Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowBankruptcy filings in Indiana are still below historic highs, but they continue to creep up as consumers struggle with high credit card debt, student loan repayments and overall financial insecurity.

Matthew Cree, a Greenwood-based solo practitioner who specializes in personal bankruptcy, debt defense and student loan resolution, said he’s seen an uptick in cases since last year.

Even with the receding of COVID, clients are still dealing with financial issues related to the pandemic, Cree said, whether that be rebounding from job losses or exhausting their savings trying to keep up with expenses.

“It just came to the point where they’re exhausted,” Cree said, adding, “It’s crazy. We’re two years out (from the pandemic).”

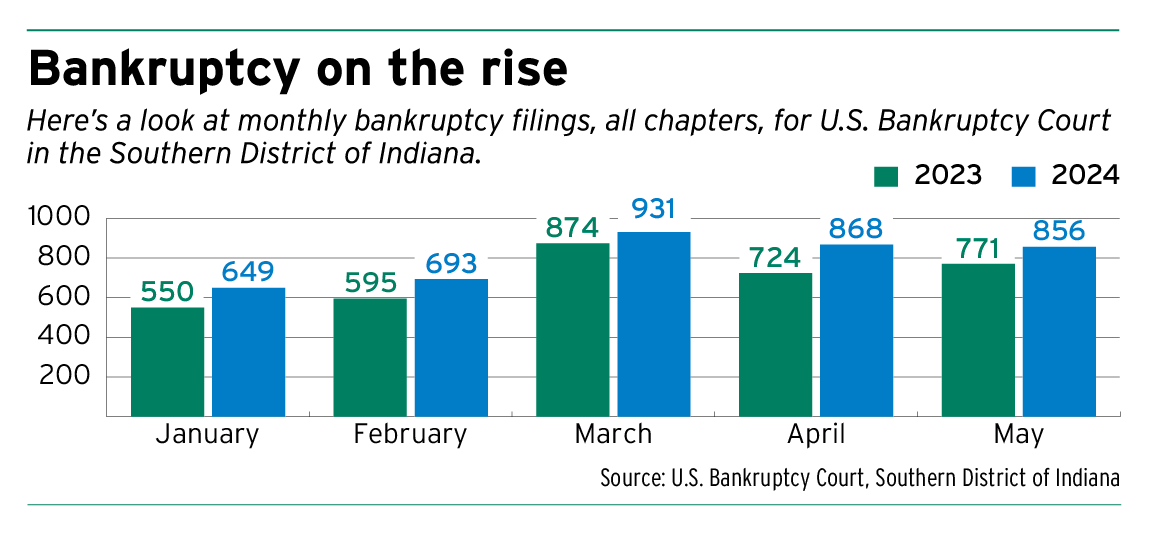

In the U.S. Bankruptcy Court for the Southern District of Indiana, April numbers for all bankruptcy cases—including Chapters 7, 11 and 13—were up 19.9% compared to the same time last year.

That followed monthly year-over-year filing percentage increases of 6.5% in March, 16.5% in February and 18% in January.

Nationally, new bankruptcy filings were up 16% for the 12-month period ending March 31, according to statistics released by the Administrative Office of the U.S. Courts.

That remains below pre-COVID levels.

Total filings rose to 467,774 new cases, compared with 403,273 cases reported during the year ending March 31, 2023.

Business filings increased 40.4%, from 14,467 in March 2023 to 20,316 in March 2024. Non-business filings rose 15.1%, from 388,806 in March 2023 to 447,458 in March 2024.

According to the federal court office, this year’s 12-month filing total for the quarter ending March 31 is nearly three-fifths of the total reported in March 2020. That year’s 12-month total was 764,282.

What Indiana bankruptcy attorneys are hearing

Corey Benjoya, an attorney with the Bankruptcy Law Office of Mark S. Zuckerberg, said his office is definitely seeing more calls since the beginning of the year.

There are a total of four attorneys in his office.

“Our calendars are jammed up,” Benjoya said.

He estimated the office’s traffic is up about 40% compared to the same time last year.

Clients are a mix of distressed individual consumers and companies.

Benjoya said trucking companies make up a significant number of the bankruptcy cases at his firm.

“We get at least 10 calls a week about trucking businesses,” Benjoya said, adding, “I think there’s not a lot of freight to be shipped. These small businesses are taking a hit.”

For individual consumers, there’s been a substantial increase in credit card debt.

Benjoya said during the COVID pandemic, creditors and collection agencies weren’t taking as much action to try and collect on debts.

That relative inactivity with collections has changed post-pandemic.

“These creditors and collection companies are hungrier, they’re more aggressive, they’re filing a lot more lawsuits. They’re trying to collect in any way possible,” Benjoya said.

The Motley Fool reported that, according to the latest Household Debt and Credit survey results from the Fed, Americans owe $1.115 trillion in credit card debt as of the first quarter of 2024, down from a record $1.129 trillion recorded in the fourth quarter of 2023.

According to Experian, Americans had an average of $6,501 in credit card debt in the third quarter of 2023.

That was up 10% from the same time period in 2022.

The credit agency reported that credit card debt saw a total balance growth of 17.4% in 2023. This increase is largely due to a 4% rise in the number of credit card borrowers who carry a balance from month to month, as well as additional retail spending.

Some law firms that handle bankruptcies aren’t seeing the same surge of cases as Benjoya’s.

Eric Lewis, an attorney at Lewis Legal Services in Indianapolis, said if he had to attach a word to filings, it would be “stagnant.”

“We have seen more Chapter 13 filings than usual,” Lewis said, attributing that in part to some homeowners having too much equity in their homes to file for Chapter 7 bankruptcy.

According to NOLO, a person can protect up to $22,700 of equity in real estate or tangible personal property under Indiana’s homestead exemption, which applies to residential property or tangible personal property (such as a mobile home) that constitutes a personal or family residence.

Lewis said he’s seeing people with a lot of high medical debt, as well as the credit card debt.

What will the remainder of 2024 look like for bankruptcy filings?

Lewis said he didn’t expect to see much overall movement up or down in bankruptcy filings through the end of the year.

Benjoya said he thought filings in his office will soar past 2023’s numbers.

He said he’s also seeing a lot of people with high student loan debt, as well as a good amount of vehicle repossessions.

Rising everyday costs for groceries and high rents means people are relying to a heavier extent on credit cards, Benjoya said.

In spite of the increased bankruptcy-related calls, Benjoya said his firm has been able to keep up.

He also has not seen any delays in the court system in terms of processing bankruptcy cases.

“We have great relationships with the Chapter 7 and 13 trustees,” Benjoya said. “We can usually resolve any problems without a judge.”

Cree said he’s been a bankruptcy attorney for 15 years.

The peak of bankruptcy filings in Indiana’s Southern District came during the Great Recession, Cree said, estimating there were more than 10,000 filings in 2010.

He said this year, the district is on pace to have between 6,000 and 7,000 filings.

Along with every other financial issue that’s spurred more bankruptcy filings, Cree said wages not keeping up with inflation may continue to be a burden as well.

“That’s putting a lot of hurt on families as well,” Cree said. •

Please enable JavaScript to view this content.

That is a lot of words to describe people spending more than they make

CC’s become a back-up to survive for some Americans. No one should be judging them. The economy is in deep water. The need to provide groceries, gas, clothing our children etc is always there. Pay attention to how many families and senior citizens are just trying financially to survive in this inflation environment. Over using cc’s is NOT always a choice. Currently, the use has become a necessity and that’s not good for America. Perhaps these same people are spending more because prices increased faster than a salary does?

I wonder how much gambling, especially sports gambling given that it’s so pervasive, contributes to these cases.

+1