a Novus director, who also is founder and CEO of Indianapolis-based medical software company hc1.com, which helps health systems deliver personalized care.

That month, the company began its first shipments of beefsteak tomatoes to retailers, including Kroger, Walmart, Meijer and Publix.

AppHarvest boasted that its high-tech, indoor farms are designed to use 90% less water with yields that are up to 30 times higher than traditional open-field agriculture on the same amount of land.

The company said it wanted to operate a dozen large greenhouses by 2025 that produce tomatoes, berries, leafy greens and cucumbers. As a first step in its expansion, it said it planned to build three more large facilities, a move likely to cost tens of millions of dollars.

Long descent

But the dreams of huge profits and returns have collapsed, at least for now. AppHarvest has posted a string of losses, including a loss of $23.9 million for the third quarter of 2022, 39% more than a year earlier.

The company blamed poor employee training and historically low tomato prices. In November, it also warned investors it had “substantial doubt” about its ability to continue as a going concern.

Shares of AppHarvest, which had climbed into the mid-$30s in early 2021, began a long descent over the next two years and are now trading in the 80-cent range.

Last summer, several investors filed suit in federal court against the company’s board members, including Laikin, accusing them of failing to disclose material facts, breaching their fiduciary duty and wasting corporate assets.

Laikin, who has talked at length to reporters and investors about the potential of SPACs, including several he was involved in, is much less chatty these days, with investors in a litigious mood.

Laikin declined to comment to IBJ on the company’s performance or on the SPAC market in general.

He resigned from the AppHarvest board last February.

Laikin made his first fortune as the founder of Brightpoint Inc., an Indianapolis-based wireless phone distributor that he sold to Ingram Micro Inc. in 2012 for $840 million.

For Novus investors, who bought shares of Novus Capital at $10 apiece during the IPO, it’s doubtful they will recover their investment unless the company shows a remarkable turnaround.

But in the meantime, Laikin’s team has made another bold gamble in the SPAC market, setting up a larger blank-check company called Novus Capital Corp. II that raised $287.5 million and went public in February 2021 at $10 a share.

In September 2021, Novus II announced it would combine with Energy Vault Inc., a California startup that builds massive towers to store and release wind and solar energy. Energy Vault, which had no revenue in 2020 and losses of $24 million, predicted it could ring up an eye-popping $2.7 billion by 2025.

In February 2022, the two companies merged, and shares climbed to $11.55 on the promise of high growth as Energy Vault ramped up its technology.

Yet, like AppHarvest, investors have backed off of Energy Vault. Shares were trading this week under $4, signifying a large capital loss for people who bought IPO shares.

Health care SPAC

Bostic, the Indianapolis executive who served as a director at Novus Capital Corp., soon jumped into the game himself as a primary player. He formed his own blank-check company called Future Health ESG Corp., which quickly raised $200 million.

The company went public in September 2021 and announced about eight months later that it would combine with Newport Beach, California-based medical tech firm Excelera Health in a deal valued at $459 million.

Excelera, which launched in January 2022, operates a network of physicians who serve Medicare patients through a direct contracting entity that aims to reduce costs.

Yet the deal was short-lived. In November, Future Health announced it was terminating the transaction, without giving a reason.

A month later, Future Health shared more news. It said shareholders overwhelmingly voted to redeem their shares, with the result that $187 million would be removed from the SPAC’s trust account, leaving it with only $16 million.

Bostic told IBJ that Future Health was not preparing to wind down and had won a time extension from shareholders through Dec. 31, 2023, to close a business combination.

He said the company could still complete a deal, using funds from private investments “or other strategic financings.”

And even as the SPAC market continued its spectacular crash, Bostic sounded a note of optimism that his company could still find a deal.

“The irrational exuberance during the recent SPAC bubble has led to too many ill-conceived and mis-priced deals getting to market,” Bostic wrote in an email to IBJ.

“As the traditional IPO market remains effectively ‘closed’ for the time being, SPACs will remain an attractive path to public listing for target companies when paired with sponsors having the discipline to execute rational high-quality transactions.”•

Please enable JavaScript to view this content.