Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowLeaders of the Republican-controlled Indiana General Assembly and Gov. Eric Holcomb have made addressing high health care costs a top priority this year, but the bills proposed to do so are unlikely to have much direct impact.

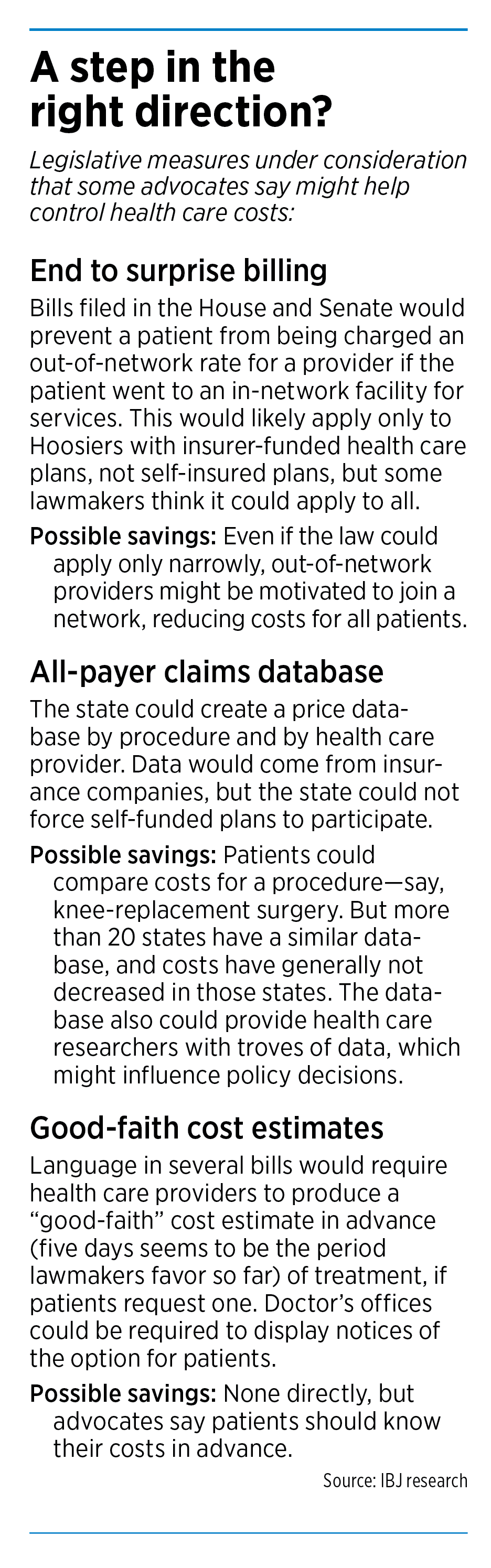

Republicans have filed a handful of bills to prevent patients from receiving surprise medical bills, require health care providers to produce cost estimates in advance, and create a public database of prices by facility and procedure for cost comparison.

Most of the measures would bring more transparency—but whether that would result in lower costs to consumers and businesses is questionable.

The transparency legislation “provides information, but in the short term it doesn’t lower costs per se,” said Mike Ripley, vice president of health care policy and employment law for the Indiana Chamber of Commerce.

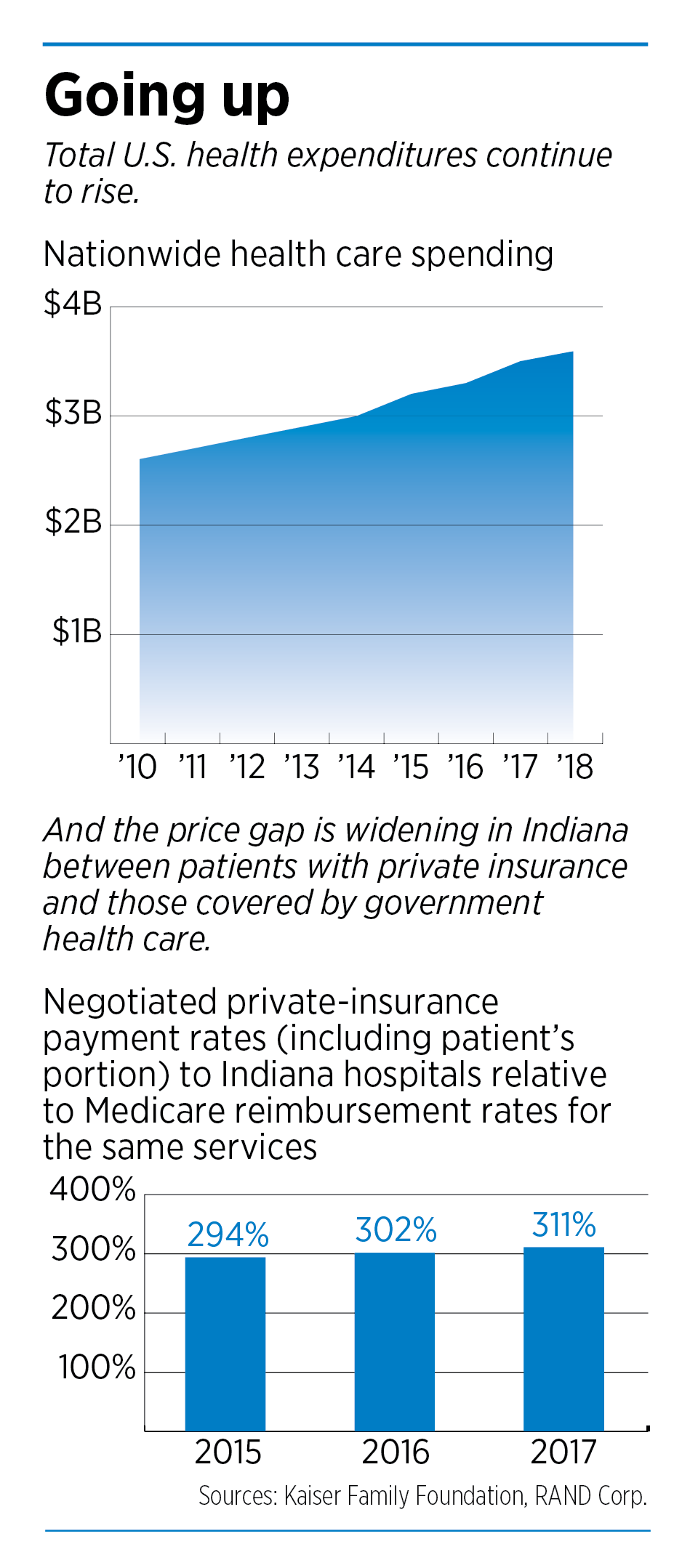

Business advocates say concerns about Indiana’s high health care costs have been growing for years—but a recent RAND Corp. study helped make the issue a top economic development priority. Indiana’s hospital costs ranked the highest of the 25 states in the study and averaged 311% of what Medicare would have paid for the same services.

“That took a lid off,” said Andrew Berger, senior vice president of governmental affairs for the Indiana Manufacturers Association. “And now everybody is super focused on this.”

Business leaders say the increasing health care costs are resulting in fewer dollars for employee raises, less capital for expansion or other investments, and higher premiums for employees.

“When those costs go up, that takes away from something else,” Ripley said.

Larry Gigerich, executive managing director for site selection firm Ginovus, said companies looking at Indiana notice the state’s high smoking rate, obesity problems and high rate of opioid use.

“You add all those things up and it translates into much higher health care costs,” Gigerich said. “It has been something that has grown in importance.”

‘We’ll grasp at anything’

Lawmakers say even if this year’s legislation doesn’t significantly and immediately lower costs, it is at least forward motion.

“If it helps one person, it’s worth it,” said Republican state Rep. Ben Smaltz of Auburn, who has authored a bill to end surprise billing.

And advocates for lowering health care costs agree that something is better than nothing.

“This is the first time that I’ve ever seen that we are actually taking a step in the right direction,” Ripley said.

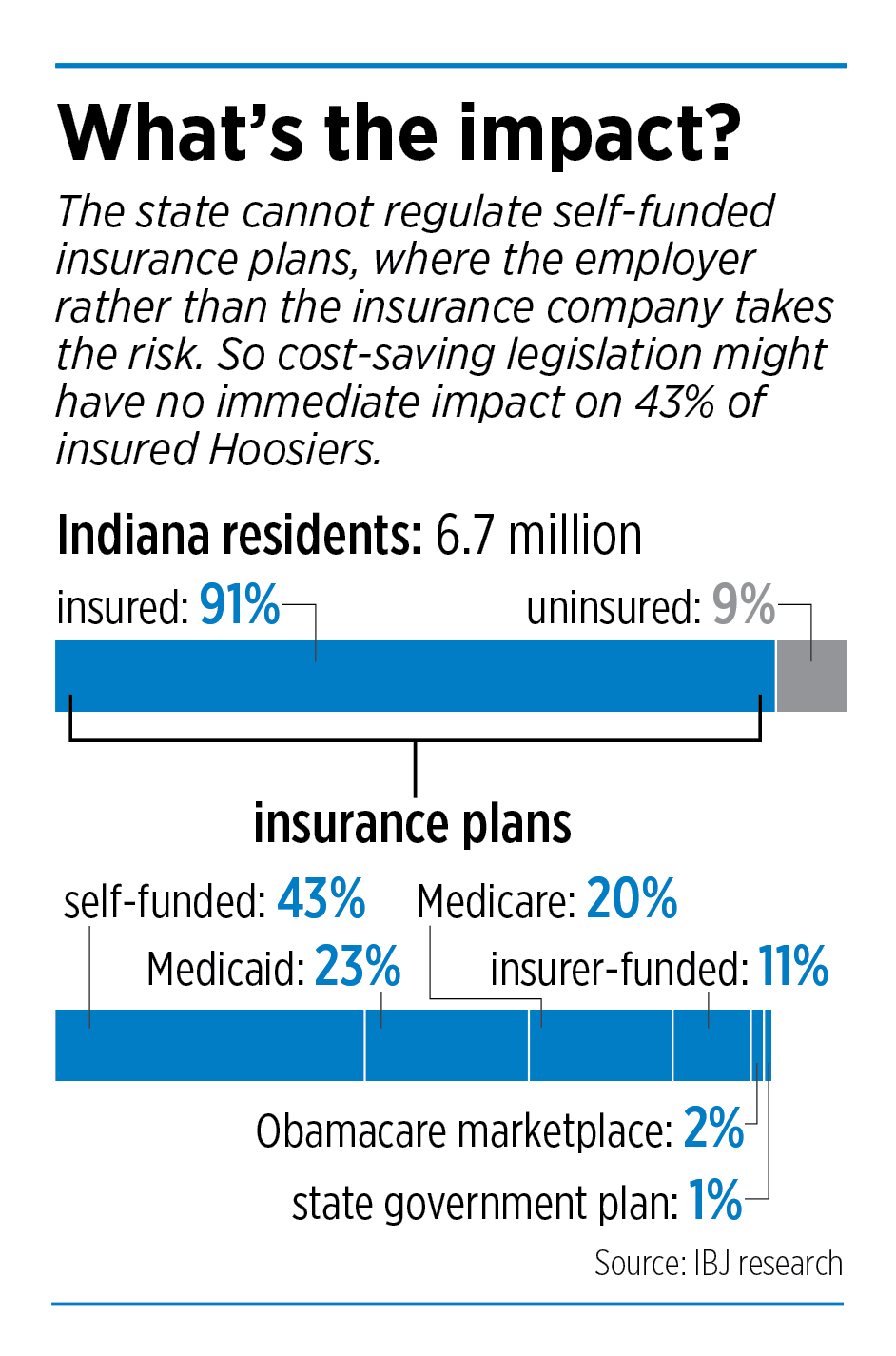

The impact of the bills on businesses and patients would vary, depending on the type of health insurance plan a business offers or a consumer buys.

Small businesses typically use what are called fully funded plans, in which the company pays an insurer to assume the risk and pay the health care costs. The users of those plans might benefit the most from the legislation under consideration.

Barbara Quandt Underwood, Indiana director for the National Federation of Independent Businesses, said bills that create an all-payer claims database and end surprise billing would have significant impact on their members, which typically have six to 10 employees.

“We’ll grasp at anything at this point,” Underwood said.

Holcomb said he’s convinced the measures can have an impact on health care costs, but is prepared to do more in the 2021 legislative session.

“This is a good step forward for all of us to build something together, and then we’ll learn more and we’ll follow up in the year to come,” Holcomb said.

Lawmakers are also prepared to continue the discussion next year.

“We’ve had this health care system developing over the last 30 to 40 years,” said Republican Sen. Ed Charbonneau of Valparaiso, who has authored several health care bills. “So it is going to be a very tedious and long-term approach to where we would like to be.”

Democrats are generally supportive of the proposals, but would like to see more done. Senate Minority Leader Tim Lanane said the state needs to figure out what’s driving up health care costs.

“It’s a much deeper dive,” Lanane said.

Surprise billing

The proposal this session that most advocates say could have the biggest impact is legislation to end surprise billing, which is outlined in House Bill 1004 from Smaltz and Senate Bill 3 from Charbonneau.

Even those bills, however, likely would help only some patients.

Both versions of the legislation would prevent a medical provider from charging a patient an out-of-network rate for any services at a facility—such as a hospital or outpatient surgery clinic—in the patient’s insurance network.

That sounds like common sense. But it’s not unusual for a patient to receive services from an out-of-network provider, such as an anesthesiologist, at an in-network hospital. That leads to an unexpectedly high bill because the insurance company pays a lower rate to out-of-network providers.

“No hospital should be permitted to stick a patient with out-of-network services if they are designated as in-network,” said Gloria Sachdev, CEO of the Employers’ Forum of Indiana. The legislation is “trying to take the patient out of the middle and protect the patient.”

But the legislation likely would apply only to the fully funded plans used mostly by small companies.

It likely would not apply to self-insured plans, in which employers take on the financial risk of providing health care coverage. Those plans are regulated by the federal government under the Employee Retirement Income Security Act.

A majority of Indiana businesses use self-funded plans; they account for about 80% of the commercial insurance market. But of the 6.1 million Hoosiers with some form of health insurance (including government plans), only about 43% are covered by self-funded plans.

Charbonneau said he’s looking into whether the language could actually apply to health plans under ERISA, which means the legislation would apply to everyone with insurance.

“This is a start,” Charbonneau said.

Smaltz said he thinks the language could be interpreted to apply broadly to Hoosiers with all types of insurance, even those regulated under ERISA, because it’s addressing what the health care provider can or cannot do rather than the insurance plan.

Rep. Terri Austin, D-Anderson, said she thinks Smaltz’s interpretation “is going to be fought in the courts.”

Berger said surprise-billing legislation could have a wider long-term impact, even if it applies only to fully funded commercial plans. That’s because it might push out-of-network doctors to join insurance networks, given they would no longer be paid more by staying out.

Mike O’Brien, lobbyist for the Indiana Association of Health Plans, agreed.

“It will actually lower the cost,” O’Brien said. “It will push more providers in-network.”

‘Y’all solve it’

The language in both the House and Senate bills is meant to protect consumers. Less clear is what the legislation would mean directly for the medical industry. It does not address how a health care provider could potentially recoup the difference between the rate charged to patients and the out-of-network rate the provider would normally charge.

Charbonneau and Smaltz say they’re staying out of that question.

“The industry needs to figure out how they’re going to work amongst themselves,” Smaltz said. “It’s very similar to the alcohol industry I’ve dealt with, and spent years in trying to mediate. I finally said, ‘Y’all solve it.’ … And I said that same thing to the medical community.”

Charbonneau agreed that those details are “a dispute the private sector should be resolving.”

The surprise-billing legislation would offer an exception that would still allow a patient to receive an out-of-network bill after visiting an in-network facility, as long as the patient is told about the potential out-of-network cost in advance and agrees to it in writing.

Lawmakers are trying to nail down how much notice providers would need to give patients, but five days is one suggestion. A key is that the notice couldn’t take place when a patient is too vulnerable to say no.

“We’ll make sure there’s a time frame there, that the person is stable, that they haven’t started whatever process they have for their surgery,” Smaltz said.

Sachdev of the Employers’ Forum said lawmakers could require that notification come within 24 hours of the procedure being scheduled.

Even less impact

The two other major proposals—to create an all-payer claims database and to require cost estimates for patients—would do even less to directly reduce medical bills. Instead, they are about transparency.

“In general, to have the free market system and competition work, you have to have information,” Charbonneau said. “And it is very tough right now to get any information on health care costs.”

Charbonneau is the author of SB 4, which includes the database language and SB 3, which includes the requirement for cost estimates. Both proposals are also included in HB 1005, authored by Republican Rep. Donna Schaibley of Carmel.

House Speaker Brian Bosma said he’s particularly interested in language that would require providers to give a “good faith” price estimate in advance, if requested by the patient. The cost could change before final billing, but providers would have to explain the difference.

“I think one of the problems we have right now is, people aren’t thinking about health care costs as much as we would like them to,” Bosma said. “This will force health care providers to sit down and say, ‘What are we going to predict for this procedure?’”

More than 20 states have some type of all-payer claims database—but there has been no evidence of health care costs dropping in those states.

Colorado’s database, which experts consider one of the best in the country, allows the public to see prices based on the facility-only costs (doctor fees not included) or the total bill for a procedure (doctor, medications, rehabilitation services, etc.). Users can select a specific service, like a colonoscopy, and enter a ZIP code. An interactive chart then lists facilities, the distance from the ZIP code, the average price, a price range and a quality-of-care rating based on five stars.

Patients can sort the list by facility name, distance, average price (low to high or high to low) and patient experience (high to low).

Patients can sort the list by facility name, distance, average price (low to high or high to low) and patient experience (high to low).

Using the database, you can see, for example, that the cheapest place to have a colonoscopy done near downtown Denver is at the Denver Health Medical Center, which has an average cost of $1,510 and a three-star rating. The highest average cost is $8,730 at Northwest Ambulatory Surgery Center, which does not have a quality rating available.

For a foot X-ray near downtown, the cheapest average price is $30, which is offered at several facilities.

Despite all the transparency, Colorado’s hospital costs have increased. According to the study the Employers’ Forum of Indiana commissioned Los Angeles-based RAND Corp. to conduct, Colorado hospitals charged privately insured patients 269% of what Medicare would have paid in 2017, up from 254% in 2015.

“There’s no correlation,” Sachdev said. “We know a [database] is not going to necessarily lead to more affordable health care.”

Norm Thurston, executive director of the National Association of Health Data Organizations, agreed.

“Having the data available doesn’t necessarily mean that any one actor in this system is going to take action to reduce health care costs,” he said. “It just doesn’t work that way. I would like to think that it would, but it doesn’t.”

Thurston said knowledge gleaned from the data could help influence policy decisions, though, and provide insight into why health care costs are so high in Indiana. And that is something lawmakers and Holcomb are interested in.

But the level of transparency and depth of data it could provide is questionable. That’s because the state cannot require companies on self-funded insurance plans to provide information to the database—and that’s the data some say is the most needed.

“It’s information that we need, but if [the database] isn’t done correctly, it may leave some gaps,” Ripley said.

Sachdev said that, to be effective, the database also needs to be specific, down to the exact hospital or doctor’s office, rather than providing regional data.

The database could eventually also provide information on quality of care, not just cost.

Regardless of what’s included, it would be years before any data were available, even if lawmakers passed the bill this session. The Indiana Department of Insurance would likely spend time deciding what specific data to include, how exactly the program should function and what privacy settings were necessary.

Then the department would likely contract with a vendor to develop the program and collect data. The Legislative Services Agency estimates the database would cost $1.8 million to $2.4 million in its first year and $250,000 a year to operate.

Thurston said it generally takes about 1-1/2 years from contract start to data availability.

More to come

A few other provisions tucked in some of the pending health care legislation have caught the attention of groups lobbying lawmakers for action.

Sachdev said she supports language that would require hospitals to post the average charges for services on their websites, as another cost-comparison tool. And that could start long before an all-payer claims database were launched.

The Employers’ Forum of Indiana also supports language that would require hospital systems to bill a patient based on the exact location the procedure took place. That would prevent, for example, a hospital system from billing as if a procedure occurred at a main campus even though it occurred at a smaller off-site office that might have lower costs.

The Indiana Manufacturers Association is also advocating for that measure, which was included in HB 1005 as of Jan. 21.

“That would make a difference right away,” Berger said. “We’re big fans of that.”

And no matter what happens this year, everyone seems to agree health care issues are coming back in future sessions.

“We hope that it’s not going to be the end of the discussion,” Berger said. “We gotta keep working on it.”•

Please enable JavaScript to view this content.

One more thing they need to pass: change the billing/deductible cycle from January->December to a rolling/sliding year.

.

Sure, it’s some extra software but with today’s technology, it should be no problem if implemented correctly.