Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowA lot of sunshine has beamed down on the Indianapolis metro tech sector in recent years. But according to a recent report, at least one ominous cloud hangs overhead.

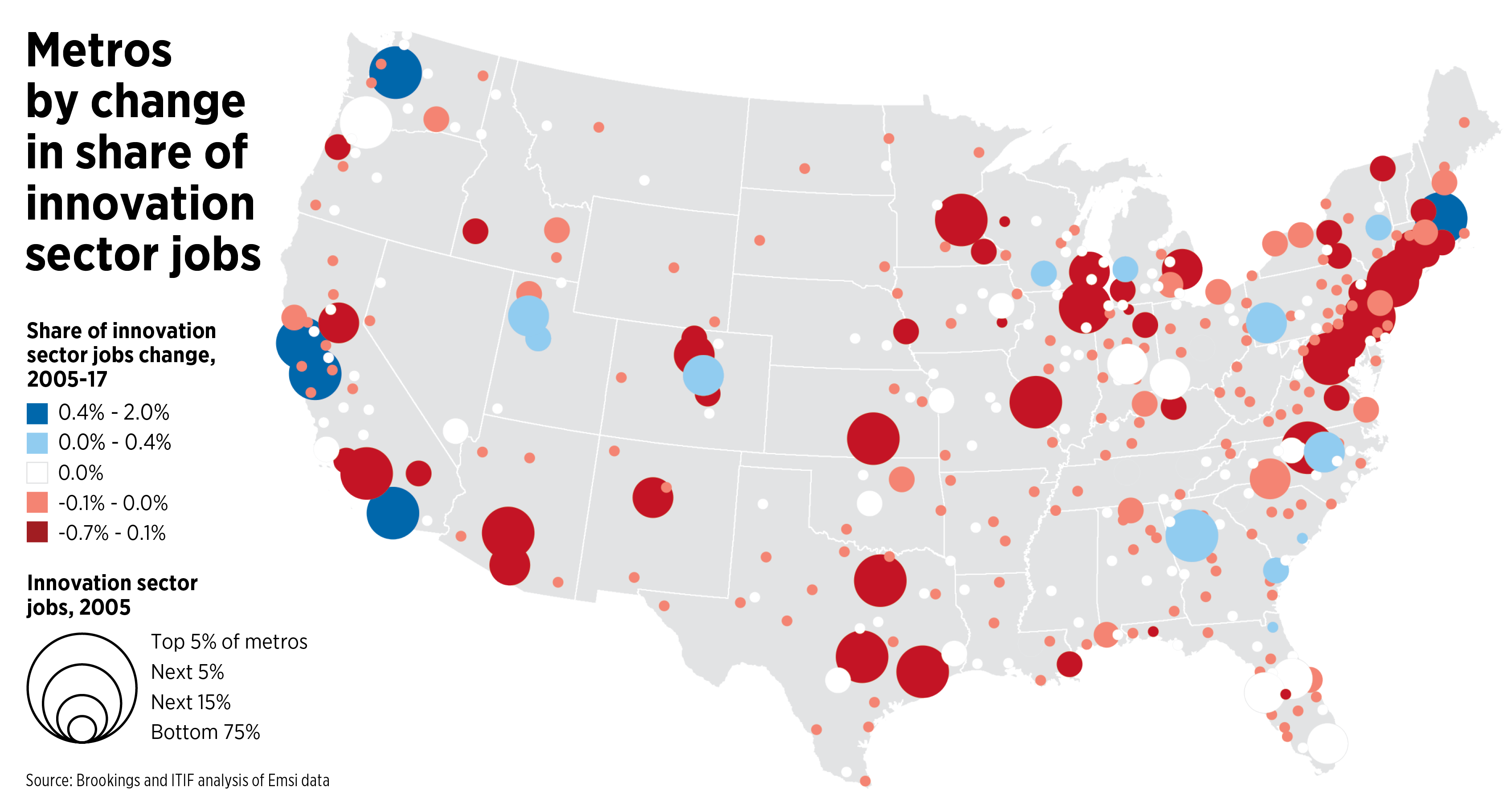

A lengthy report—published by the Brookings Institute and Information Technology & Innovation Foundation, both based in Washington, D.C.—concluded that 90% of the nation’s tech and innovation sector employment growth from 2005 to 2017 was generated in just five major coastal cities: Seattle, Boston, San Francisco, San Diego and San Jose, California.

Those five regions increased their share of the nation’s total tech employment from 17.6% to 22.8% in the 12-year period. In contrast, the bottom 90% of metro areas—343 of them—lost share.

The news is slightly better in Indianapolis. The metro area’s share of tech jobs remained unchanged, even as the number of tech jobs rose significantly.

The report found one-third of the nation’s tech jobs resided in just 16 counties, and more than half were concentrated in 41 counties.

“All of this points to the extent to which innovation-sector dynamics compound over time, leaving most places falling further behind,” the report stated.

The study has generated some skepticism, notably by Midwestern tech leaders.

“Studies like these are good touchstones, but they’re not be-all-end-all,” said Kristian Andersen, principal of Indianapolis-based venture studio High Alpha. “These studies tend to be a look in the rearview mirror, not front-windshield assessments.”

To be sure, local tech leaders in recent years have put many building blocks in place—from new coding academies and venture funds to efforts to bring expat Hoosier techies back home and intern programs aimed at reversing the brain drain. And many of those efforts are just now starting to pay off.

But one of the report’s co-authors, Brookings Senior Director and Policy Director Mark Muro, said Midwestern outposts haven’t yet done enough to keep pace.

“Sure, dozens of snappy startups are launching in places like Akron, Ohio; Memphis, Tennessee; and Louisville, Kentucky—enough so that metro areas across America have added tech jobs since 2010. But even so, digital tech by our measure has continued to concentrate in a short list of major cities over the decade, rather than disperse outwards. Many metro areas are losing their shares of the overall tech sector even as they grow,” Muro said.

“The upshot is sobering,” he added. “Winner-take-most seems more the rule than the hoped-for rise of the rest. And that’s a problem we will need to confront more directly than we have until now.”

Indy luckier than most

Indianapolis could be considered one of the lucky ones. According to the report, the metro area is largely staying even—not gaining or losing—on market share. But the country’s five big tech hubs are gaining market share at a low-single-digit percentage clip annually.

That doesn’t mean the Indiana and Indianapolis tech sectors aren’t growing. To the contrary, the number of tech jobs are growing dramatically across Indiana and the region.

That doesn’t mean the Indiana and Indianapolis tech sectors aren’t growing. To the contrary, the number of tech jobs are growing dramatically across Indiana and the region.

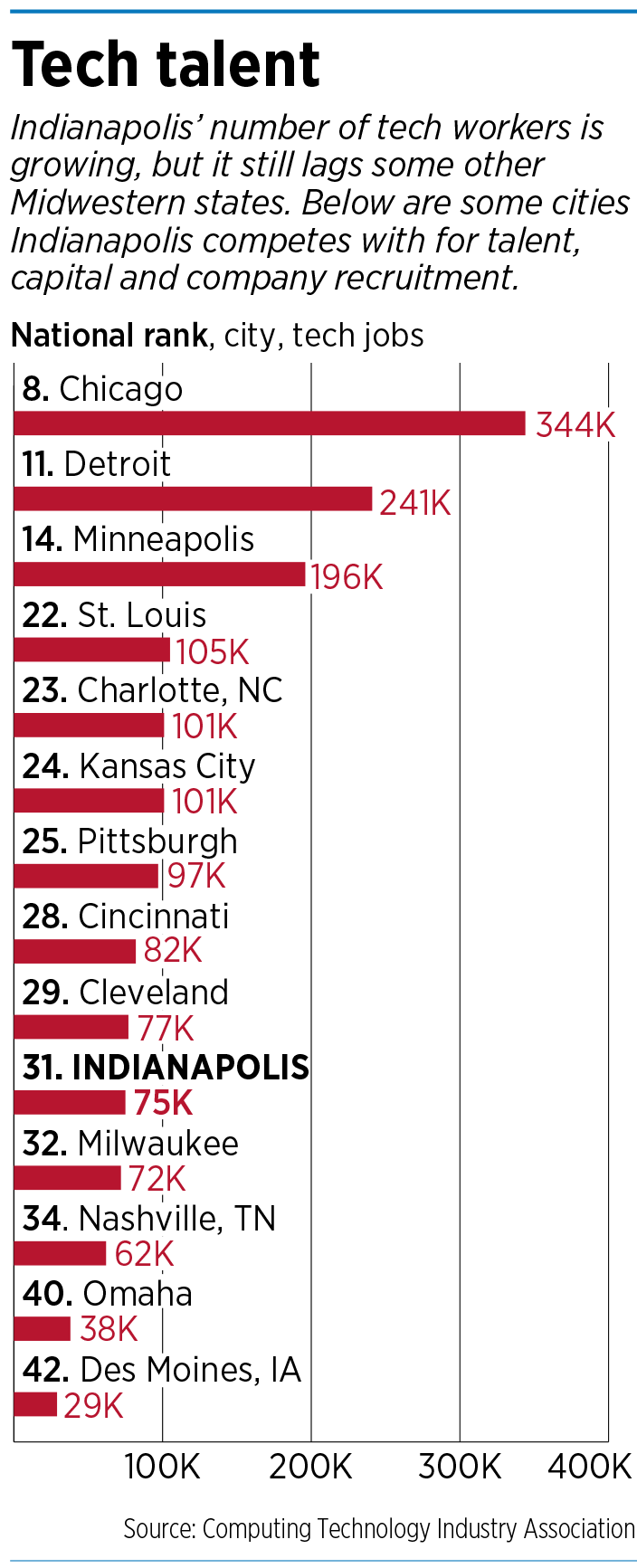

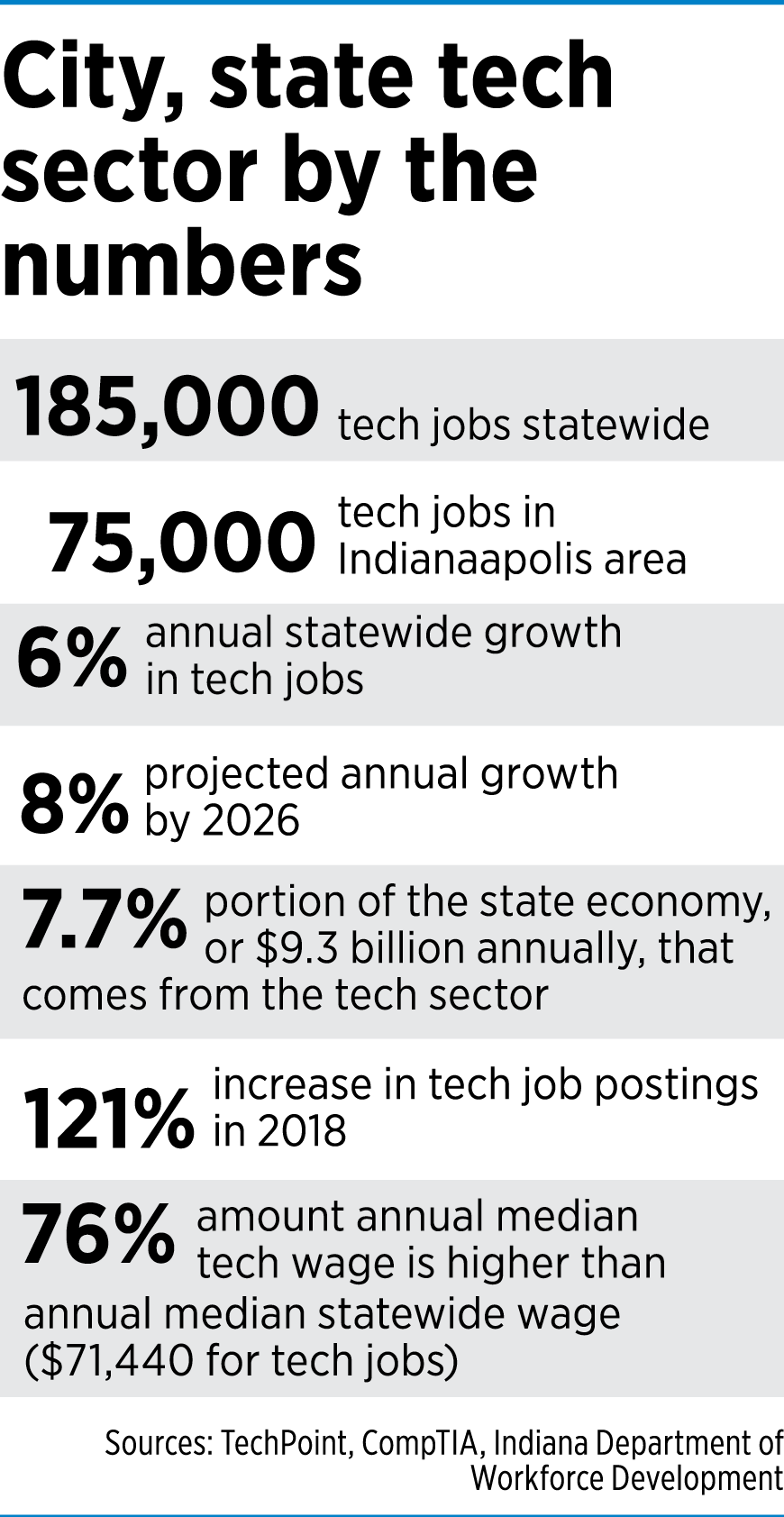

The state has nearly 185,000 technology jobs, which is nearly 6% of its total workforce, according to the Chicago-based Computer Technology Industry Association.

About 75,000 of those are in the Indianapolis metro market. That’s up more than 70% from 2010, which makes tech the state’s fastest-growing major industry by far.

The tech sector’s contribution to the state economy is estimated at $9.3 billion, or about 7.7%, according to CompTIA. That’s more than a $3 billion increase in the last decade.

The median tech wage is $71,440, 76% higher than the state’s median wage for all occupations.

It’s also important to note that the Brookings report didn’t include digital-services industries such as computer systems design, in its definition of the “innovation sector.” And that’s an area where Indianapolis has excelled.

Digital-services jobs in Indianapolis have grown from 11,750 in 2010 to 20,429 in 2018, according to the Information Technology & Innovation Foundation. Indianapolis’ 7.2% annual growth in digital-services jobs over that period outpaces that of Los Angeles, Chicago and even Seattle. The downside is, Indianapolis’ national market share of those jobs during that period increased only 0.1%.

‘We need to act with urgency’

Local and state officials do lots of chest puffing about the region’s tech sector, and rightfully so. But in terms of national players, Indianapolis—with just 2.8% of the national market share of tech jobs, according to Brookings—is still just a mighty mouse.

After all, the region still has less than half of the tech jobs, on a per-capita basis, as do the nation’s biggest tech hubs and major metropolitan areas, according to Statista.

“We need to double just to be average,” said Scott Jones, a serial entrepreneur, who in 2014 started local computer coding school Eleven Fifty Academy. “We need to act with urgency.”

John McDonald, founder of Fishers-based internet of things integrator ClearObject, agrees with Jones that Indianapolis must double its rate of growth. That’s no small task, he admitted, “but neither was getting where we are. And we’ve done that.”

“We have done wonders in the tech sector to get to the middle of the pack, but there’s so much more we can do,” said McDonald, who is now a partner with newly formed local venture firm Boomerang Ventures.

Central Indiana’s growth to date has been concentrated largely in marketing technology and software-as-a-service companies. One thought is that Indianapolis might need to diversify to accelerate growth.

Jones—who started his tech career in Boston inventing the platform that enabled voice mail before moving back to his hometown of Indianapolis—isn’t convinced that’s the way to go.

“You can’t try to boil the ocean. My experience in Boston is that, if you get those points of light, critical-mass areas where you can focus your karate chop, you get a natural expanding around those,” Jones said. “You want to run with your winners. You do that, and you build your talent and capital and it builds from there.”

While most agree urgent action is needed, the consensus is that panic is not.

“We have to remember, this is a share of the fast-growing tech sector,” said Bill Oesterle, former CEO of Angie’s List and founder of TMap, a company designed to bring Hoosier expats who are up-and-coming business leaders back to Indiana. “This [report] isn’t all doom and gloom. We’re holding our own.”

Recipe for success

Local tech leaders said three ingredients are needed to accelerate growth: ideas, capital and talent.

“We have lots of great ideas, but in the other two areas, we’re not great,” McDonald said.

He’s convinced the answer to increasing the city’s share of tech jobs is to focus on launching homegrown companies, rather than spending too much time luring out-of-state firms here.

“I believe with all my mind, heart and soul, the answer is to create new local companies,” he said. “By doing that, you accelerate that ‘build, grow, exit and reinvest’ strategy.”

That strategy has paid off in the past for central Indiana. A number of local entrepreneurs have started and sold off their tech firms—including Software Artistry, Interactive Intelligence, ExactTarget, Aprimo and Baker Hill—and used the proceeds to start other area tech ventures and venture funds.

While 80% of Indiana’s job growth comes from local companies, Sarah Iglehart, Indy Chamber vice president of regional economic development, said the city and state cannot ignore efforts to recruit out-of-state firms.

She pointed to the success with Infosys, an India-based tech behemoth that located in Indianapolis in 2018. It now has hundreds of jobs here and is building a large training facility on the grounds of the old Indianapolis International Airport terminal site on the city’s west side.

The ability to recruit out-of-state tech firms “gets back to some of what we’ve talked about with the talent pool,” Iglehart said. “The name of the game is no longer just incentives. Companies want to know the total picture, with things like quality of life, cost of living and depth of talent pool really mattering.”

Either by starting tech companies or attracting firms here, “We have to prime the pump to fuel the stream of great ideas here,” McDonald said.

Call for talent

The report from Brookings Institute and Information Technology & Innovation Foundation agrees.

The report from Brookings Institute and Information Technology & Innovation Foundation agrees.

It concludes that Midwestern cities have a lot of pluses, including a favorable cost of doing business and affordable cost of living for employees, along with far less traffic congestion and superior logistics infrastructure than places like Boston, Seattle and Silicon Valley.

But, the report said, there’s one major downfall: a shallow tech talent pool.

It’s a vicious cycle, the report’s authors said. The super tech hubs continue to drain brainpower from the other markets. Meanwhile, foreign markets have ramped up and amassed enough tech talent to become key rivals to aspiring Midwestern tech hubs.

“The result is that investments flow to places such as Bangalore, Shanghai, Taipei or Vancouver, rather than Indianapolis, Detroit or Kansas City,” the report says.

While there’s a temptation for Midwestern cities to try to swipe share from the coasts, it might be smarter for them to target foreign competitors.

The authors of the Brookings report say the overseas talent pool, as much as the cost of doing business, pushes tech business out of the nation’s Heartland and offshore.

The authors of the Brookings report say the overseas talent pool, as much as the cost of doing business, pushes tech business out of the nation’s Heartland and offshore.

The Brookings report says that, while the cost of living in Taipei “is 16% less than in Austin, Indianapolis costs 14% less. Shanghai is 35% cheaper than Boston, but Detroit is almost as cheap at 34%. And while Tel Aviv is 23% cheaper than San Francisco, Kansas City is 41% cheaper.

“The reason, then, that companies in U.S. tech hubs go to these foreign hubs is not only because they are cheaper but also because they are tech hubs in their own right, with large pools of skilled workers, sizable innovation infrastructure, and rich ecosystems of suppliers and competitors,” the report said. “With the ability of global tech firms to locate anywhere in the world, in short, these affordable alternative hubs are increasingly outside the United States.”

Authors of the report advocate for some federal assistance to help turn a handful of Midwestern cities into stronger tech hubs. “Enabling the creation of moderate-cost, but still-robust tech hubs in the heartland would not only help U.S. geographic balancing, but also foster technology competitiveness as firms would be more likely to choose Indianapolis over Taipei, Detroit over Shanghai, or Kansas City over Bangalore,” the report concluded.

Jones said the city is “running in place. The talent gap is critical, and we have to start thinking of new ways to solve it.”

One way to do that, Jones said, is to rethink our educational system. While many in the local tech industry say Indiana colleges punch above their collective weight in terms of producing STEM graduates, Jones and others say more needs to be done.

“We have to think of alternative ways of educating and training our tech workforce,” Jones said. “The reason I started Eleven Fifty is to shortcut the education system. Putting people through four-, six- and eight-year degrees can slow down our growth.”

Capital gains?

While a handful of local venture firms—including Allos Ventures, VisionTech Partners, Boomerang Ventures and Elevate Ventures—have started since 2010, access to capital is still a major concern here. And that limits the launch of new tech firms.

While a handful of local venture firms—including Allos Ventures, VisionTech Partners, Boomerang Ventures and Elevate Ventures—have started since 2010, access to capital is still a major concern here. And that limits the launch of new tech firms.

The start of the state’s Next Level Fund, which in mid-2018 designated $250 million for investment in high-yield asset classes including venture capital, is seen as a key step.

And while venture capital flowing into Indianapolis is still only a fraction of that flowing into the nation’s power tech hubs, it is seeing substantial gains.

Indiana tech companies made a major haul in venture and growth funding in 2019, scoring a 260% increase over 2018, according to TechPoint, a statewide tech industry advocacy group and accelerator.

In 2019, 62 Indiana tech companies publicly announced venture capital investments, grant funding, merger and acquisition deals, private equity and debt financing for total investments of more than $358 million. That’s a huge increase from the $135 million raised by Indiana’s tech companies in 2018.

Inner focus

Indy Chamber’s Iglehart isn’t overly concerned with what’s happening in other markets.

“Yes, we have to be aware of industry, national and global trends, but focusing too much on other markets can be distracting from the work we have to do here,” she said.

In addition to the gains in venture capital, Iglehart said city and state officials have done much to address the talent issue, including the launch of the Orr Fellowship, a program designed to develop the next generation of entrepreneurs and business leaders; TechPoint’s Xtern program, an internship program designed to bring top young tech talent to the state; the Ascend Indiana Network, an initiative designed to match talent with Indiana job opportunities; and TMap, which kicked into high gear last year and is coordinating with TechPoint’s red carpet events and state universities to reverse the brain drain.

“We are positioned really, really well,” Iglehart said.

Regional leaders have also done much to address infrastructure issues related to tech, she said, including the recent launch of various coworking spaces, the Indiana IoT Lab and 16 Tech, a campus of facilities designed to draw tech and other innovative talent to its campus on the northwest edge of downtown. The first building at the $500 million 16 Tech project is set to open in June.

“We’re growing, but we’re still a relatively new tech hub,” High Alpha’s Andersen said. “So, a lot of our growth initiatives are just starting to bear fruit in a big way. These things may not be reflected in a backward-focused report like the one published by Brookings Institute, but it will most certainly be reflected going forward.”

And the Indy metro area has one more critical arrow in its quiver, Iglehart said. She puts the region’s private-public partnerships up against those of any city in the world.

“You just don’t see the level of city, county and state collaboration that you see here in very many other places,” she said. “And there’s only two degrees of separation from a Scott Dorsey [ExactTarget and High Alpha co-founder], or other experts that could be a sounding board or offer other help. Everyone here supports the tech industry as a whole. And in the long run, that’s going to help put us ahead.”•

Please enable JavaScript to view this content.