Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Dr. Idella Simmons, who has practiced family medicine downtown for more than two decades, was astounded when her employer, Chicago-based VillageMD, sent a letter to her patients last month with the news that her office was closing.

“After careful consideration, we have made the difficult decision to close our practice at 950 N. Alabama St., IN 46202 on Jan. 19, 2024,” the letter said. It added that patients would have several options “to transfer your care to another doctor,” such as contacting the state medical association, their private insurer or Medicare.

But Simmons, who joined VillageMD in 2021 after years of practicing independently, doesn’t plan to shut her doors. She is preparing to stay in practice at the same location under a new name, Downtown Primary Care LLC. She told IBJ that VillageMD’s letter left her patients with the impression she was closing her practice for good.

“I’m just sorry that my patients received a startling letter,” Simmons told IBJ. “A lot of them thought I was retiring.”

Around Indiana, thousands of patients at more than a dozen VillageMD clinics, which operate under the Village Medical brand, have received similar letters, with instructions on how to find a new doctor.

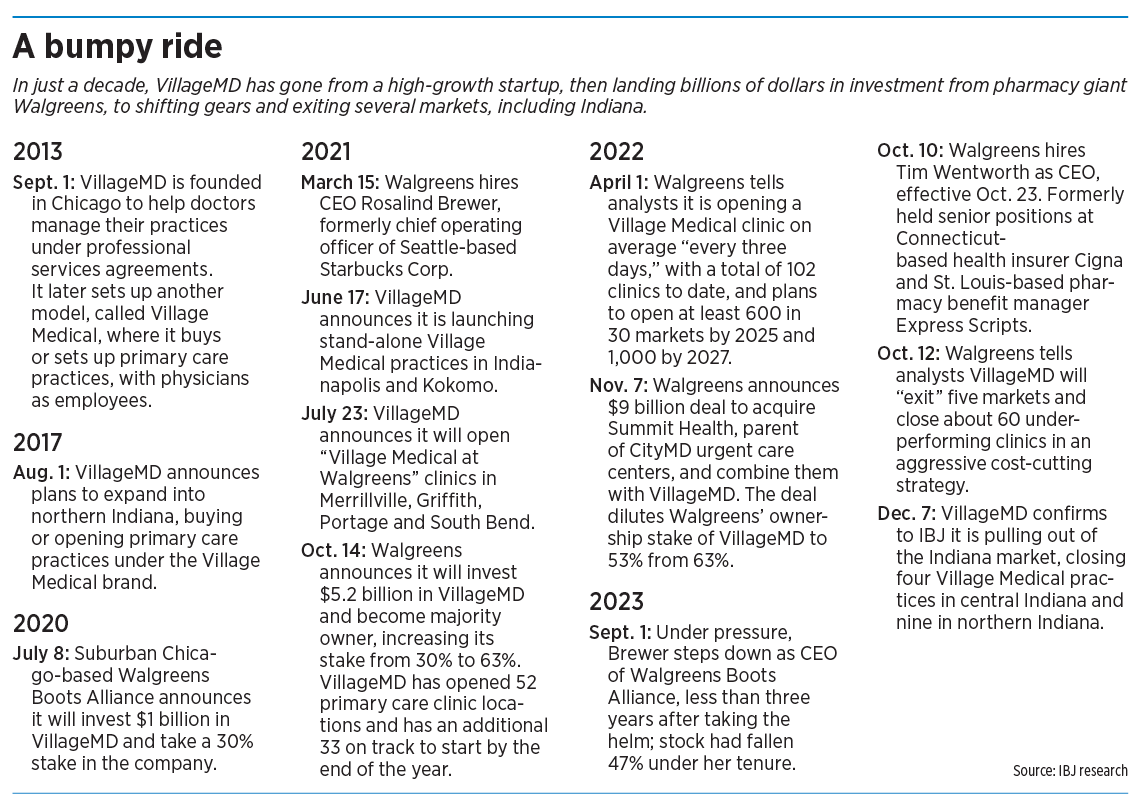

Altogether, VillageMD, a subsidiary of Chicago-based pharmacy giant Walgreens Boots Alliance, is closing more than 60 primary care clinics in five markets, including nine practices in northern Indiana and four in central Indiana.

A spokeswoman for VillageMD confirmed the company is preparing to “exit the Indiana market,” but she did not give a reason. She declined to make a senior official available for comment.

“High-quality care for our patients is always our top priority and we are working diligently to ensure this is a smooth transition for them,” the spokeswoman, Molly Lynch, wrote in an email.

It’s a remarkable about-face for VillageMD, which entered Indiana with a splash in 2017 and expanded over the next five years. By 2021, VillageMD and Walgreens announced plans to open clinics in Indianapolis, Kokomo, Griffith, Portage, South Bend and other locations, usually recruiting local primary care physicians to staff the clinics.

In 2021, Walgreens announced it would invest $5.2 billion in VillageMD and take a 63% ownership. That ownership level has since been diluted to 53%.

Some Village Medical locations were stand-alone on street corners in traditional walk-in doctor’s offices. Others were next to Walgreens pharmacies, under the same roof, operating under the “Village Medical at Walgreens” brand.

The strategy was to help Walgreens expand from its traditional role as a dispenser of prescription drugs and general retailer of greeting cards and candy and reinvent itself as a health care provider.

“What we’re really building are key relationships, the relationship with the consumer between the primary care physician and the pharmacist,” Rosalind Brewer, then-CEO of Walgreens, told financial analysts in April 2022.

Walgreens officials boasted they were opening a new Village Medical clinic attached to a drugstore every three days.

But in an amazingly fast turn of events, Walgreens has struggled to deliver. Last May, the company said it would cut around 500 employees, or about 10% of its head count. A month later, it said it would close 150 underperforming stores in the United States and 300 in the United Kingdom.

And in September, Brewer announced she was stepping down as CEO, less than three years after taking the helm. Walgreens’ stock, which had been falling in recent years, continued to slump after news of Brewer’s resignation, pushing shares to levels not seen since 1999.

The company racked up losses of $376 million for the 12 months ending Aug. 31, as spending on Village Medical and other operations ballooned. VillageMD currently operates more than 680 locations in 26 cities, with a workforce of more than 20,000.

It remains unclear whether VillageMD and its Village Medical brand of clinics will bounce back and continue to expand. Some health care experts said they had doubts Walgreens could pull off a move into health care delivery without a few bumps.

“Walgreens is a pharmacy, not traditionally a service provider,” said Ed Abel, retired director of health care practice at Indianapolis-based Blue & Co., an accounting and consulting firm. “They’ve had some moderate success in it, but running a pharmacy is just a different animal than seeing patients and treating patients day in and day out.”

Walgreens officials said they had little choice but to try a new strategy because the company’s traditional business was suffering from slow growth. Walgreens spent billions of dollars to buy a chain of urgent-care clinics and a home-health benefits management company, in addition to VillageMD, under the Walgreens Health umbrella.

“Walgreens bets all its chips on a new healthcare strategy,” said a November 2021 headline in MedCityNews, an online news site covering the health care industry. “Will patients buy in?”

“Walgreens bets its future on an unprecedented reinvention,” said a headline in Crain’s Chicago Business in December 2022. Erik Gordon, a professor at the University of Michigan’s Ross School of Business, told Crain’s: “It’s a giant, complicated undertaking. Going into delivering primary care—that’s not an easy business.”

A few months later, in February, The Wall Street Journal laid out the pharmacy giant’s gamble under the headline: “Walgreens CEO bets on doctors over drugstores in search for growth.”

But it wasn’t a sure bet, and soon, Walgreens came out with some bracing news. Two months ago, the pharmacy giant said its overall health care business unit posted an adjusted loss of $30 million in the quarter ending Sept. 30, even as revenue in the VillageMD operation grew 17%.

“While we have made progress on the buildout of our health care business, we are not satisfied with the near-term returns on our investments,” John Driscoll, president of the U.S. health care business, told analysts during a recent conference call.

He added that the company was focusing on “increased density in the highest-opportunity markets” with VillageMD. Translation: Places such as Indianapolis, Kokomo and South Bend were not cutting it.

It’s something of a comedown for VillageMD founders, who set up the small operation in 2013 to help doctors manage their practices under a professional services agreement. Later, they created Village Medical to set up or buy primary care practices, with doctors as employees.

VillageMD’s goal was to help consolidate the $1 trillion U.S. primary care market.

“Here we are, eight years later, with several billion dollars [from Walgreens] invested in the company, and a lot of believers that we have a very attractive model to primary care physicians,” co-founder Paul Martino told IBJ in December 2021.

Whether he still believes that VillageMD is an attractive model remains unclear. Martino did not respond to messages to his LinkedIn page or emails sent to the company spokeswoman.•

Please enable JavaScript to view this content.