Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIt’s been more than six months since the U.S. Department of Labor announced a proposed new rule to the Fair Labor Standards Act that would extend overtime pay to 3.6 million salaried workers.

More concrete action could come by April, but even then the new rule is expected to face legal challenges.

A 60-day public comment period ended in November with thousands of Americans, labor advocates and business groups weighing on the rule’s proposed changes, which include a substantial boost in the salary threshold to allow more salaried workers to qualify for overtime under the law’s executive, administrative, and professional exemptions.

Rhonda Burke, a labor department spokeswoman, told Indiana Lawyer the department’s current regulatory agenda estimates that the overtime final rule will be published in April 2024.

“This is just an estimate; sometimes rulemaking can take longer to complete than initially expected,” Burke noted.

Whenever the final rule is published, it’s expected to spur immediate legal challenges.

If it survives those and is implemented, the department estimates it will restore and extend overtime protections to 3.6 million salaried workers, as well as automatically update the salary threshold every three years to reflect current earnings data.

Salaried managers in the retail, hospitality and food service industries are expected to benefit the most from the proposed change.

Currently, salaried workers making $684 a week or less (an annual salary of $35,568) qualify for overtime under federal rules.

Under the proposed change, that standard salary level would jump to $1,059 per week, or $55,068 annually.

That’s tracked to the 35th percentile of weekly earnings of full-time salaried workers in the lowest-wage U.S. Census region.

And the proposed salary threshold could change in the final published rule, said Quincy Sauer, an employment law attorney with Macey Swanson LLP.

“My guess is as time has passed, that number will be higher,” Sauer said.

Sauer said there is a footnote in the proposed rule, which was released in August, which mentions that in the final rule, the department will use the most recent data available, which would change the dollar figures.

That footnote pointed out that the proposed rule relied on data for calendar year 2022.

“In the first quarter of 2024, the Department projects that the salary threshold could be $1,158 per week or $60,209 for a full-year worker,” the footnote stated.

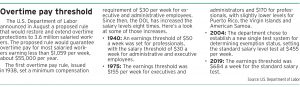

History of threshold adjustments

When the salary threshold was first established in 1938, it set a minimum compensation requirement of $30 per week for executive and administrative employees exempt from overtime..

Since then, the department has increased the salary levels eight times—in 1940, 1949, 1958, 1963, 1970, 1975, 2004, and 2019.

In 1940, an earnings threshold of $50 per week was set for professionals, with the $30 threshold kept in place for administrative and executive employees.

Beginning in 1949, the part 541 regulations contained two tests for the executive, administrative and professional employees exempt from overtime.

Gradually, the time between salary threshold revisions lengthened considerably.

Judy Conti, National Employment Law Project‘s government affairs director, said the threshold, up until the mid 1970s, was raised frequently every four-to-six years.

But then it was not raised from 1979 to 2004. And then not raised again until 2019.

The proposed new overtime rule would index the threshold every three years.

“I would prefer to see it indexed every single year, so workers don’t fall behind,” Conti said.

Opposition to proposed rule

Comments received in response to the department’s notice of rulemaking can be viewed on regulations.gov.

Burke said the web site listed 33,310 comments received, with 26,280 comments posted. She said the difference is because one commenter attached thousands of comments to their one submission.

John Haskin of Indianapolis-based John H. Haskin & Associates LLC said every time the department goes to raise the salary threshold levels for the exemption, there have been lawsuits challenging the increases.

In 2016, the Obama Administration attempted to bring back a two-tier system for determining exemption status after the Bush Administration chose to establish a new single-test system in 2004.

The 2016 rule also included a provision to automatically update salary levels.

Multiple business groups joined in a lawsuit against the proposed rule, which was invalidated by the U.S. District Court for the Eastern District of Texas.

That court concluded the labor department had exceeded its authority because Congress intended the exemption to be primarily defined by an employee’s duties, not salary.

Haskin said he expected every employer would fight the new rule.

“I think if they would grant it, if the courts would approve it, it would bring in a substantial amount of employees that could be exempted,” Haskin said of the new proposed rule.

The U.S. Chamber of Commerce issued a statement announcing its opposition when the proposed rule was announced.

The organization stated that additional changes in the economy make the proposed boost in the salary threshold even more problematic.

“Employers continue to struggle to find enough employees and have to pay higher wages as a result. Increasing the cost of labor even further through this regulation will add to their burdens and will be felt particularly severely among small businesses, and charitable nonprofits who can’t just increase prices because they are dependent on contributions to maintain operations,” the statement read.

Chris Netram, managing vice president of the National Association of Manufacturers, also weighed in on the proposed overtime changes.

“Manufacturers have spent the past several years adapting operations and personnel management resources to meet the evolving needs of their workforce in a post-pandemic environment, including through improved wages and benefits and productive workplace accommodations. The DOL’s proposed rule would inject new regulatory burdens and compliance costs to an industry already reeling from workforce shortages and an onslaught of other unbalanced regulations.

“Creating new regulatory processes and imposing additional mandatory costs will act as a drag on the sector and upend productive employer–employee relations,” Netram said.

Sauer is a member of the National Employment Lawyers Association

NELA submitted collective comments of more than 1,500 members to the labor department regarding the proposed changes to the regulations applicable to executive, administrative, and professional employees.

In its comments, NELA proposed that the department adopt a current salary threshold of $1,145 per week based on the 40th percentile of weekly earnings of full-time salaried workers in the lowest-wage Census Region.

This is the same increase to the salary threshold that the department proposed in 2016.

Sauer said many states already index their minimum wage laws.

The Economic Policy Institute reports that the minimum wage is indexed for inflation in 19 states and the District of Columbia.

What comes next?

The Office of Management and Budget’s Office of Information and Regulatory Affairs is reviewing the proposed rule.

Like Haskin and Sauer, Conti said she expects swift legal challenges to the final published rule.

Conti said she thought there could be a final rule published within two to four weeks.

“I hope we can get this across the finish line.” Conti said.•

Maybe this is just my opinion, but I don’t think any employee without a significant ownership percentage or partnership (let’s say 5%) should be exempted, no matter what their tasks or salary or wage may be. You do the work, you get paid. You do more work, you get more pay. Why make it complicated?

Agreed!