Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

The swell of development downtown and across central Indiana has put a strain on worker supply for general contractors, particularly as they look for subcontractors to complete electrical, drywall and concrete work.

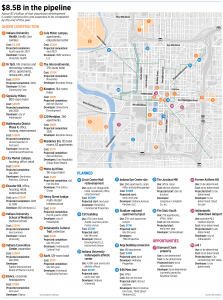

More than $7 billion in development is under construction downtown, with at least $1 billion more planned. Since early 2023, more than $600 million in projects has been completed, including the $400 million overhaul of Gainbridge Fieldhouse, and the Industry and Rise on Meridian apartment properties.

But other major Indianapolis-area efforts—like the new Indiana University Health Hospital campus, the Signia hotel and Indiana Convention Center expansion, and even the LEAP Research and Innovation District in Lebanon—are making subcontractors scarce, construction executives told IBJ.

While contractors have so far been able to keep up, the strain could get worse next year and beyond.

Phil Kenney, president of Indianapolis-based F.A. Wilhelm Construction, said the competition for contractors has loosened somewhat over the past 12 months but continues to be difficult in some areas.

“The bigger projects … are a challenge, but also, those out in more remote areas of Indiana—outside of Indianapolis or central Indiana—there are times it’s hard to find big mechanical, electrical bidders,” Kenney said.

Wilhelm Construction is among the largest firms in Indiana. It employs 3,000 workers directly and works with numerous subcontractors for needs in certain trades. It also serves as a major subcontractor on concrete pouring.

Kenney said that while the glut of work is causing some problems, like finding large enough crews to bid on jobs, many of the biggest projects currently underway have staggered construction schedules that allow for subcontracting crews to move from one large-scale project to the next.

“These projects are spaced out enough that we should be fine for subcontractor capacity” long term, he said, noting that the current trend reminds him of whathappened in the early 2000s, before the 2008 recession. During that period, he said, Indianapolis never “saw the full effect of the capacity” shortages because many planned projects were later canceled. He projected that, this time around, most of what’s on the construction docket will carry through.

According to the Indiana State Building & Construction Trades Council, an umbrella organization representing the state’s construction unions, more than 77,000 union tradespeople work in Indiana.

While non-union tradespeople are not tracked directly, the U.S. Bureau of Labor Statistics reports about 132,000 people work across the state’s entire construction industry.

Ermco Inc., a Greenwood union electrical contractor, employs about 200 people. CEO David Peterson said the company has had consistent work over the past three years, and he doesn’t expect opportunities to dry up anytime soon.

“It definitely hasn’t eased up, but I think we have done an amazing job of understanding what the market looks like while managing the volatility of the schedule of projects and what the true need and resources looks like,” said Peterson, who has been with the company nearly 25 years. “We meet as a company every two weeks, and we talk about internal and external resources to complete projects, making sure that we don’t take on any work that would overextend our capabilities.”

He said in addition to the company’s role at the IU Health campus and at LEAP, where Eli Lilly and Co. has announced plans to invest up to $13.5 billion by 2030 across multiple projects, the firm has also worked closely with Ascension St. Vincent’s hospitals and done work on the Fishers Event Center set to open next month.

The workload, Peterson said, has been lightened by prefabricating and modularizing many of the units it’s been tasked with installing while also working closely with other trades and construction managers—firms tasked with overseeing the development’s progress—to identify cost- and time-saving opportunities.

“Coming up with creative ways to build these projects starts with conversation, so making sure everybody’s on the same page and understands [that] the obstacles we’re up against is half the battle,” he said.

Extraordinary demand

John Abbott is president of Circle B Construction Systems, which specializes in drywall, plaster and fireproofing services. He said the level of activity is so high that his company has to take measures to ensure it is not overextending itself on jobs.

“The demand for our services is at the highest I’ve ever seen; there’s just a plethora of projects,” he said.

And with more projects coming down the pike, he projected that demand on subcontractors will only grow.

“I think our main focus is just making sure that we stay within our capabilities, but if we try to get outside of those lines, then yes, the availability of manpower would be a big worry,” he said. “It’s even a worry if we stay within our capabilities, because there’s just going to be a point where I think there’s going to be more work than there is manpower, and I think that will probably be in 2025.”

In downtown Indianapolis, 10 projects individually valued at more than $100 million are under construction, with three more in the planning stages. Most of those projects are expected to be completed by the end of 2028, and some experts say that tight turnaround could be challenging.

Across the state, major economic development deals in places such as Boone County, Kokomo and New Carlisle will require construction for emerging sectors like advanced manufacturing and electric vehicle batteries.

The Indiana Economic Development Corp. through the first three quarters of this year has seen $88 billion in committed capital investment for the next five to seven years, and the Indiana Department of Transportation is likely set to spend another $5 billion on infrastructure over the next two years.

Finding workers

According to the Indiana Construction Roundtable, a trade group for Indiana’s construction contractors, the average age of construction workers is about 55. As workers have retired in recent decades, they’ve been difficult to replace because interest in construction jobs among young people has been lower than in years past. A concerted recruiting effort is making inroads into the problem.

“What we’re seeing now is, the manpower that we’re getting is mainly apprentices,” Abbott said. “If we were to call and ask for people, we would mainly get apprentices, which is fine, but we have to train them, versus trying to find guys with any level of experience.”

The state’s union trade council is increasingly focused on offering apprentice classes and hands-on experience, and the effort shows signs of paying off. In 2014, there were about 4,700 union apprentices in the state across various sectors. In 2024, that figure is closer to 9,000, across 62 training centers registered with the U.S. Department of Labor.

Indiana’s subcontractors spend $55 million annually on apprenticeships, which are generally high-intensity, paid programs designed to help future workers learn their craft and receive accreditations.

Rob Henderson, president of the trades council, said the intensified approach to recruiting and training taken by Ermco and other firms is critical to meeting the current demand for subcontractors. He said bringing those groups to the table as part of conversations about potential projects can go a long way in helping prepare firms for bidding down the line.

The industry needs “continued communication and collaboration between all the parties, because when a major development is coming, the sooner we know the better,” he said. “That way we can scale up appropriately and make sure we have the construction workforce to complete the project on time.”

John Thompson, an Indianapolis entrepreneur who owns multiple firms in the construction industry, said the state is experiencing “unprecedented construction volume”—something he, like Abbott, projected will grow.

Thompson’s companies consist of Thompson Distribution, First Electric Supply, CMID Engineering and Beyond Countertops.

Thompson said if the industry continues to work on reaching and expanding minority-owned business participation requirements, subcontractor availability will grow. Likewise, he said, finding ways to integrate former offenders into construction jobs can expand the construction workforce and also give people convicted of crimes an opportunity to reenter the workforce.

“It’s an opportunity for new groups that had a tough time breaking in to break in,” he said. “And if those workers prove to be very effective, then they’ll become permanent industry workers. Now folks feel better about adding more [from] those minority groups.”•

Please enable JavaScript to view this content.

Great news! Growing pains that will last for decades! Money talk!!!

I think it’s going to get worse with all the reconstruction that needs to be done in the South.Workers who can will probably want to head South to get in on what will surely be some very lucrative work.

meanwhile, down on the southern borders sit thousands of people who just want a chance to work hard and support themselves and their families…

So, workers are needed but immigration reform to ensure an orderly process to vet and admit appropriate workers stalled due to congressional inaction directed by someone not in Congress.

Apparently, an insignificant number of US citizens are available to fill the open constructions positions in Indiana. Perhaps seek to recruit workers from other states, but Indiana might be a hard sell. Maybe some at the border or some already with temporary status could fulfill the need, but one hopes they any who may become members of the workforce are not vilified by false claims from politicians and subsequently subject to ridicule, insults, and even death threats as occurred in Springfield, Ohio..

It wasn’t Congressional inaction. There was lots of activity. All of it directed as kissing the ring (or whatever) of the Prophet of Perjury, who didn’t want to let Joe Biden have a win to take on the campaign trail.

The bill just didn’t die…it was killed off by those who now complaing the loudest about the situation at the border.

Forgot to include the 21C hotel project.

You’re absolutely right. I think I saw an article where they just got the green light to move forward with the project. I’ve also read where the taxes from that project was a key piece in helping finance a new soccer stadium. So it was a must have for the city to move forward with its dreams of landing and financing a new stadium