Subscriber Benefit

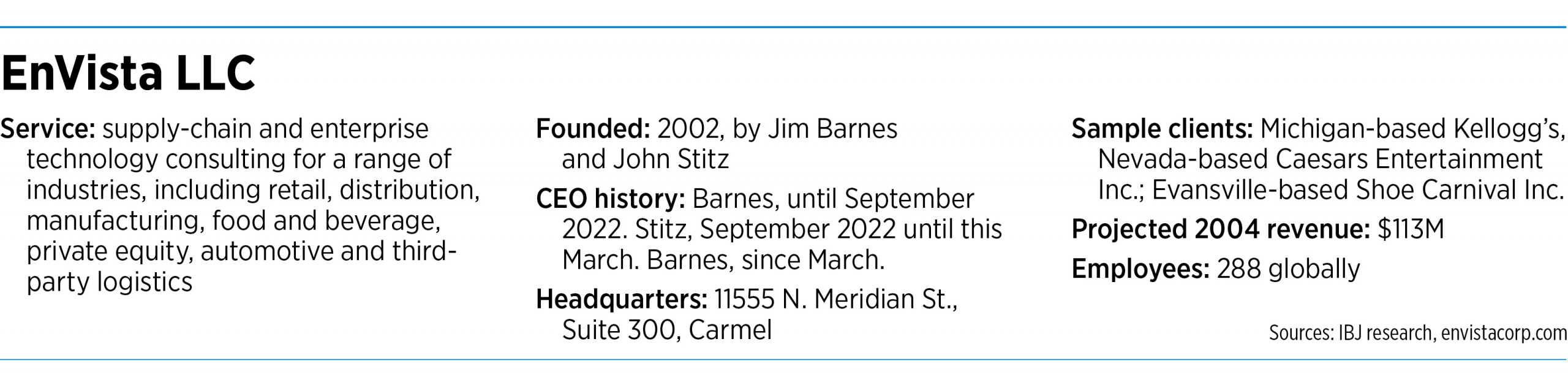

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowEnVista LLC co-founders Jim Barnes and John Stitz, who built the Carmel-based supply-chain technology consultancy from a two-man startup to a company with $113 million in revenue and hundreds of employees, are now battling each other in court.

Barnes and Stitz launched EnVista in 2002, and the company enjoyed considerable success over the years as it helped its customers navigate the evolving landscape of e-commerce, technology and big data. Over its first 15 years, EnVista saw average annual revenue growth of 22%, the company told IBJ in 2018.

The company landed on the Inc. 5000 list of fastest-growing privately held companies for eight straight years and was part of IBJ’s Fast 25 list in 2015 and 2018.

But EnVista recently hit a rough patch, and now Barnes has filed a lawsuit against Stitz. The suit centers on the $13.2 million Barnes says he paid Stitz to buy out Stitz’s ownership stake in March.

In his legal complaint, filed July 25 in U.S. District Court in Indianapolis, Barnes alleges that Stitz concealed the company’s financial status from him, including losses from two significant customers.

Had he known of EnVista’s true financial situation before the deal closed, Barnes alleges in his complaint, he “would have never consummated the transaction on the same terms.”

Stitz, who lives in Westfield and is now retired, denies the allegation that he misled his former business partner.

Stitz did not return a phone message from IBJ. His Indianapolis-based attorney, Andrew Hull of Hoover Hull Turner LLP, responded to an IBJ query with an emailed statement he said had been authorized by Stitz.

“We believe the complaint is baseless, both as a matter of fact and a matter of law,” Hull’s statement read in part, also saying that Stitz was “surprised and disappointed” when he saw the complaint.

Since its launch, EnVista has served hundreds of midsize companies and large corporations in industries that include logistics and distribution, retail, consumer goods and manufacturing. Its customers over the years have included well-known companies such as Michigan-based Kellogg’s and Whirlpool Inc., Nevada-based Caesar’s Entertainment Inc., Ohio-based Briggs & Stratton and Evansville-based Shoe Carnival Inc.

Two customers, retailers North Carolina-based Advance Auto Parts and San Francisco-based Williams Sonoma, are mentioned in Barnes’ complaint.

Barnes served as CEO at EnVista from 2002 until September 2022, when Germany-based technology company Körber acquired the software portion of EnVista’s business. As part of the deal, Stitz became CEO while Barnes went to Körber, later transitioning into semi-retirement. Barnes now lives in Menomonee Falls, Wisconsin.

Barnes’ allegations

In his complaint, Barnes alleges that he began expressing concerns about EnVista’s financial performance starting in March 2023 and “offered to help support the business multiple times and in multiple ways throughout 2023.”

But Stitz resisted those offers, Barnes says. “Rather than treat his partner with honesty and candor, [Stitz] began a scheme to deceive him from understanding the true condition of EnVista,” the complaint says.

Barnes alleges that Stitz ordered EnVista’s vice president of finance to alter the company’s 2024 operating plan to project that the company would generate profit of $726,188 during the first quarter.

But, the complaint alleges, Stitz had learned in December 2023 that two important EnVista customers had decided not to engage the company this year.

Barnes alleges that EnVista’s 2024 operating plan included a projected $7.2 million in revenue from Advance Auto Parts, even though that customer had advised EnVista in late 2023 that it planned to delay a project with the company.

Likewise, the complaint alleges, Williams Sonoma had also revised its plans, leaving a revenue hole for EnVista that was not reflected in 2024 projections.

Those projections, the complaint alleges, “were significantly more optimistic than was reasonable given EnVista’s historical performance and current market conditions.”

Barnes alleges that, this February, he shared with Stitz a plan that included Barnes returning to the company to support Stitz.

Stitz refused that idea, the complaint says, and instead proposed that Barnes buy out his stake in the company.

“Fearing that his investments would be worthless if he did not rescue EnVista, the company he founded, [Barnes] agreed to buy [Stitz] out,” the complaint says.

During buyout negotiations, the complaint alleges, Stitz never disclosed that EnVista’s 2024 annual operating plan presented “falsehoods and impossibilities.”

According to the complaint, Barnes agreed to buy out Stitz for $13.2 million. That included Stitz’s ownership stake in EnVista, plus a $3.2 million note payable by EnVista to Stitz that Stitz had taken as part of the 2022 Körber transaction.

Barnes’ purchase of Stitz’s stake closed on March 6, the complaint alleges, and on March 7 EnVista announced via email that the company was $3.4 million short of the projections in its 2024 annual operating plan. Barnes was not copied on that email, the complaint alleges.

“It is more likely than not that [Stitz] withheld disclosing that EnVista was ‘unfavorable to AOP by $3.4 million’ until after the closing to induce Barnes to close the transaction at a higher price than the actual market value of [Stitz’s] shares,” the complaint alleges.

Barnes alleges that on April 8 he learned the annual operating plan “was based on assumptions that were already known to be false at the time of the transaction and in the three months leading up to it.” The lawsuit does not say how Barnes learned this.

EnVista ended the first quarter with a $2.4 million loss, which required Barnes to lend the company $2 million and renegotiate its bank loan with a personal guarantee, the complaint alleges.

Stitz’s version

Stitz has not filed a response to Barnes’ complaint. On Aug. 14, Stitz asked the court for an extension until Sept. 18 to file his response, noting that Barnes’ attorney had agreed to the request. As of Monday, the court had not ruled on Stitz’s request.

But through his attorney, Stitz offered a different version of events.

“EnVista faced its share of challenges, and Mr. Stitz and Mr. Barnes ultimately had different opinions on the best way to move forward. They agreed to part ways, and Mr. Barnes took control of the company,” Hull said via e-mail. “As the company’s co-founder, co-manager, and longtime CEO, Mr. Barnes was well aware of the company’s competitive posture when he took control, and the parties’ buy-out agreement contains numerous provisions making clear that Mr. Stitz was not making any representations or warranties about the business. To the contrary, the agreement states that it was an ‘as-is’ deal between ‘sophisticated parties,’ that neither party was relying on the other for information relating to the business, and that Mr. Barnes was releasing Mr. Stitz from any and all liability in connection with enVista and the transaction.”

A larger context

Through his attorney, Barnes said he has “worked tirelessly to restore [EnVista] to solid financial and operational footing” over the past few months and things have already started to improve. “My return as the CEO of enVista has re-energized and focused the company on developing and executing new growth strategies in keeping with enVista’s mission,” Barnes wrote in a statement supplied by his legal counsel at the Chicago firm Hansen Reynolds LLC.

Since EnVista is a privately held company, it’s difficult for outsiders to get a full picture of the company’s finances.

But the company’s ups and downs are reflective of recent industry trends related to the pandemic, said Roger Lee, director of research at Columbus, Indiana-based financial firm Kirr Marbach & Co. LLC. Lee is not involved with the dispute between Barnes and Stitz and said he is not familiar with EnVista.

Lee said the pandemic accelerated the transition to what is known as omnichannel commerce. Omnichannel refers to integration between a company’s physical and digital operations, such as allowing customers to order a product online and pick it up at a local store.

The pandemic also caused significant supply-chain disruptions.

As a result of these two factors, Lee said, any company that deals with physical goods—manufacturers, retailers and the like—was probably using a company like EnVista to help it figure out its supply-chain challenges. “COVID was a boom for anyone in supply chain.”

But those supply-chain problems have receded, Lee said, which means less work for the consulting companies.

The rise in artificial intelligence is likely also impacting firms like EnVista, Lee said.

AI is an evolving technology that represents a big unknown, he said. The technology holds promise for dramatically improving business operations and efficiency, but companies are still evaluating how they might best use it.

So, Lee said, many companies are rethinking their IT budgets and weighing whether they could get a better return from an AI investment than from hiring a consultant. “Companies have a finite amount of IT spending.”

Regarding the legal dispute between Barnes and Stitz, Lee said business projections are by nature predictions that might not prove accurate. The outcome of this case, he opined, “really will boil down to who has better lawyers.”•

Please enable JavaScript to view this content.

How are you that successful for 20+ years and then not understand the financials and day to day of your own firm?