Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Jennifer Goldsby of Whitestown seems like the perfect example of a low-risk auto insurance customer.

She said she hasn’t filed a claim in years nor done other things that might cause her premiums to go up: “No tickets, no damage, no claims, great credit, pay my bills on time.”

Yet when Goldsby’s current policy expires next month, she’s anticipating her annual premium to increase 30% to 40%.

Under her current policy, she pays about $1,000 a year to insure her 2019 Toyota Corolla with Wisconsin-based Secura Insurance Cos. But that company announced late last year that it plans to exit the personal insurance market, so Goldsby will have to switch carriers.

Goldsby said her rates with Secura have stayed flat over the last few years, but she expects to pay $1,300 to $1,400 under a new policy. She doesn’t yet know the exact amount because her agent at Carmel-based Shepherd Insurance is still working to find her the best deal.

Goldsby, who works in the mortgage industry, earns part of her income from commissions and said her income has fallen significantly as higher interest rates have dampened homebuying activity. “Everything’s going up, but my income’s going down.”

She said she can afford to pay the higher premiums. But the increase has caused her to rethink transportation options for her teenage daughter, who expects to get her driver’s license within a few months. Goldsby had planned to buy her daughter a used car, leaving it to her daughter to cover car insurance costs. Now, her daughter will likely share Goldsby’s car instead.

Goldsby’s situation is far from unique. For a variety of reasons, some related to the pandemic, auto insurance premiums have risen dramatically over the past few years. That’s true for consumers insuring personal vehicles and for businesses insuring commercial vehicles.

Marty Wood, president of the Insurance Institute of Indiana, an industry lobbying group, said Indiana is actually in a better position than some states when it comes to rates. State laws here are generally friendly to insurance carriers, he said, which attracts carriers to do business here. That, in turn, creates competition, which generally results in lower rates. Indiana’s relatively light traffic congestion also means the state has fewer fender-benders and fewer damage claims than other states do, Wood said.

But rates are still up in Indiana just as they are nationwide, Wood said. “Coming out of COVID, it’s been pretty consistent across both commercial and personal lines. And it’s your standard reasons for this: It’s inflation, it’s supply chain, it’s labor costs.”

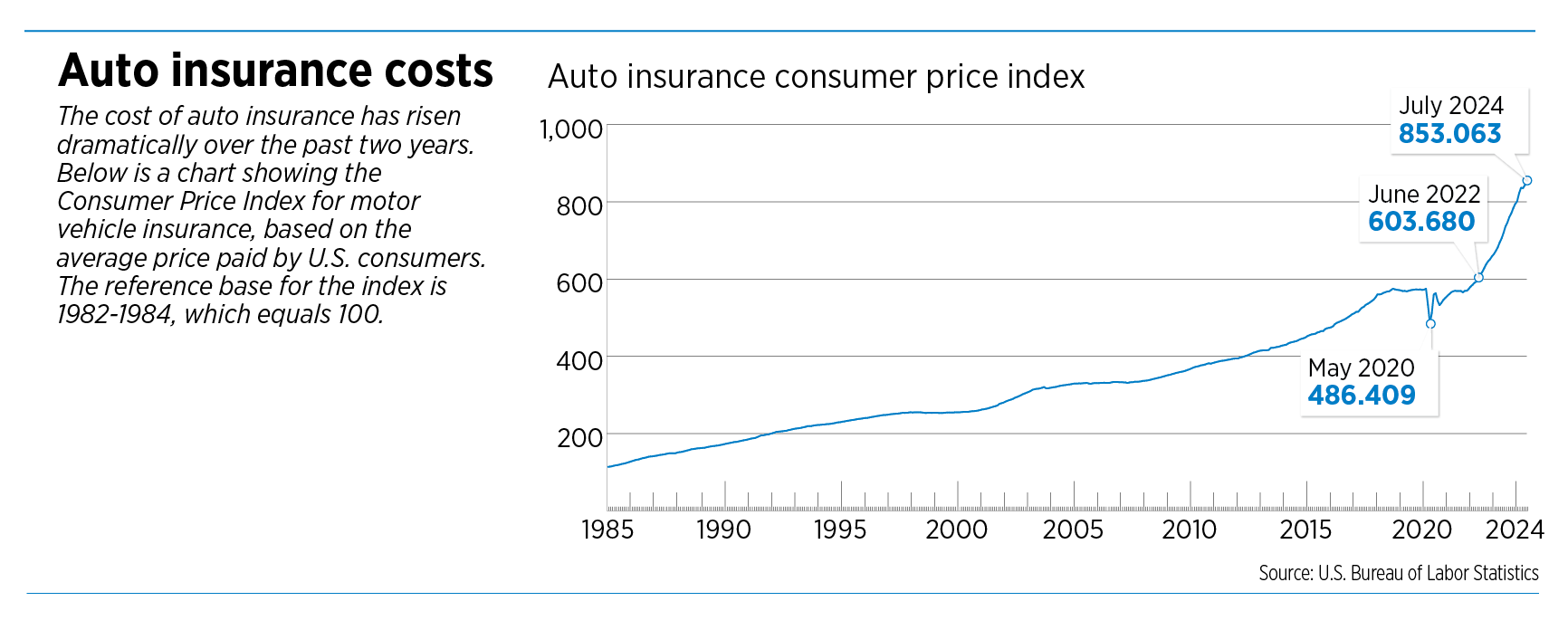

According to the U.S. Bureau of Labor Statistics’ Consumer Price Index, the average consumer’s auto insurance costs actually declined during the first year of the pandemic, when stay-at-home orders meant many people were driving less. But rates for personal auto insurance have consistently risen by double digits on a year-over-year basis since September 2022. This July, the most recent month for which data is available, the increase from July 2023 was 18.6%. That’s actually down from earlier in the year, when year-over-year increases topped 22% in both March and April.

Those pandemic-era premium decreases actually helped set the stage for the big increases that have followed, said Susan Morgan, a partner at Shepherd Insurance and president of personal lines at the independent agency.

“When people were staying at home and they weren’t driving, auto rates started to come down. Companies were giving rebates, refunds on car insurance, and I think by doing that, they didn’t anticipate what was coming when we came out of the pandemic,” Morgan said. “To get them back to where they needed to be, it’s almost like they had to take double increases just to get back to where they were.”

In general, Morgan said, insurance carriers look at their loss history as an indicator of what their losses might be in the future. Their goal is to charge high enough rates to cover their losses, while not charging so much that customers leave in search of a better deal.

“Sometimes [carriers] get it right. Sometimes they don’t,” Morgan said of the process.

Other factors

Part of the increase is linked to the lingering economic impact of the pandemic. Inflation, for instance, has increased the cost of everything, including motor vehicle parts. Add in supply-chain problems and rising labor costs, and you get higher repair costs.

Vehicle repairs are also more costly because today’s vehicles are loaded with sensors, cameras and other safety equipment that often needs to be repaired or replaced along with a bumper or door panel when a car suffers damage.

“You don’t realize what the costs to repair are until you need [insurers],” said Sandra Shambaugh, vice president of insurance at AAA Hoosier Motor Club. The organization sells its own AAA auto insurance to both AAA members and non-members. It also operates as an independent agency and sells policies from other carriers.

As one example, Shambaugh said, a windshield replacement in a modern vehicle involves more than just the glass—it also involves the sensors and other technology that tie into that windshield.

The increase in vehicle complexity is also a factor for commercial vehicles. The camera systems and lane-departure and collision-avoidance technology in today’s commercial trucks help make them safer, and trucks with these features can qualify for insurance discounts, said Gary Langston, CEO of the Indiana Motor Truck Association. But, he added, “the bad part is, that equipment does cost a lot more to buy. It does cost a lot more to repair.”

According to the Washington, D.C.-based Council of Insurance Agents & Brokers, the average cost of commercial auto insurance premiums has risen consistently over the past decade.

Unlike personal auto insurance, commercial auto insurance premiums did not decrease during the pandemic—they continued to go up. The highest quarter-over-quarter increase since 2015 came in the third quarter of 2020, with an 11% increase. For the second quarter of 2024, the average increase was 9%.

A phenomenon called “nuclear verdicts” is the main factor in driving up the cost of commercial auto insurance, industry experts say. If a motor vehicle accident ends up in litigation, a nuclear verdict is commonly defined as one in which the settlement amount or jury award is $10 million or more.

If a commercial truck is involved in an accident, even if the truck driver is not at fault, the trucking company’s insurer could be facing enormous liability, Langston said. “It’s one of the top concerns, if not the top concern, in the industry.”

Nuclear verdicts are associated with jurisdictions that are considered to be favorable to plaintiffs, said Greg Feary, president and a managing partner at Indianapolis-based law firm Scopelitis Garvin Light Hanson & Feary PC, which specializes in transportation law.

Indiana does not have any such areas, Feary said, but if an Indiana-based company’s vehicle is involved in an accident in one of these locations, the accident could end up in litigation there.

A turning point?

Regarding personal auto insurance, Morgan said she believes the era of huge premium increases is at an end.

From mid-2023 to early this year, Morgan said, some insurers stopped offering personal auto insurance because they found it unprofitable. Now, she said, some of those insurers have begun to come back into the market.

In the world of property and casualty insurance, a metric called the combined ratio is a standard measure of profitability. A combined ratio of 100 represents break-even status, with the amount in premiums collected equal to the amount the insurance carrier pays on expenses and claims. If the ratio is above 100, the carrier’s premium revenue is insufficient to cover its claims and expenses. The higher the ratio, the worse it is for the carrier. Ratios below 100 represent profitable operations.

According to S&P Global Market Intelligence as reported in a July 23 Insurance Journal story, the average combined ratio for personal auto insurance last year was 104.9. Although that’s unfavorable to insurance carriers, it represents an improvement from the 112.2 recorded in 2022. S&P Global Market Intelligence predicted that personal auto insurance will become profitable again for carriers this year, with a projected combined ratio of 98.4.

But neither Morgan nor AAA’s Shambaugh said they expect premiums to return to the prices of a few years ago. Instead, they believe premiums will settle into a new normal.

With that in mind, they said, consumers can take actions to potentially reduce their bills.

Morgan said she’s seen an uptick in clients opting for telematics—technology that records a customer’s driving habits and can result in lower rates for safe driving. She said this option could lead to real savings for customers with a spotty driving record or young drivers in the home.

Other options can include multi-line discounts for drivers who use the same carrier for multiple policies—auto and homeowner’s insurance, for instance. Carriers might also offer discounts to customers who sign up for automatic payments or policy renewals.

Shambaugh said an insurance agent can help you find options you might not have considered. “My advice to the consumer is, now more than ever … it’s beneficial to work side by side with the local insurance agent.”

Morgan said some of her clients have opted to adjust their coverage in pursuit of lower premiums—maybe opting for higher deductibles or doing without benefits like rental car coverage or roadside assistance.

But don’t take that strategy too far, Shambaugh advised. “We would recommend against cutting your coverage for a cost reduction if it’s going to damage you [financially] in the long run.”

For her part, Goldsby said she’s not considering reducing her coverage when she obtains her new policy. “I’m in an industry where I see what happens when you don’t have adequate coverage.”•

Please enable JavaScript to view this content.

How long will the pandemic continue to be the reason and justification for everything? 5 years? 10 years? Are any politicians working on a plan to solve the problems that were created?

Increasing the deductible reduces the cost of the premium.

The entire country is controlled by big insurance and big pharma. It’s insane.

The pandemic created numerous issues with supply chain, as did international trade policy. Many of those parts are produced in China and other Asian nations. Shipping is more expensive, the labor is more expensive. There are tariffs in place. I’m still waiting for my mechanic to let me know they have the radiator hoses for my domestic vehicle. It’s not an emergency, but they need to be replaced. He just can’t get them.

Increasing the deductible does decrease premium, to some extent. But make sure you have the financial ability to cover that larger deductible. When decreasing the deductible was popular back in the 90s, and agents had all their customers taking $1000 deductibles, I was a field claims adjuster. More than one family with whom I dealt couldn’t pick up their car when it was finished, and after the rental was cut off, because they didn’t have an extra $1000 or more laying around in their checking or on their credit cards. They never put two and two together, until after the accident, to realize that larger deductible meant they had to pay more of the claim.

I can’t speak as to big pharma…but insurance doesn’t control the country. vice versa. Insurers pull out of the market, especially personal lines, because they can’t control the expense side of the claims. Labor costs to repair have gone up (think about your own raises), parts still aren’t available, and jury verdicts and therefore settlements cost more. Coupled with losses in home owners insurance due to hail storms, wind storms, tornadoes, and insurers have a hard time keeping up with breaking even. Several insurers have been downgraded by the rating agencies, and some have just given up on personal lines and will try to make a go just in commercial.

Some solutions? Litigation reform. Stop building in flood zones and on coastal properties. Stronger local building codes so homes and buildings have a better chance of surviving storms. Better protection for sensors and cameras and computers in cars. Better traffic enforcement…stop people from routinely ignoring yellow lights and going through intersections on or after red. Stronger enforcement of cell phone and other distracted driving laws (really, do you have to text and face book while you’re driving?)

I have received calls from three different Indianapolis residents who had their cars stolen this year. I generally tell them they should remember this when they vote. When mayors blame car companies, rather than thieves, and prosecutors do not prosecute, that causes damage to the rest of us (with inflated premiums).

or maybe we should blame the car thieves who disregard the law and steal the cars. Odds of catching a car thief are pretty low, and you have to catch them to prosecute them. How many police would you put on that patrol?

How much more in taxes are you willing to pay in Marion County to afford all those new officers at their current increasing salaries? How many more prosecutors and judges are you ready to hire, and new court rooms to build and staff, to handle these cases? How many more prisons will you build to house all these criminals.

Choices have to be made. Do I chase stolen cars, or do I chase drugs and sex traffickers, especially police officer pedophiles. Do I try to bring down murder cases (which maybe happening), or try to find a car thief? Or do you, as a prosecutor or police agency, try to find the organized rings. Go ahead, I’m waiting to see your plan to allocate the resources. And please, don’t try to say it would work better if it were privatized. That is essentially what having insurance handle it does. Insurance pays, and then organizations like the NICB try to find the thieves.

What would you have the Mayor do? Two car companies have admitted their cars are too easy to steal, and are implementing better car security. Hyundai/Kia are paying owners of their cars some $200 Million in compensation. Should the Mayor and city government test each car before it goes on sale or is permitted to be parked in the city/county to make sure its anti-theft devices are adequate? Should we fine and imprison people who leave their cars running as they run into a store or some other quick errand only to have their car stolen while they’re gone? How about people who leave their cars unlocked and parked in places where no one will see the thief stealing the car?

Blaming a mayor or prosecutor for increased car thefts is ignorant, especially when so many other factors go into the calculation…

Just checking back in a few days later to see if Patrick O. has that budget alloction plan ready…or if it was just more of a steady stream of complaining about the Mayor and Prosecutor with nothing useful to add to the discussion. I think we have the answer…