Barnes & Noble uses COVID-19 shutdown to refresh stores

It’s part of a chain-wide move to give store managers more autonomy. Also this week: Apocalypse Burger, Enterprise Car Sales, and America’s Best Contacts & Eyeglasses.

It’s part of a chain-wide move to give store managers more autonomy. Also this week: Apocalypse Burger, Enterprise Car Sales, and America’s Best Contacts & Eyeglasses.

The owners of Moonshot Games are launching a delivery service they say can help local independent retailers compete with Amazon.com and the big-box stores.

The historic Hammond Block building will be the second location for the bar that started in South Bend. Also this week: Fresh Thyme, The Empty Vase, Forever Gallery, Lily & Sparrow, Kits & Kaboodle and more.

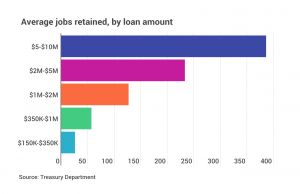

In Indiana, more than 90% of federal loans topping $150,000 went to companies, according to the Treasury Department data. About 6% of the loans went to not-for-profit organizations.

The pandemic has been a boon for Indianapolis-based Piano in a Flash, which teaches adults how to play the piano using a simplified version of sheet music.

The campaign, which launches Wednesday, has two goals: Supporting local Black-owned businesses and helping other companies do a better job of supporting the Black community.

Indiana lenders had secured a total of $9.5 billion in Paycheck Protection Program loans for their borrowers as of Saturday, according to the Small Business Administration.

While Heliponix’s in-home computerized vegetable-growing machine has always seemed like a great idea, the coronavirus pandemic might be the push to get the wider public to realize what the company’s two young founders have been espousing since they germinated the startup as Purdue University seniors in the fall of 2016.

It will be the second location for Moonshot Games, which opened its Noblesville location in 2018. The company says business is booming despite the COVID-19 pandemic.

During the coronavirus pandemic—which research shows has disproportionately affected black-owned businesses—the 250-member organization has received no city funding to give loans or grants to its members who were struggling.

Costumes by Margie, which opened in 1970, almost changed ownership last month, but the pandemic ruined those plans

Up to five more locations could open in the next 16 months. Also this week: The Black Acre Loft, Dave & Buster’s, Gold Leaf Savory & Sweet

The owner, who has operated toy stores for more than 40 years, said she closed the shop so she could retire.

The Indianapolis City-County Council is scheduled to meet at 7 p.m. Monday night to consider the proposal.

Looting and vandalism in cities across the country have dealt another blow to small businesses that were already reeling from the coronavirus outbreak.

The shop, which opened in 2007, has been closed since March because of the pandemic. It aims to reopen Tuesday.

The husband-and-wife owners say the violence over the weekend stems from issues of inequality that society must address.

The combination of the pandemic and ransacking of his business has been hard for the owner of the nearly 50-year-old shop to take.

The biggest portion of the funds will go toward a $30 million grant program called the Small Business Restart Fund.

ActUp Consulting founder’s classes focus on principles of improvisational theater—celebrating failure, adapting to the moment, and making your fellow performers look good.