Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

They were rolled out 20 years ago to encourage people to set aside money to pay for out-of-pocket health expenses, from doctor and dental visits to prescription drugs, hearing aids and wheelchairs.

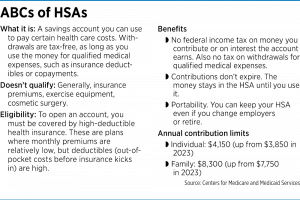

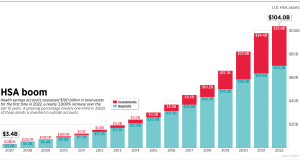

And over the past two decades, health savings accounts, or HSAs, have grown into a huge industry, surpassing $100 billion in assets in 2022, as more Americans have taken advantage of the plans. HSAs allow people to sock away pretax dollars from their paychecks into checking or savings accounts, then withdraw the funds as needed for health care expenses.

But increasingly, benefits brokers and personal-finance experts are advising people to consider another option: using cash to pay for health care and investing the HSA funds for decades. They say the funds can grow handsomely to pay for health care expenses in retirement, a period when many people rack up higher medical and hospital bills.

“We encourage people to leave the money in the accounts if they can afford to pay the [medical] expenses out-of-pocket using current income or savings,” said Stan Jackson, vice president at Indianapolis-based Apex Benefits.

Why? Because investing HSA funds for the long term can leverage so-called “triple-tax” benefits, which can stretch money even further.

In a nutshell, triple tax means the funds are eligible for three types of tax benefits. First, HSA contributions are tax-deductible (or pretax, if made by payroll deduction). Second, the money in the account can grow tax-free for decades. And third, funds that are withdrawn down the road for a raft of qualified medical expenses are tax-free.

Add it all up, and even with a modest rate of return on any investments, investing your HSA funds rather than draining the account frequently to pay for current needs means significant growth over time, experts say.

That’s especially true as Americans live longer but can expect to face an increasing number of major health problems in old age, such as heart conditions, osteoarthritis and joint replacements.

“I’d really like to have some funds saved up for that, so let’s grow them through an investment approach, and then I’ll use them when I need them later in life,” said Chad Morris, vice president at Gregory & Appel Insurance, an Indianapolis-based benefits firm.

Two decades old

HSAs burst on the scene in 2004 after then-President George W. Bush signed into law the Medicare Prescription Drug, Improvement and Modernization Act. They are a type of savings account that lets Americans set aside money for a wide array of medical expenses.

The funds can pay for deductibles, copayments and coinsurance but generally can’t be used to pay health care premiums. Americans can set up and contribute to an HSA only if they have a high-deductible health insurance plan—a rarity when the plans were rolled out but increasingly common today, covering 55% of Americans in 2021.

Employers offer HSAs through banks, credit unions and other financial institutions, which manage the savings and provide debit cards to pay for expenses at the pharmacy counter or doctor’s office.

In the beginning, typical HSAs had no investment options; the money was held in a savings or checking account, according to Investor’s Business Daily.

“And not surprisingly, most HSA account owners used the money in their accounts to pay for current medical expenses,” the newspaper said in a November 2023 story that accompanied its annual report on HSAs.

But over the past 15 years, the number of HSA options has grown exponentially, as employers have teamed up with banks and investment houses to offer thousands of dedicated accounts that invest in a wide assortment of stocks, bonds, mutual funds, money market funds and index funds.

In response, a growing number of Americans have chosen to invest their HSA funds to take advantage of tax incentives.

By the end of 2022, nearly 32% of total HSA assets in the United States were held in investment assets—up from just 6% in 2007, according to Devenir, a Minneapolis-based investment firm that publishes frequent reports on the HSA sector.

Even so, all that money still represents a small fraction of Americans. Most HSA owners still aren’t taking advantage of HSA tax and investment opportunities. As of 2021, 88% of HSA owners still held their full balance in cash, according to the Employee Benefit Research Institute, a nonpartisan research organization based in Washington, D.C.

That means a small fraction of Americans accounts for the bulk of HSA investment funds. “Relatively few accountholders took advantage of this ability, and those who did tended to have very large balances,” the institute wrote in an October 2021 report.

One possible reason: Only 55% of working Americans know that HSAs can be used to pay for health care expenses in retirement. And just 27% know that HSAs can be used as an investment vehicle, according to Voya Financial, an investment firm based in New York City.

A wide range of newsletters and magazines are reporting on the trend and possibly nudging more people into considering investing their HSA funds.

“The ultimate retirement savings account? Surprise, it’s an HSA,” said a 2022 headline in Kiplinger’s Personal Finance.

“Health Savings Accounts: From Simple Savings to Investment Powerhouse,” said a 2023 headline in Investor’s Business Daily.

Growth potential

The most compelling reason for investing HSA funds, of course, is the potential for large growth, as the stock and bond markets usually provide better returns than low-interest savings accounts. Participants can generally invest once their accounts reach $1,000.

HSAs with investments had an average total balance of $16,397, nearly seven times higher than accounts with no investments, according to Devenir.

For people who contribute $2,000 in an HSA account every year, their investment account can grow to nearly $139,000 over 30 years (assuming a 5% return), compared with just $64,000 if they were to keep the money in a savings account (with an average of 0.5% return), according to investment bank Merrill Lynch.

Companies, unions and other employers that offer HSA plans typically include a range of investment options but require their members to actively choose one. Otherwise, the funds will automatically go into a savings account.

Of course, Americans have the option to sock away more than $2,000 a year. Individuals can contribute $4,150 a year, while families can invest $8,300. (That includes contributions from employers.)

“Those with greater disposable income levels tend to max out their contributions because of the current and future tax advantages,” said Jackson of Apex Benefits.

Not everyone is in a position to invest the HSA funds, of course. People who have large out-of-pocket health costs for chronic or severe diseases and have little extra cash on hand often drain their HSA accounts annually.

“I think it’s so situational based on where somebody is at in their career, their age, etc.” said Morris of Gregory & Appel. “There’s definitely a bucket of people that will use it for today. Because really, that’s the intended purpose of the account, and we do encourage them to do that. … And there are others that will use it as an investment vehicle.”

HSA funds, whether invested or saved, can be used only to cover qualified health care expenses, not for general retirement needs. The list of qualified expenses, though, is huge, ranging from hospital services and physical therapy to crutches, X-rays and dental fillings.

Examples of purchases that normally don’t qualify include food, exercise balls, standing desks and facelifts.

Regardless of the goal for an HSA, experts recommend setting up an account as early as possible, contributing as much as possible in pretax dollars (up to the limit) and taking advantage of employer matches. That will allow the money to be there when you need it.

Once you reach retirement age and enroll in Medicare, it’s generally too late to set up an HSA account; that’s because they must be paired with a high-deductible health insurance plan. But you can keep your HSA if it existed before you enrolled in Medicare and spend from the balance to help pay for medical expenses.

So how do HSAs compare with typical retirement vehicles, such as a 401(k) or an investment retirement account?

The main advantage is that an HSA is the only vehicle that offers tax advantages across the board—with no taxes on contributions, growth or withdrawals. With traditional IRAs, withdrawals are taxed; for Roth IRAs, contributions are taxed.

And for one of the most popular investment vehicles, the 401(k), withdrawals are also taxed. But for both the traditional IRA and the 401(k), those withdrawals in retirement are normally taxed at lower rates than you would have paid during income-earning years.

“Every dollar in an HSA is worth at least 17.65% more than a dollar in a 401(k),” Blake Hilgemann, author of the “Pathway to Financial Independence” newsletter, wrote last year in a widely quoted report.

“If you’re in a high tax bracket,” Hilgemann told CNBC, “an HSA is a complete cheat code for you.”•

Please enable JavaScript to view this content.

Using an HSA as a ‘”cheat code” is such a vague term. It’s just a lever to pull in retirement but I wouldn’t make it my foundation for retirement. Consider happens when you don’t want to spend the money on qualified medical expenses… “In addition to the 20 percent penalty, the IRS will also consider any HSA funds spent on non-qualified expenses as taxable income.” Ouch.

The story doesn’t advocate using HSA funds for non-medical expenses. In fact, it specifically mentions that HSA savings and investments can pay for health care expenses in retirement, “a period when many people rack up higher medical and hospital bills.”

The full quote was: “If you’re in a high tax bracket,” Hilgemann told CNBC, “an HSA is a complete cheat code for you.”

In other words: if you’re rich, you’d be crazy not to max your HSA contribution since it has outrageous tax benefits and a relatively low annual cap of $8,300. Since everyone is likely to have large medical expenses at some point in their life, some financial planners will tell you to max your HSA BEFORE you max your 401(k) or other investment vehicles.

Chris C. Yes, if you’re rich and can afford to max out your 401K contributions, then by all means go ahead and max out your HSA contributions. If you’re that rich and you want to retire before the age of 65, I can see this as huge boon where you can pay your $1000/month health care premiums tax free from your HSA.

I can also see a risk here that you’re healthy for many years and then suddenly you die and all of the money in the HSA goes unspent.

Dan, the HSA funds go to the spouse tax free, then to children but taxed. Still worth it.

I will say that your investment options with HSAs are also usually limited to maybe one option. In addition, my HSA required the first $1,000 to be held as cash, which means none of that was growing at all.

I get it, but to another poster’s point, this seems like something for people above my tax bracket.