Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

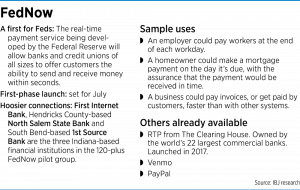

With help from a national pilot group that includes three Indiana-based banks, the Federal Reserve will soon launch an instant-payment service that could help smaller banks and credit unions keep up with their much larger competitors.

The service, FedNow, is set to launch in July, and it will allow financial institutions to offer their customers instant payments for everything from business invoices to payroll to household bills.

Using FedNow, customers will be able to send and receive money within seconds, including nights, weekends and holidays. That makes it different from the Federal Reserve’s existing automated clearinghouse, or ACH system, in which electronic payments can take anywhere from hours to a few days to settle.

FedNow is the Federal Reserve’s first new payment system since the launch of ACH in the early 1970s.

“It’s a very exciting application, and it’s due,” said Nicole Lorch, the president and chief operating officer at Fishers-based First Internet Bank.

First Internet Bank, Hendricks County-based North Salem State Bank and South Bend-based 1st Source Bank are the three Indiana-based financial institutions in the 120-plus-member national FedNow pilot group. The pilot participants have been advising the Federal Reserve on the development of the instant payment system, and they will be among the first to start using FedNow when it launches.

FedNow is not the first instant payment service—a handful of private-sector bank and nonbank options already exist—but it is the first associated with the Federal Reserve. Customers can also use wire transfers for instant or near-instant transactions, though these transactions can carry significant fees.

Proponents say FedNow will be accessible to smaller financial institutions in a way existing options might not be.

“It provides an opportunity for smaller financial institutions to remain relevant and competitive with some of the other payment service offerings in the market,” said Connie Theien, director of payments industry relations for the Federal Reserve System.

The nation’s existing interbank instant payment system, called Real Time Payments, or RTP, was launched in 2017 by The Clearing House, a payments company owned by 22 of the world’s largest banks, including JPMorgan Chase & Co., Bank of America, Fifth Third Bank, PNC Bank and others. Currently, about 285 banks and credit unions use RTP.

While The Clearing House is more oriented toward larger financial institutions, the Federal Reserve is connected to all of the nation’s 10,000 or so financial institutions.

“We have historically served the smallest to the largest financial institutions,” Theien said. “Because of that, we have a keen sense of what [smaller institutions’] needs are, what types of services they’re looking for.”

As a smaller bank, the ability to offer instant payments is “critical to our ability to serve our customers long term,” said Chris Murphy III, CEO and chair of South Bend-based 1st Source Corp., the holding company for 1st Source Bank. “The big guys don’t like it, because now they have a competitor in this area.”

Murphy said his bank does offer a popular instant payment service, Zelle, which launched in 2017 with 19 banks and now has more than 1,800 financial institutions in its network.

But Zelle comes with fees that mean 1st Source loses money on every transaction it handles, Murphy said. He said FedNow’s fees will be significantly lower.

Fees for banks

Financial institutions will pay a fee to participate in the FedNow system, along with per-transaction fees.

Murphy said 1st Source is still working through the details of how it will structure customer fees for FedNow.

Sherri Reagin, chief operating officer at North Salem State Bank, said her bank doesn’t offer Zelle at all. Zelle transactions take place on one of the participating banks’ payment infrastructure, a situation with which North Salem was not comfortable, Reagin said. “We wanted to protect our customers’ data.”

But North Salem is interested in FedNow, Reagin said, especially since instant payments have gained such traction in recent years.

“Everything is instantaneous in this economy anymore,” she said. “Instant payments are just pretty much an expectation.”

The availability of instant payments, Reagin said, could be useful for everything from speeding an emergency payment to a family member to allowing gig workers to get paid for their labors at the end of each day. Instant payments should also help businesses manage their cash flow, she said, because, if a vendor pays a bill, that money is available to the recipient right away.

“We actually think FedNow is a very versatile system,” she said.

Despite the enthusiasm, even the early adopters expect it to take a while for FedNow to become widely used.

“You don’t just flip the switch, and everybody jumps onto it,” Murphy said. “This is not going to be an overnight thing.”

For one thing, FedNow is just the mechanism that allows for the bank-to-bank instant transfers. Individual participating institutions will also need to do some work on their end before they can offer the service to their customers. That work includes developing a way for customers to access the service—perhaps as part of the bank’s existing mobile app or website.

Making preparations

First Internet Bank has been integrating new technology into its system to get ready for FedNow—a process that’s more complicated than it might appear from the outside, Lorch said. “We want to make it look as simple as possible, but the reality is, for bankers, there’s a lot to figure out.”

Lorch also said FedNow will become one of several options, depending on a customer’s needs. She likened it to the U.S. Postal Service’s range of shipping options. If a customer wants to send something overnight, he or she can choose that option—and pay a higher price.

Another consideration that could affect FedNow’s rollout: If a financial institution’s technology is more than a few years old, it might not be up to the task, Reagin said. “Your online banking platform has to be up-to-date enough to enable FedNow.”

Reagin said North Salem’s banking platform is ready. The bank plans to start doing some small-scale beta testing of FedNow in May and June, mostly with employees and their friends and families, before the widespread launch in July.

And all three of the Indiana pilot participants said they’ll start out in receive-only mode, meaning customers will be able to receive FedNow payments but not send them, as a protection against potential fraud. Banks will also have to educate their employees and customers about fraud protections—unlike payment by check, there’s no “stop payment” option once a customer initiates a transaction.

Outside of the FedNow pilot group—which includes both small financial institutions and some big banks such as JPMorgan Chase & Co., Wells Fargo & Co. and BMO Harris Bank NA—adoption might be slower.

Indianapolis attorney John Tanselle, a partner at Amundsen Davis LLC, said his banking clients are mostly taking a wait-and-see approach. Though his clients see instant payments as the inevitable future of banking, Tanselle said, they also exhibit the caution one might have when presented with a software upgrade. “It’s kind of like when Microsoft puts something out. You don’t want to be the first one to use it.”

Theien said the Federal Reserve expects it might take four or five years before FedNow is widely adopted. “There will be some laggards, but we’re hoping to have a pretty robust network in that time frame.”

Reagin said she’s hopeful that, within a year of launch, 20% to 25% of North Salem’s online payments will happen on the FedNow system.

And eventually, Reagin predicted, this new system will become the norm. “In five years, we’ll look back and say, ‘How did we live without FedNow?’”•

Please enable JavaScript to view this content.