Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Over the past few years, banks have increasingly set their sights on winning business from a specific type of customer: the mass affluent.

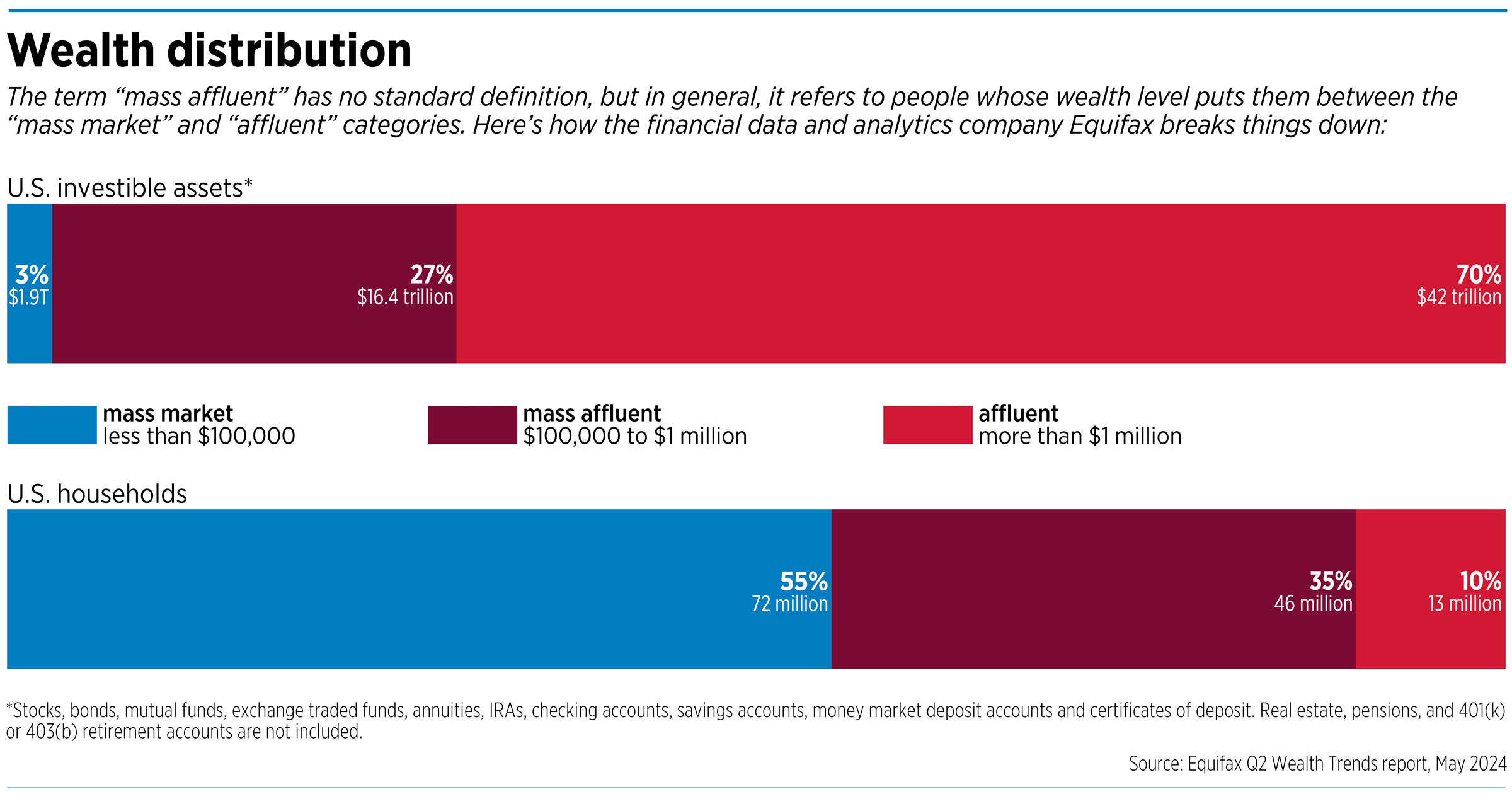

The term “mass affluent” doesn’t have a set meaning—different banks define it in different ways—but in general, the term refers to households that have accumulated some wealth but not enough to put them in the wealthiest crowd.

However they define this group, banks are working to entice the mass affluent with offerings such as financial advice, personalized services and even outright cash incentives.

A variety of factors—including demographic shifts, regulatory pressures and industry competition—are driving the trend.

“That’s the group that everyone is going after,” said Olivia Lui, senior vice president of channels advisory at Curinos, a New York City-based firm that advises financial institutions.

Curinos defines the mass affluent as those with household incomes of at least $100,000. (The baseline is above $100,000 in parts of the country where the cost of living is higher, Lui said.)

These customers are attractive to banks, she said, because they are likely to have healthy account balances “and are prime candidates for cross-selling into more profitable products, such as loans and wealth management services.”

A dramatic shift in cash offers—one-time cash incentives banks offer to new customers—is an example of how keen banks are to land the mass affluent, Lui said.

A year ago, she said, 7% of cash offers went to affluent customers. That percentage has nearly tripled, and now 20% of the cash offers banks extend are to affluent customers.

Put another way: Until about two years ago, the average cash offer was around $250 or $300. Now, Lui said, that average is more like $900. For customers who have $500,000 or more to deposit, banks are making cash offers of up to $3,000.

“We’re seeing the average offer amount really shoot up, really flow through the roof when it comes to trying to target more of these affluent customers,” Lui said.

KeyBank is among the banks that have recently launched a concerted effort to win over mass-affluent customers. The Cleveland-based bank has 19 branch locations in central Indiana.

In the first quarter of 2023, Key launched what it calls Key Private Client, a targeted suite of products and services aimed at the mass affluent. The bank’s definition of mass affluent is people with $250,000 to $2 million in investable net worth, or $250,000 to $5 million in total net worth. Investable net worth includes assets such as cash and retirement accounts. Total net worth would include the client’s home and business, if they own one.

Mike Harris, Key’s Indianapolis-based market leader for Key Private Client in Indiana and central and southwestern Ohio, said the bank has for years had a strategy for its wealthy and ultra-wealthy clients—those with investable assets above $2 million.

But about 3-1/2 years ago, Harris said, the bank realigned its wealth offerings under new leadership. In the process, the bank discovered a gap—it didn’t have anything to specifically target the mass affluent.

“Lots of our competitors had a strategy around this, and Key, frankly, did not,” he said.

The opportunity

Key is not the only local bank courting the mass affluent. In March 2022, Cincinnati-based First Financial Bank rebranded its existing wealth management division as Yellow Cardinal Advisory Group so it could specifically promote this part of its business.

Yellow Cardinal’s target customers include the mass affluent, as well as more wealthy households and plan sponsors. The bank defines a mass-affluent household as one with household income of at least $75,000 and with $100,000 to $1 million in liquid or investible assets.

“Ideally, you help that mass affluent [client] grow to a place where they do become a high-net-worth, or ultra-high-net-worth type client,” said Jim Klasa, Yellow Cardinal’s Indianapolis-based regional market president. “A lot of the clients that we’ll work with might be small-business owners, and as their business grows, we want to be there with them through that growth and help them at any stage and bring the expertise to them along the way.”

Klasa said wealth advisory firms like Yellow Cardinal also have the opportunity to pick up new clients who are at the end of their working life. As America’s population ages, those nearing retirement might for the first time seek professional financial advice about how to handle their 401(k) accounts or other retirement savings.

Some of Key Private Client’s offerings are new, such as a checking account with perks like higher ATM withdrawal limits and fee-free wire transfers for customers who have at least $250,000 in deposits at the bank. It also launched a U.S.-based customer service line.

The bank also beefed up its staff of branch-based financial advisers throughout its operating footprint. In Indiana, Harris said, Key has increased its advisory staff from six people to 10 over the past two years.

In other cases, Key has offered its mass-affluent clients perks that were previously offered only to its wealthiest clients. As one example, Key Private Client customers now have access to white papers produced by the bank’s chief investment officer—reports that offer guidance and insights on investment-related topics.

Harris said Key Private Client has seen big success so far, signing on 24,000 households who have brought an additional $2 billion in assets to the bank. “It was about triple what we thought we were going to be able to bring in, both from an assets standpoint as well as from a number-of-clients standpoint.”

A competitive market

Fifth Third Securities, which is the wealth management arm of Cincinnati-based Fifth Third Bank, is no stranger to serving the mass affluent.

“We have been committed to this market for the last decade-plus,” said Bob Corsarie, the Cincinnati-based CEO of Fifth Third Securities.

For Fifth Third, a mass-affluent client is someone with $100,000 to $2 million in investable assets. That does include retirement accounts, but it does not include real estate. Fifth Third Securities services include personalized advice and guidance, typically delivered to clients at a local branch. Clients also have access to Life 360, an online platform that allows users to track all their financial information and securely store digital documents.

Corsarie said he’s seen the mass-affluent market become more competitive over the last few years. “We have seen other entities enter the market and put some resources behind it post-pandemic,” he said.

One reason for this shift, Corsarie surmised, might have to do with regulatory pressures.

The Consumer Financial Protection Bureau has been cracking down on what it describes as “junk fees” charged by financial institutions, and in recent years, many banks have done away with overdraft fees on checking accounts.

Wealth management and other services offered to wealthy clients can be a way to make up for that lost overdraft revenue.

Corsarie said the information explosion might also be driving a demand for financial advisory services. “You’re starting to see [among clients], they’ve never had access to more information, but I think there’s never been a greater need for advice and guidance.”

Urich Bowers, the chief consumer banking and strategy officer at Warren, Pennsylvania-based Northwest Bank, said Northwest doesn’t have a set definition for mass affluence because it thinks of its customers in terms of their life stages rather than their asset levels.

The bank entered Indiana in 2020 when it completed a merger with Muncie-based MutualFirst Financial Inc. Northwest has 19 branches throughout Indiana and a regional business office in Fishers.

Northwest focuses on business and commercial banking, but it does offer wealth management and trust services.

Bowers said Northwest has seen growth in its wealth management and trust business over the past few years. Part of that is because the financial markets have done well, increasing the overall value of customers’ assets, he said. But the bank has also won business from both existing customers and new ones.

Going into 2025, Bowers said one of his goals is to achieve more growth in that part of the bank’s business.•

Please enable JavaScript to view this content.