Subscriber Benefit

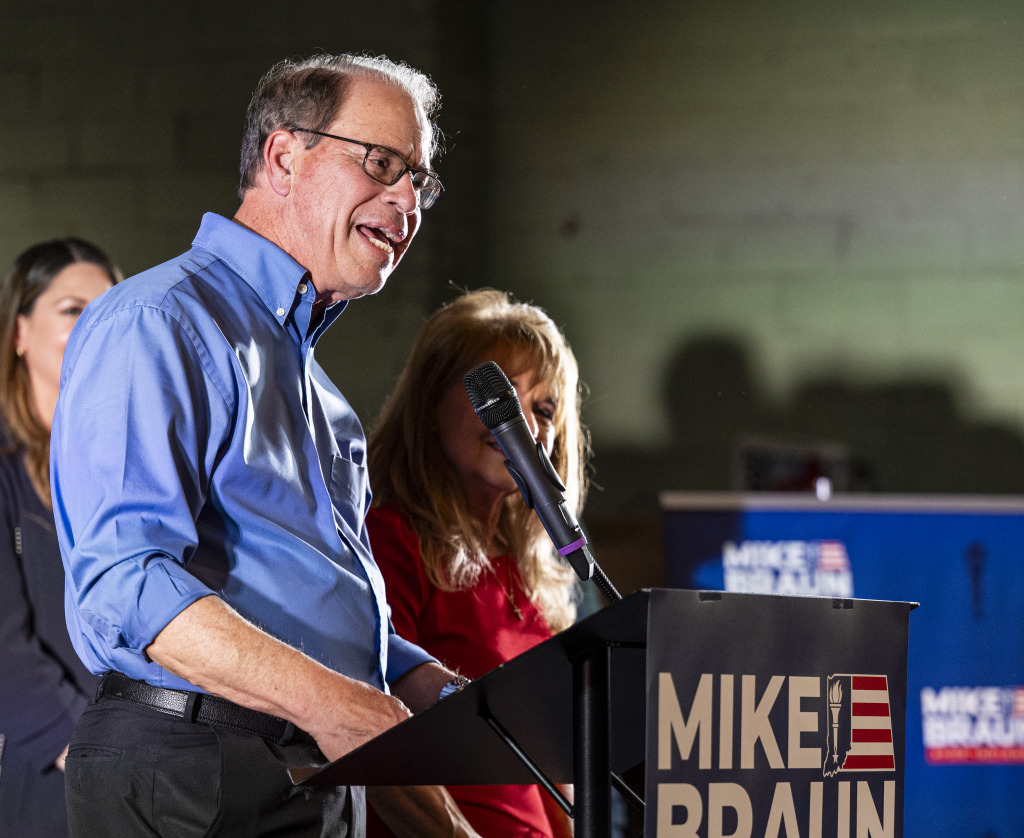

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowSen. Mike Braun, the Republican candidate for governor, released his plan to control property taxes on Friday, calling for increasing the homestead deduction, capping property tax increases and increasing voter participation in property tax referendums.

“Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in home values,” Braun said in written remarks. “My commitment to this agenda stems from my dedication to protecting the financial stability and well-being of Hoosier families.”

Under the plan, Hoosiers with an assessed home value over $125,000 could deduct 60% of their home’s assessed value for property tax purposes through a homestead deduction. Homeowners with an assessed value under $125,000 could use the 60% deduction, plus the current standard deduction of $48,000.

Braun’s campaign said these reductions would result in a 21% cut in the average homeowners’ tax bills, with more savings for homes with lower assessed values. For example, a homeowner with a home of an assessed value of $80,000 would see a 39% reduction in their tax bill on average.

Braun’s Democrat challenger Jennifer McCormick called his tax plan “irresponsible,” saying it would result in cuts to local government services.

“We have to be realistic,” McCormick told IBJ. “My biggest concern is we already have a revenue shortfall, and we’re also looking at services that are tied to his plan would be impacted significantly.”

It was not immediately known how deeply Braun’s proposal would impact local governments, but organizations representing county governments and local schools feared it could be dramatic.

Braun seemed to anticipate some those criticisms in an interview Friday morning with WIBC, saying: “Government at the local level should never grow faster than the ability of a taxpayer to pay for it.”

Braun also wants to cap property tax bill increases to 2% for seniors, low-income Hoosiers and families with children under 18. Tax bill increases would be capped at 3% for everyone else. Any property tax increases over the cap would require a referendum.

Braun’s proposal also would bring more scrutiny to property tax hike referendums. If Braun’s plan in enacted, referendums would be required to be on the ballot only during general elections, when there is a higher voter turnout. The proposals would also be required to include a total levy and data on the impact of the median taxpayer’s bill.

Interest groups representing local schools and county government expressed concern with Braun’s proposal, specifically with the lack of a revenue replacement plan for the local services the tax cuts would impact.

Scott Bowling, executive director of the Indiana Association of School Business Officials, said he has major issues with property tax cuts and caps. The impact could be dramatic on schools, he said, specifically on operational costs for busing, maintenance and utilities.

“Even at this early stage, when we look at it, there’s no way to get around the fact that doing this would have a negative impact on funding for schools,” he said.

David Bottorff, executive director of the Association of Indiana Counties, said he’s concerned about revenue reduction and is left with several questions. One of which is whether the 2% cap applies to all seniors regardless of income level.

“Asking us to further reduce our new revenues is going to create challenges and potentially a reduction in services,” he said.

Often, counties are tied to mandates that dictate their spending, Bottorff said. The application of this tax plan could make it even more difficult to meet mandates handed down by the state Legislature.

“We’re going to have to urge the General Assembly to look at some of the unfunded mandates they hand down, if they’re going to ask us to reduce spending,” Bottorff said.

Changes in property tax policy would need approval from the Legislature.

Please enable JavaScript to view this content.

Better to charge sales taxes on consumption than taxing assets which people don’t have any control over their valuations.

Sounds like Braun wants to defund the police…. and jails, and fire, and schools, and parks…

and instead increase one of the most regressive, anti-consumer spending (the thing that drives a large portion of the US economey), taxes calculated on the basis of prices over which people don’t have any control.

Fact: every single sales tax increase in Indiana history, was perpetuated under Republicans. It’s a regressive tax, it penalizes the middle class and those with less money, and it can paralyze large-ticket purchases for awhile.

I applaud Mr. Braun for recognizing the immediate need for property tax reduction. I would like to see a change in the formula that computes the amount of tax especially since it is based on inflated home values. I would also like to see a proposal to excuse property owners over the age of 65 that have owned their primary residence for over 5 years to be exempt from any property tax on their primary residence. Just some thoughts.

You do realize that if inflation is driving up taxes, that same inflation is driving up the cost of providing government services?

Indiana already ranks 48th in quality of life (IBJ’s result of MSNBC ranking) so what else is going to get cut?

Anything from MSNBC has a heavy thumb on the left side of the scale.

Yeah, I know, but you don’t accidently rate at the very bottom, even if some of the factors they picked only have minimal impact on quality of life, Indiana is still close to the bottom compared to ALL 50 other states.

Indiana seems to be adopting the Kansas Plan, where Republicans cut taxes to the point where everything was falling apart.

For Braun this is a good one. He gets all of the kudos and doesn’t have to deal with the real problems is causes.

Property taxes are too low.

Increase them to 1.5% like Ohio and do not enact socialist laws allowing the elderly to live off my tax dollars AND avoid paying taxes

State government is going to have to find efficiencies…i.e. cutting jobs in areas that don’t relate to the core mission. As Medicaid takes more and more resources, it;s time to look at all the other areas of state expenditures as well including “education”. Let’s give vouchers to all Hoosier families so parents can choose the accredited educational institution that THEY think is best! An education should be guaranteed to all Hoosier kids..that doesn’t mean that the corrupt, bureaucratic “public education system” should be sacrosanct!

The problem Indiana has isn’t that our taxes are too high.

It’s that they’re too low and we don’t spend enough on education and infrastructure.

To suggest property tax cuts without also specifying what spending you’re going to cut is systematic of the “I’m a businessman so it’s your problem” approach Braun brings to governance.

Let’s start cutting social spending and reevaluating Medicaid.

Property taxes mainly fund local government. Those cuts will go to police, fire, courts, parks schools….

Local governments are already wayyyy underfunded.

Braun won’t have to deal with the consequences so it’s a great political win for him.

When your local government lays off cops that’s on Bruan.

Students fall behind academically when they leave public education for voucher funded schools.

State law requires public schools to accept and all students who show up at their front door–24/7/365. No private school ever has to do that. The concept is expensive, and requires aggressive physical plant and staffing planning, far into the future. Indiana has an obligation to properly fund the public education system.

The best and only plan we’ve heard so far.

It’s not a plan.

A plan would be “we are going to take X amount less in, so here are the resulting spending cuts and the areas I want to cut”. Or, “we are cutting X from property taxes and raising (some other tax) Y to compensate”.

Kevin, if it is “the only plan” it cannot be “the best plan” or even “a better plan.”

How about fixing our streets and roads first?

How, tax caps are strangling localities while the state sits on billions in excess revenue.

there’s the rub…we cut property taxes and don’t replace the revenue, the streets and sidewalks don’t get fixed. Schools are not refurbished or built anew. Police, fire, and EMS are underfunded and understaffed. Libraries are underfunded, under resourced, understaffed. Parks aren’t maintained, public swimming pools aren’t opened.

The list goes on and on.

Apparently Braun and his Republican ilk didn’t read the recent report by Professor Hicks of Ball State indicating people in Indiana tend to move to places with higher property taxes to obtain the amenities they want. Corporations look for support for education, public infrastructure, and quality of life amenities when deciding where to locate their offices and factories.

Okay, reduce property taxes…but how about a means test. If your income, including retirement benefits, is above some number like $100K, you don’t get the cuts because you should be able to afford the taxes.

The tax relief doesn’t apply if you bought your home in the past five years, because you purchased at the higher market values and your financial planning should have taken property taxes into account.

If your home increases in value due to market conditions, once you sell you owe all the property taxes not paid because you took these tax relief benefits. If you employ these tax deductions, you can’t use the current market value of your home in taking out loans or otherwise listing the value of your assets…you’re capped at the value at some date prior to the enactment of the taxe cuts, say 1/1/2020. You can’t use the current market value to tell your stock broker you qualify as an accredited investor to invest in otherwise precluded investments. In short, you don’t get to cap the value of your property for tax purposes but use the increased value for all your other transactions.

If property tax “reform” is the goal, let’s provide the relief to the folks who have been in their homes for years, are just scraping by financially, and are being forced out of their homes or other issues (buying food or medicines) because of the tax increases flowing from increasing valuations.

But don’t tell me the folks who bought their houses in the past few years, at the higher valuations, should have relief. Don’t tell me the folks who bought in the new high value neighborhoods in the donut counties should have relief. Unless, or course, the state legislature is willing to increase state corporate income taxes to replace lost local property tax revenue.

Absolute insanity. He’ll bankrupt the state for the elderly vote. A regressive tax break that benefits the wealthiest the most, and robs communities of any reason to invest in their futures because the increased property value won’t allow them to pay back the bonds they need to take out to even make the improvement.

This is among the worst tax-relief proposals possible.

IBJ just published the results of MSNBC poll that ranks Indiana in the top 10 for being business friendly but at #48 for quality of life. I understand you get what you pay for and I think Indiana property tax caps have already left most cities in Indiana struggling to fund infrastructure and police services.

The only reason we are seeing so much infrastructure work in Indy is because of Biden’s policies and Federal funding, ending the idea of trickle down economics. Brauns plan is just more trickle down economics, and that hasn’t played so well with the bottom 50% for the last 40 years. Go for tax cuts if you want to clinch that bottom spot for “quality of life”.

100%

+1

☝️

How about Braun uses some data to back up his ideas. In 2024 the Median price of all home sales in Indiana $271,800. Half of the homes sold cost more, half cost less. Put the tax break on anything below that number? Phase it out up homes above $1 million and they don’t get any break at all?

a data-driven plan. Not a chance any Republican would support it.

I’d suggest any home over $400K have the caps removed. Or, make it $542,000, twice the median price.

But if you’re buying a home and not considering the property taxes, especially in the donut counties that are having to spend vast amounts of tax dollars to build infrastructure to support your home, then shame on you. You’re the problem…people who want all the cool stuff like roads and schools and police and such but don’t want to pay for it.

This is placing a band-aid on a self-inflicted gunshot wound. Republicans in Indiana have systematically defunded our public schools by redirecting funds through vouchers to charter schools, forcing public schools to sell under-used assets to charter schools for $1, and then when public schools turn to referendums to make up the funding gap these policies created, the state wants to force them to share the referendum funding with charter schools too.

Mind you, these schools are often for-profit entities, are not held to the same accountability as public schools, and eligibility for the vouchers no longer has any income limits. We are literally paying for rich people to send their kids to private school.

If you want to know why your property taxes are skyrocketing, that’s why. This plan does nothing to address the fundamental problem that Republicans are intentionally starving public schools. In fact, it’ll make it even worse.

Repeal the voucher program and all other Republican legislation funneling your tax dollars to private, for-profit “schools”, and you’ll be amazed at the property tax relief you’ll enjoy.

You are assuming that Republicans consider this a wound. They consider the last two decades a success.

A functional Indiana Democratic Party should be able to make hay on this, but such a thing hasn’t existed for a decade.

There are numerous ways that Republicans could reduce the tax burden for households without gutting municipalities, but they don’t want to. Bringing services in-house would be a big one, but that means that taxpayer dollars wouldn’t be flowing into the pockets of a handful of business owners and contractors.

Let’s look at this proposal for what it is – another way to starve Marion County (and the other larger counties) because we’re finally seeing a (marginal) increase in revenues to actually operate city services. Indy can’t be allowed to enhance quality of life for its citizens.

Reducing taxes during periods of high consumer confidence INCREASES inflation! It doesn’t decrease it! This is a bad proposal all-around. If the State wants to cut taxes, take a look at the State sales tax and maybe consider dropping a penny that localities could then pick up if they so choose. Stop making already under-funded municipalities bear the brunt of State desires for tax cuts!

Additionally his plan to cap increases will once again decouple the assessed value of the homes from the market value, creating chaos and heart ache when a heir inherits a home from a senior.

That is more or less how Prop 13 in California works and it has been a DISASTER. People paying taxes on homes that are “assessed” at hundreds of thousands of dollars below market value because there is a cap on the amount increased value that can be taxed. The result has been people sitting on multi-million dollar houses, not paying the appropriate taxes, starving localities of revenue, and removing an incentive to sell to either new home owners or developers who can redevelop the properties to split the land value among multiple units. It has been a major contributor to California’s housing crisis.

Fiscals conservative watch our Hamilton County “conservative mayors” and city councils that will gobble up every penny that are given to them and then some. Are they true conservatives??? Not sure on that…..

HamCo also gets roughly $50 million/year from the redistribution of revenue from Marion County.

We also need to take into consideration the millions of dollars in property taxes which are not collected. I am not referring to tax exempt not-for-profits related to healthcare, religeous organizations, etc. I am referring to the incentives and tax breaks given to the new developments going in. Localities, and the state, are offering millions in tax breaks to get these new companies to invest in their jurisdiction and they need services immediately while not paying for the services until years later.

Property tax caps under Mitch Daniels were supposed to replace lost revenue for local service (police, fire protection, schools, etc.) with STATE funds. We’ve had a state surplus for years, but NOT replacement of lost LOCAL government revenues. We’ve had GOP control for 20 years, but that replacement promise has never been kept.

If you want more potholes, more crime, more fire damage, and even more teacher shortages, larger class-sizes, and school closings, vote for Braun. If not, vote for Jennifer McCormick for Governor to use state government funds to HELP local government and contain property taxes.

Why is it states with higher taxes tend to attract more businesses, more residents, and more praise? It is because those taxes mean the state is better able to sufficiently fund core programs and services. You get what you pay for. If you don’t like it, Quartzite AZ is the place for you.

I see some suggestion of cutting the social safety net, which is already barely there in most ways in the state of Indiana. We do have a fairly robust Medicaid program, but the cost overruns, as has been widely reported, are not due to working people whose jobs don’t offer healthcare and end up on Medicaid – the overruns are due to medically complex children and seniors who cannot easily be cut off of Medicaid unless the Indiana GOP wants to have state government deciding when we pull the plug on Grandma’s ventilator, or tell little Suzie who was born needing a lot of medical care that, sorry, she can’t get the help she needs to live with independence and dignity. It’s not clear that simply moving to managed care is going to substantially move the needle on cost. These kids and seniors all need a lot of care, and someone has to provide it, somehow.

Something else to consider is if Medicaid coverage or rates are cut, hospitals will then raise prices for everyone else, exacerbating the problem of high healthcare costs that is, as has been reported, causing employers to look outside of Indiana to locate new facilities. Google “medical anywhere but Indiana” for example.

Instead, why don’t we look at new revenue sources? Another dollar could easily be added to the cigarette tax, for example. We could also look at medical or adult use cannabis programs, as every state that borders Indiana now has one or both, and capture that revenue for Indiana instead of letting the money go out of state. It would seem to be a slam dunk to use one or both of those to backfill our Medicaid fund, and that could free up other state money for other needs.

All that said – I’m not saying don’t do anything about property taxes, but let’s be smart and not leave a massive budget hole for local schools and local law enforcement when we do it. I like the idea of moving homestead assessed valuations to a 3 year moving average, so that any increase would be phased in over the 3 years instead of a “shock” tax bill all at once. I also agree that most of the people truly paying high property taxes probably bought into that, understanding they were moving to a higher cost, higher quality of life county or city within Indiana. Such “high tax, high quality of life” areas seem to have been responsible for virtually all of Indiana’s population growth in recent years, per Professor Hicks at BSU.

For the people such as a senior citizen who bought a home 30 years ago and is now struggling – I really do like the idea of offering an income based waiver for those situations that would cap them to 0.5% or maybe even less, but it must count all income from all sources, and should probably also not apply to homes worth more than, say, $400,000 or $500,000. Something like that would make sense.

But, let’s not make the property tax mistakes of California.

Joe B, you recently said I don’t know the difference between news and opinion. 80% of “journalists” content is opinion. The headlines, wording, positioning, the stories they run; Braun Bad! the stories they bury; Hogsett, Carson, mocking Christianity at the Olympics, the stories they make up; Food Deserts!

Property tax is a hot topic and the vast majority of voters support relief. Only a handful of Center Township democrats and some IBJ readers think otherwise, but IBJ following their Masters’ orders positioned a story painting Braun as the outlier, knowing it would bring some clicks they can sell for advertising.

Yet you keep coming back for more. Tell us where we should be getting the “straight news” from. All you folks who complain about the news are mostly embarrassed to tell others where your news from.

Meanwhile this joint is owned by a local Republican and that isn’t good enough.

Best I can tell, you get your news from the conservative outrage cycle that keep you angry and coming back for more with the latest outrage of the day, regardless of the lack of accuracy in the coverage. No different than “those kids hooked to their phones”, really.

What is this drivel? Can you even call this word-salad a coherent thought? And quit the persecution complex, it wasn’t even a depiction of any kind of Christian event. Wah, wah, wah, manufactured outrage, wah wah!

Good grief.