Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowA national proposal to remove medical debt from consumer credit reports could have a significant impact in Indiana, where the percentage of residents with delinquent medical debt is higher than in 39 other states.

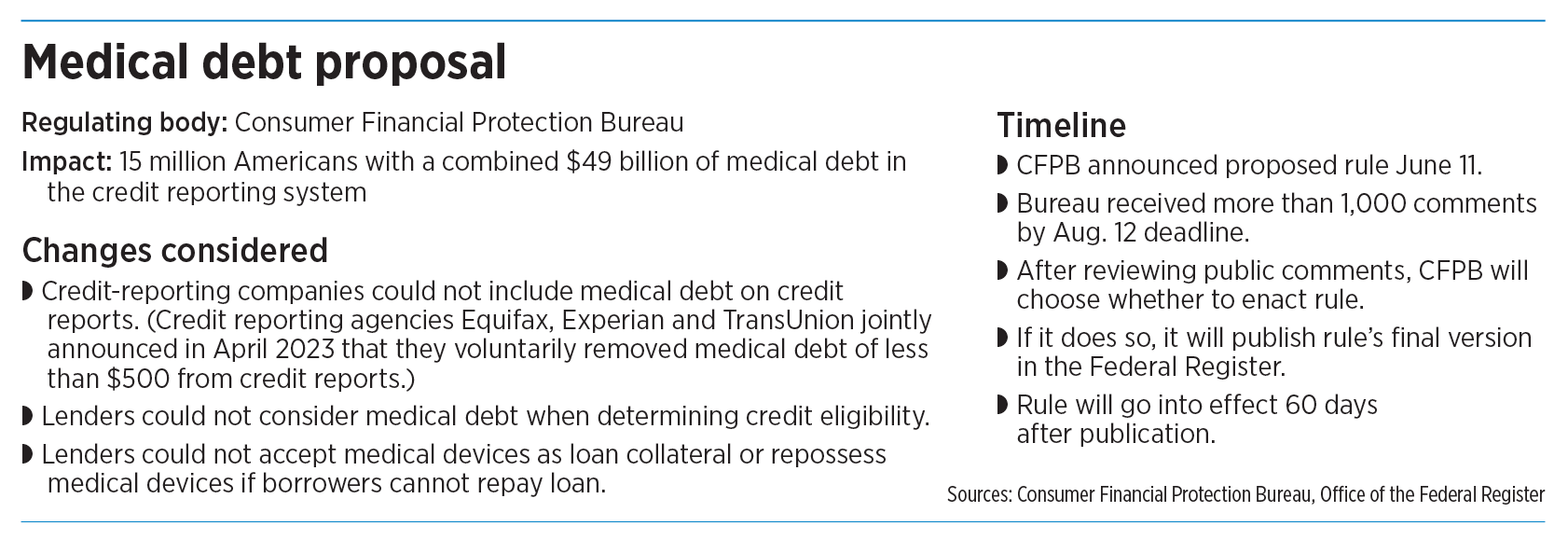

The Consumer Financial Protection Bureau announced its proposal in June, saying the change would affect 15 million Americans who have a combined $49 billion in medical debt on their credit reports—debt that affects their credit scores and hurts their ability to access credit.

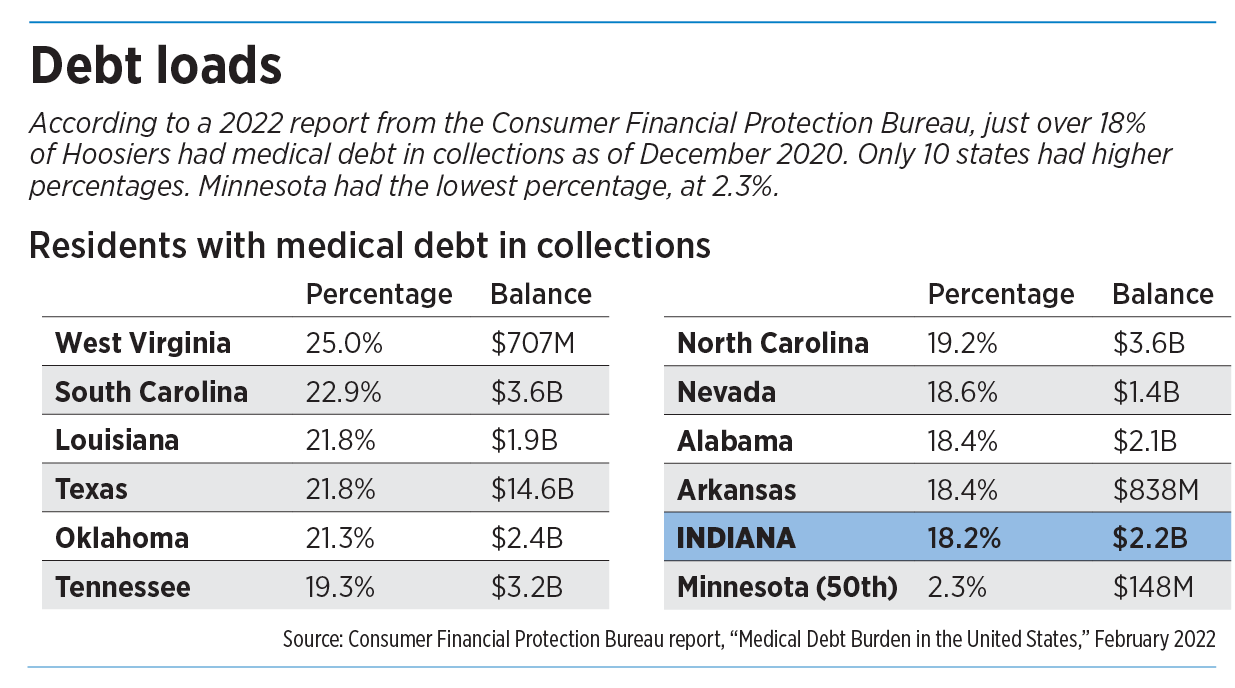

Indiana residents likely would be among some of the biggest beneficiaries in the nation. According to a 2022 report from the CFPB, 18.2% of Hoosiers had medical debt on their credit report as of December 2020. That’s the 11th-highest percentage in the nation.

The top five states—West Virginia, South Carolina, Louisiana, Texas and Oklahoma—all had rates between 21% and 25%. The state with the lowest rate was Minnesota, at 2.3%.

Not only would the proposal remove medical debt from credit reports, but it would also prohibit lenders from considering medical debt when determining an applicant’s eligibility for credit.

“Medical bills on credit reports too often are inaccurate and have little to no predictive value when it comes to repaying other loans,” CFPB Director Rohit Chopra said in a prepared statement when the proposed rule was announced.

The CFPB also said that people with medical debt on their credit reports would see their credit scores rise an average of 20 points if the proposed rule goes into effect, leading to the approval of about 22,000 additional mortgages per year.

But interested parties on various sides of the issue—lenders, debt collectors, medical providers and consumer advocates—offer more nuanced views.

Some who generally favor the proposal say it doesn’t go far enough, while those opposed to the change say it could lead to a variety of harmful consequences. And, regardless of their feelings about the proposal, they say it won’t attack the root of the problem: rising health care costs.

A complex issue

“The proposal, while it is helpful, is still not quite what individuals need,” said Sam Snideman, vice president of governmental relations at the United Way of Central Indiana.

The United Way has done work to help Hoosiers who carry medical debt.

In June, the organization worked with the United Neighborhood Centers of Indianapolis and a national not-for-profit, Undue Medical Debt, to erase medical debt for more than 112,000 people in the Indianapolis metro area. An anonymous donor gave $1.2 million to Undue Debt, and the United Way gave an additional $500,000. Undue Debt used the donations to purchase medical debt and abolish it. Because medical debt typically sells at a steep discount, Undue Debt leveraged that $1.7 million to abolish more than $239.6 million in medical debt.

Unpaid medical debt can have real consequences, Snideman said. It can cause people to put off needed care because they don’t want to incur more medical bills, and delinquent medical debt can make it harder for people to qualify for a mortgage or rental housing.

But even if the CFPB’s proposed rule change goes into effect, he said, the problem of delinquent debt won’t disappear. “In an aggregate sense, you still have the debt. You still have either a responsibility to pay the provider, or you have a responsibility to pay the collections agency.”

Elizabeth Nash, east-side economic mobility district director at John Boner Neighborhood Centers, raised a similar point.

The John Boner Neighborhood Centers, which is part of United Neighborhood Centers of Indianapolis, was also involved in the local medical debt eradication effort.

Nash said medical debt could still damage a person’s credit report even if the CFPB proposal goes into effect.

That, she said, is because a person who pays medical bills with a credit card might become delinquent on those credit-card payments. And that delinquency will show up on a credit report as credit-card debt, even if the debt consists of medical bills.

Nash said she’d like to see the CFPB’s proposal address this complication, though she said she supports the proposal overall.

“Medical debt is one of the only types of debt that you don’t have a choice to take on,” Nash said. “You have to take care of your health, and if you have to go to the emergency room, you don’t have a choice on what that’s going to cost you.”

Supporters and detractors

The American Medical Association, which represents physicians and medical students, also raised this point in its public comment on the CFPB proposal.

In a letter in which the AMA said it “strongly supports” the CFPB’s proposal, the organization also said, “we urge the CFPB to amend its proposed rule to also apply to medical debts on general-purpose credit cards, medical credit cards, and medical payment products. Negative information regarding those debts is just as harmful as medical-debt collection items on credit reports.”

The Indiana State Medical Association said it has not taken a position on the CFPB proposal.

Steve Hooley, president of Goshen-based debt collection agency Business & Professional Services Inc., said he believes the CFPB’s proposal would be harmful.

If medical debt is removed from credit reports and no longer factors into a person’s credit score, Hooley said, that person will be less motivated to pay off the debt.

This is what has happened over the past year or so, he said, when the big three credit agencies announced they were voluntarily removing medical debts of less than $500 from credit reports. Equifax, Experian and TransUnion made this announcement in April 2023.

That change has made it harder for his agency to collect these small-dollar medical debts, Hooley said. “That has made a significant difference, without a doubt.”

Medical debt represents about 75% of the collections Hooley’s agency handles. Most work is done on a contingency fee; if the agency can collect on a past-due account, it receives a percentage of the recovery.

And if people don’t pay their bills, Hooley predicted, medical providers will make up the shortfall by raising their prices.

Hooley said he believes the CFPB’s proposal is a response to the rising cost of health care and the complexities of the medical billing system, but done in a way that is “probably politically motivated to grab a quick headline” rather than solve the problem.

“It’s a complicated process, and to try to put a Band-Aid on it in this manner. … It’s going to make it worse, in my opinion,” Hooley said.

What would actually help, he said, is increased price transparency from health care providers, increased transparency from insurers about the billing process, and more consumer education about health care costs.

What lenders say

Lenders offer mixed opinions on the proposal.

“We generally oppose removing any debt record from a credit report as it does not give lenders an accurate picture of how much more debt a potential borrower can handle,” the Indiana Bankers Association told IBJ via email.

The association’s national counterpart, the American Bankers Association, has expressed similar concerns.

“If lenders are not able to consider medical debts in credit underwriting, consumer delinquencies and defaults will increase, impacting banks’ safety and soundness and consumers’ credit access,” the ABA wrote in its public comments to the CFPB. “If lenders know that credit scores have increased, but believe that risk has not decreased, they will simply offset the increase by further tightening their lending standards.”

One local mortgage lender offered a different take.

Chris Pisano of Carmel, vice president of mortgage lending at Chicago-based Rate, said he favors the CFPB’s proposal.

Mortgage lenders look at a potential borrower’s debt-to-income ratio when assessing whether to offer a mortgage to that person—and eliminating medical debt from the equation will improve the equation, Pisano said. “I think it’s going to allow quite a few more borrowers to qualify for homes.”•

Please enable JavaScript to view this content.

Just the very fact that Americans can acquire medical debt poses a huge opportunity cost to the economy. A lot of people just don’t take the risks necessary to be an entrepreneur because they cannot afford to leave their job & go without insurance. There is a reason why countries like Sweden are very entrepreneurial; people don’t have to worry about losing everything if they or an immediate family member develops a health condition.

We have to figure this out.

Agree with Robert H. The combination of high medical prices and high insurance deductibles (along with less-than-universal coverage) results in financial burdens for many and risks for all of our citizens.

Medical Debt collectors are evil predators that prey on both the medical providers and the sick and injured patients !

This proposal would be a positive step. How many bankruptcy filings are driven by overload of medical bills. How many families and individuals who pay bills, work hard to buy a home then it all crashes because your child develops a life threatening disease.

I think a proposal should consider banning insurance companies from using your Credit Score to determine policy cost.