Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowA little-known piece of legislation surfaced earlier this year that would have banned Indiana government and its pension funds from working with investment firms that boycott coal and gas companies.

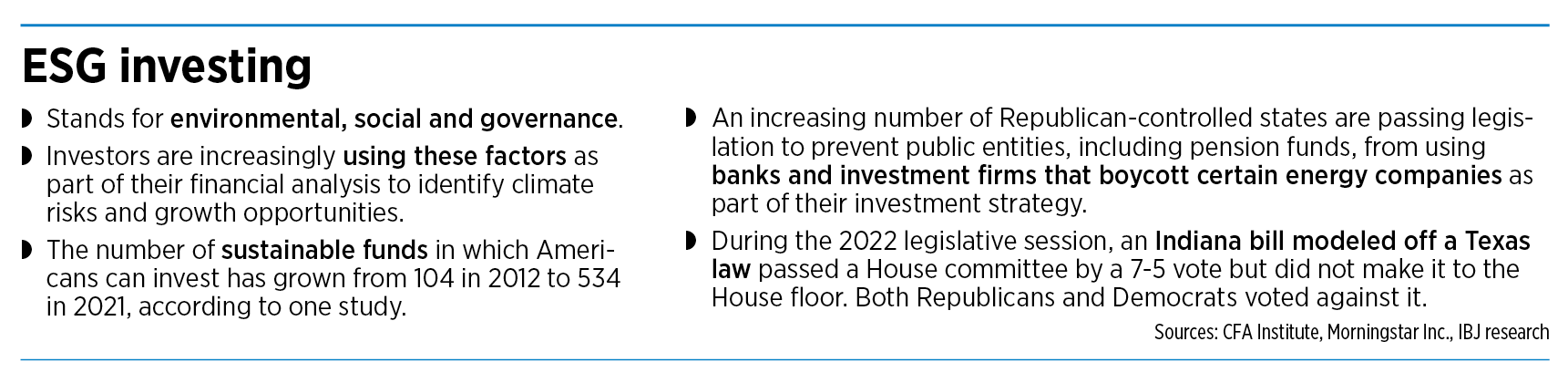

Ultimately, the bill didn’t have enough support to clear the Indiana General Assembly. But conservative Republican blowback continues to grow against a concept known as ESG investing, which takes environmental, social and corporate governance concerns into consideration when assessing the value of companies. ESG investing often eschews companies believed to contribute to climate change or human-rights violations.

Proponents of ESG investing argue that investment firms are merely responding to market forces and customers’ desires for “socially-responsible” investment options. The firms often offer some “green” funds that favor solar and wind companies over fossil-fuel providers, for example.

But critics say banks and investment firms such as New York City-based BlackRock Inc., the world’s largest asset manager (which has $10 trillion under management), are using activist investing to control board seats of major companies and push their political agenda instead of prioritizing their clients’ financial interests.

“You have three entities [BlackRock among them] that control $20 trillion—more than the whole budget of the United States—walking into your boardroom and saying, ‘Here is our political agenda. You either carry it out, or we’re going to take board seats,’” said Rep. Ed Soliday, a Republican from Valparaiso who co-sponsored a bill in the 2022 session that pushes back against investment firms that are actively divesting from fossil fuel companies.

House Bill 1224, modeled after a Texas law, would have prohibited state government and the Indiana Public Retirement System from working with investment firms that boycott fossil fuel companies.

Despite clearing the finance committee by a 7-5 vote—both Republicans and Democrats voted against it—the bill was never brought to the House floor. But it could emerge again in the 2023 session.

“We’re looking at what some other states are doing,” said Rep. Ethan Manning, a Republican from Miami County who authored the 2022 bill.

Manning said firms pulling money out of fossil fuels amounts to “setting energy policy for the state,” which should be the duty of lawmakers.

“These investment firms are taking away options that we need for a reliable and affordable grid,” he added.

Still, it’s not clear exactly what “boycotting” fossil fuels means in the context of investment firms. BlackRock executives might advocate for wind and solar energy, The Washington Post recently reported. But in Texas, it still invests more than $100 billion in Texas energy companies on behalf of its clients.

Indiana Attorney General Todd Rokita added some momentum to opposition to ESG investing when he issued an advisory opinion this summer. It argued that state law prohibits INPRS, which uses investment firms that engage in ESG investing, from choosing investment strategies based on ESG considerations.

“We must root out investment-management companies that scheme to leverage Hoosiers’ retirement funds to advance leftist social and economic agendas that otherwise cannot be implemented through the ballot box,” Rokita said.

An INPRS spokesperson declined to say whether the law would hinder its ability to ensure financial returns for its members.

“If a bill were introduced changing the law, INPRS would evaluate the fiscal impact of that bill at the time it is introduced and provide this information to the Legislative Services Agency pursuant to the established legislative process,” INPRS spokesperson Dimitri Kyser told IBJ.

Kyser said the INPRS board recently passed a governance risk policy that will be incorporated into the agency’s Investment Policy Statement, affirming its commitment to “invest its assets in the best interests of INPRS’ members and beneficiaries.”

‘A devastating blow’

Lobbyists for the fossil fuel industry also are pushing back against ESG investing.

During a recent meeting of the 21st Century Energy Policy Task Force, a legislative summer study committee tasked with making energy policy recommendations, Matt Bell, CEO of Reliable Energy Inc. (formerly known as the Indiana Coal Council), said ESG investing is “starving cost-effective fossil fuel energy and capital by pressuring companies to divest” from coal and gas.

“We encourage Indiana to join the growing force of states who are recognizing that ESG discrimination delivers a devastating blow to fossil fuel companies seeking to meet the demand for affordable and reliable energy, and it does so at the expense of the state’s pension,” Bell said.

Rep. Matt Pierce, a Democrat from Bloomington who also serves on the task force, said divesting from major banks creates confusion and uncertainty in the financial marketplace, which is why banking lobbyists in Indiana spoke out against HB 1224 last year.

He said he also understands why the fossil fuel industry supports the legislation.

“The coal and the fossil fuel industry really wants this protection. They can see the market is moving away from them,” Pierce told IBJ. “They’ve got a motivation to try to limit anything that’s going to reduce their access to capital.”

Sen. Shelli Yoder, also a Democrat from Bloomington and a member of the energy task force, introduced a bill last year that would have done just the opposite: Require the board of trustees of INPRS to divest from the top 200 largest fossil fuel companies.

“We have to think about the security threats that the climate crisis is going to continue to have on Hoosiers. It’s beyond smart investment,” Yoder said.

Growing movement

In recent years, several Republican-controlled states have sought to penalize banks and investment firms that have made public commitments to shift away from fossil fuel companies.

In May 2021, 15 state treasurers signed a letter expressing concerns that members of the Biden administration were reportedly pressuring U.S. banks and financial institutions to refuse to lend to or invest in coal, oil and natural gas companies. Indiana Treasurer Kelly Mitchell did not sign the letter.

“As a collective, we strongly oppose command-and-control economic policies that attempt to bend the free market to the political will of government officials,” the letter read. “It is simply antithetical to our nation’s position as a democracy and a capitalist economy for the Executive Branch to bully corporations into curtailing legal activities.”

That August, Texas passed a law banning some financial firms from doing business with the state. State Comptroller Glenn Hegar prohibited BlackRock, as well as some investment funds within large banks such as Goldman Sachs and JPMorgan Chase, from entering into most contracts with state and local governments because they avoid the fossil fuel sector.

Earlier this year, West Virginia followed suit with similar legislation, and Arkansas recently stopped using BlackRock for certain services due to its stance on climate change.

Last month, 18 state attorneys general joined Missouri’s investigation into ESG investing ratings company Morningstar Inc. and its subsidiary Sustanalytics for alleged consumer fraud or unfair trade practices. Rokita was among the signatories.

‘Fundamentally flawed’

Some say it’s easy to see why Indiana—the eighth-largest coal-producing state—could be next in line to take a public stance against so-called green investing.

“I would certainly expect a piece of legislation this year,” said Kerwin Olson, executive director of Citizens Action Coalition, an Indiana consumer and environmental advocacy organization. “We know that the fossil fuel industries are lobbying hard on this idea and this piece of legislation that we see in other places across the country.”

Idaho, Oklahoma and Florida have also created policies that restrict whom they will do business with, which some Democrats argue will result in financial costs to taxpayers.

Earlier this month, 14 state treasurers from mostly Democratic-controlled states crafted a missive of their own in response to the anti-ESG movement. Mitchell also did not sign this letter.

“The blacklisting states apparently believe, despite ample evidence and scientific consensus to the contrary, that poor working conditions, unfair compensation, discrimination and harassment, and even poor governance practices do not represent material threats to the companies in which they invest,” the letter reads. “They refuse to acknowledge, in the face of sweltering heat, floods, tornadoes, snowstorms and other extreme weather, that climate change is real and is a true business threat to all of us.”

When asked for her views on legislation banning the use of ESG-focused investment firms, Mitchell urged a thoughtful review.

“The Treasurer’s Office performs duties enjoined to it by state law,” Mitchell said in a written statement to IBJ. “Any legislative directive that narrows free market options impacts investment of Hoosier funds, and the potential ramifications of such actions should be thoughtfully considered.”

Banks and investment firms are increasingly offering ESG funds to their customers; in 2021, ESG funds in the United States attracted nearly $70 billion in new assets, up from $51.1 billion in 2020 and $5.4 billion in 2018, according to Morningstar Direct, an investment analysis firm.

Dax Denton, chief policy officer for the Indiana Bankers Association, said restricting investments or state commerce based on objections to ESG approaches is a “fundamentally flawed” approach.

“These types of bills attempt to prioritize specific industries for access to capital, an approach that runs counter to the free-market structure and the very foundation of our nation’s banking system,” Denton said. “This free-market approach has given our nation the strongest and most resilient financial system in the world.”

There is some evidence to suggest that these restrictive policies are yielding negative returns for taxpayers.

After Texas passed its law, five of the largest underwriters for municipal bonds left the market, which resulted in less competition and higher borrowing costs, according to a study by the ESG Initiative at the Wharton School of the University of Pennsylvania.

Researchers estimated that Texas cities will pay an additional $303 million to $532 million in interest on $32 billion in bonds as a result of the new law.

SEC floats new rule

While the legislative debate roars on, regulatory review of ESG practices is also picking up steam.

The U.S. Securities and Exchange Commission is pursuing new rules that would, for the first time, require funds and advisers to disclose financial data that show how ESG issues actually factor into their investment products and services.

It’s a sort of a truth-in-advertising approach that, for example, would require an investment fund focused on protecting the climate to show how it chooses “green” companies to invest in.

The SEC is also asking ESG-focused funds and firms to disclose more details about their ESG strategies in their fund prospectus and annual reports.

While firms like BlackRock have already been engaged in such practices, the rule would help ensure that investment funds aren’t “greenwashing,” or presenting themselves as more environmentally focused than they actually are.

The Indiana Banking Association has expressed concerns that details from newly required disclosures could be used to implement “unrelated policy preferences” that would restrict banks’ business practices.

The lobbyist group signed onto a letter sent by the American Banking Association to federal financial regulating agencies that said banks should be “free to lend to, invest in and generally do business with any entity or activity that is legal, without government interference.”

The SEC is expected to finalize and adopt the rule before the end of the year.•

Please enable JavaScript to view this content.

Remember when Republicans believed in the free market? Yeah, me too.

Did you even read the article? Nothing to do with free market. As usual your ignorance is enlightening.

Sure did. Apparently you didn’t.

“ Dax Denton, chief policy officer for the Indiana Bankers Association, said restricting investments or state commerce based on objections to ESG approaches is a “fundamentally flawed” approach.”

“These types of bills attempt to prioritize specific industries for access to capital, an approach that runs counter to the free-market structure and the very foundation of our nation’s banking system,” Denton said. “This free-market approach has given our nation the strongest and most resilient financial system in the world.”

You want to try again?

What may be missing is that Black Rock is not about capitalism. Black Rock is working in concert with government to control capital and global commerce through ESG ratings.

They are not asking corporations to comply, they are mandating compliance, to a scheme that has no investor ROI. Of course they are banking on investor ignorance to what outcome they are attempting mandate.

Steve R., you couldn’t be more wrong. Black Rock, like any investment firm, has to provide above-par ROIs to its investors or else it loses business, loses money, and ceases to exist. As of last Friday, Black Rock has a $90.5 billion market capitalization, putting it in the 99th percentile of companies in the Investment Management & Fund Operators industry. It’s current price-earnings ratio is 15.6. For your myopic mindset, you deserve a lump of coal.

D D — you are of course correct, but you have to bear with those at IBJ who are part of the “Lincoln Project Republican” collective who basically embrace everything coming from the Biden administration but will at least go tsk-tsk-tsk when Biden constituents loot and riot and set fire to small businesses or rampage through a Christmas parade or run over an 18-year-old with full intent to kill. But will still ensure the lawlessness continues because, of course, MAGA is far far far more dangerous and violent. They know this because “moderate” news sources like Reuters and NBC tell them this, even though they’re also perfectly happy with sites like Daily Beast, RightWingWatch, and Raw Story–essentially QAnon for lefties.

You have to bear with them: they think that corporations taking marching orders from the Washington Uniparty is actually “public private partnership” and that the very existence of the Uniparty is “reaching across the aisle”.

In their world, Romney and Sasse and Kinzinger are the true voice of the GOP, even as this ethos gets trashed in 80% of the GOP Primaries. But it doesn’t matter: Kinzinger and his ilk can run to the Dems and be welcomed with open arms. And to the Lincoln Leftists, there’s nothing weird about this. Nancy Pelosi has far more integrity than Liz Cheney, but then, that’s because although they’re fundamentally the same person with different colors of hair dye, only one pretends to stand for families and community and small businesses. And it ain’t Nancy.

Big Tech and the legacy media take marching orders from the current administration. Any attempt to point this out, in their eyes, is standing in the way of the free market. This is crony corporatism, it’s favor-granting and anti-competitive (since the richest corporations are helped by the government to keep competitors at bay, while they then reward the government by donating $$$ to their campaigns who will ensure the cartel remains unchanged).

Companies make more money for their shareholders when they use tools and methods that keep expenses low. Examples: 1) renewable energy sources are cheaper than coal; 2) treat your workers fairly who are therefore happier and more productive; 3) don’t break laws and therefore avoid legal costs.

ESG is straightforwardly good capitalism. To subsidize coal, which a hundred years ago was the cheapest source of energy but no longer is, is not good capitalism. To cheat or mistreat your workers is not good capitalism. To cheat your contractors, befoul the air, water, and soil, or get tied up in litigation because you are dishonest are not good capitalism.

ESG is about CONTROL, not capitalism. Keep researching it is pretty sinister when you get in to the details.

Black Rock is a globalist cartel.

If companies were engaging in these practices voluntarily, we wouldn’t witness such intense pushback. It’s not “good capitalism” if alternative business practices aren’t allowed to compete freely, or if the moral cartel that controls the legacy media and big tech wouldn’t defame a company for defying the ESG cult and thereby destroy them…thus indicating that many of them are doing this out of fear. Just look at how John Schnatter got treated after he dared question the NFL’s woke practices on helping him sell his sugary pizzas. Thrown out of a company he started from a garage in Jeffersonville IN. And some people here would be cheering this on. Such a “free” market.

Does anyone really think that the Salvation Army, a rock-ribbed conservative religious organization as recently as 10 years ago, would start promoting Queer and Critical Race Theory through its charity due to “shifting business culture”? Course not. The Woke Cult went after them.

So I’m supposed to buy into your thoughts about the global elite and groupthink and cancel culture and all that for billionaires business owners … when you dox regular citizens like me who post strong opinions you don’t like.

I don’t see a difference, whatsoever, between the two. If you don’t want it practiced against people you agree with, don’t practice it yourself against those you don’t agree with.

Joe B. Just because I know you full name (only because you wrote here all the time back when you…we…used a Disqus acount) doesn’t mean I know your address.

You’ve never been doxxed. I wouldn’t even know how to doxx you and wouldn’t even if I could. I don’t have a cult of followers who would do my bidding, even if I asked them to. With few exceptions (and yes, I’m willing to admit there are exceptions), doxxing what leftists do.

Like most people who write at IBJ, you’re a white-collar individual whose income and life achievements are significantly to the right of the bell curve. You’re not a victim. Why do people of your socioeconomic caliber continue to pretend that they are?

Doxxing: “to publicly identify or publish private information about (someone) especially as a form of punishment or revenge”

You love to mention you know where I work and have done it at least twice. That’s attempting to intimidate me to be silent and irrelevant every single time you mention it, which just so happens to be at the end of debates when you’ve run out of points to make.

If the IBJ wanted us to hang our place from employment over each other, they would still include our full names on the comment forms. Just because you data-mined everyone’s names several years ago, quite possibly when you were using someone else’s account (as you recently admitted), doesn’t mean you should use the information.

Public entities, such as the state pension fund, have a fiduciary responsibility to invest state monies where the opportunity exists for the best potential return on investment.

Yet in essence critics such as Rokita, Soliday, and others want to deprive public entities the opportunity to invest is portfolios that may very well achieve the best financial returns. They decry “activist investing” by Black Rock et al which they allege seek “to control board seats of major companies and push their political agenda.”

But isn’t that exactly what Rokita and Soliday seek to do? Isn’t their aim to steer public investing entities away from some firms so as to favor other firms, to suit their political preferences? Are they not the “activists” in this effort?

For the record, BlackRock Future Climate and Sustainable Economy ETF (BECO) purports in its filings with the Securities and Exchange Commission to be investing for value – not values – stating that it “seeks to maximize total return by investing in companies that BlackRock Fund Advisors believes are furthering the transition to a lower carbon economy.” Similarly, Morgan Stanley touts its sustainable equity funds as outperforming their traditional peer funds. To me, it sounds like a “win-win” when investors can achieve the best ROI while at the same time helping solve a serious public policy problem.

An attorney general and a state representative are not seasoned experts in investing. Rokita and Soliday need to stay in their lane and let the investing professionals do the work without being micromanaged by politicians who themselves want to use political means to achieve political ends.

ESG is the opposite of profitability.

What may be missing is that Black Rock is not about capitalism. Black Rock is working in concert with government to control capital and global commerce through ESG ratings.

They are not asking corporations to comply, they are mandating compliance, to a scheme that has no investor ROI. Of course they are banking on investor ignorance to what outcome they are attempting mandate.

Steve, you couldn’t be more wrong. Black Rock, like any investment firm, has to provide above-par ROIs to its investors or else it loses business, loses money, and ceases to exist. As of last Friday, Black Rock has a $90.5 billion market capitalization, putting it in the 99th percentile of companies in the Investment Management & Fund Operators industry. It’s current price-earnings ratio is 15.6. For your myopic mindset, you deserve a lump of coal.

Brent is cheering on the railroad tycoons. The railroads of the Gilded Age yielded tremendous ROIs to their investors too. And Weimar and–ahem–post-Weimar Germany had a surging economy. So has China for most of the last 20 years. All of them also exploited weak management of public goods, which (during the Gilded Age) Presidents like Arthur, Cleveland, Indiana’s own Harrison, and McKinley failed to rein in sufficiently…because their campaigns undoubtedly benefited greatly from letting them go.

I recognize that one could pose the same argument about fossil fuel energy companies–that they have enjoyed cozy relations with the feds (especially the GOP) in the past. And that’s probably true. So then it comes down to what people want: an energy sector spread heavily across low-emissions, boutique green producers that may result in the sort of shortages that California and Europe are facing…or the capacity to afford heat for their homes this winter, even if it means a dirty (but cheap and plentiful) resource like coal?

If you think the former, I’m not sure I can be of much help to you.

As usual, count on the GOP to conjure demons with crooked noses every time they’re called out for literally robbing the poor and burning the forests.

As usual, count on Dems to try to use the Antidefamation League’s favorite intellectual shield and bogeyman when trying to deflect from legitimate criticism of corrupt, anti-market corporatist practices like ESG.

All the while they have not one, not two, but at least three members of US Congress who openly share “crooked nose demon” propaganda focusing on a tiny, Western, democratic country that they don’t feel should have a right to exist. And the ADL lets them get away with it because the ADL (much like the SPLC) only scrutinizes “hate” from one political wing.

Our country’s system allows so many investment choices. It seems someone (or any entity) can pick an ESG focused investment or not – free country.

Investment decisions should be based on expected return.

Completely missing from this conversation are the preferences of the retirees whose retirement funds are being invested. What if they prefer investments which are BOTH profitable and environmentally responsible? Shouldn’t the State of Indiana prefer that as well?

I do not get why this is such a fraught issue – all the uber-agitated comments about things like ADL and legacy media and leftists and on and on.

Republicans are ideologically opposed to mandates, bans, regulation and the “nanny state”. That is definitionally what legislation that prohibits ESG investment is.

Republicans are ideologically supportive of free market concepts. Investment managers providing investors with both opportunities to invest in vehicles that are either ESG or not and allowing investors to pick and choose between those different investment vehicles are both couldn’t be more aligned with free market principles.

Back in the early 20th century, some were excited for the arrival of the motor car and supported it enthusiastically. Others insisted it was foolish, couldn’t work, would harm the horse breeding business and would likely be a failed venture. This is the modern equivalent of states attempting to ban the ability of their citizens to invest in automotive companies back then.

Bad faith argumentation and hyperventilation then, bad faith argumentation and hyperventilation now.