Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIndiana is home to more than a half-million small businesses, and experts say most of them need extra capital to get started. This week, the Indiana Economic Development Corp. announced the launch of a lending source called the Legend Fund to help entrepreneurs and small businesses with small loans, typically under $50,000.

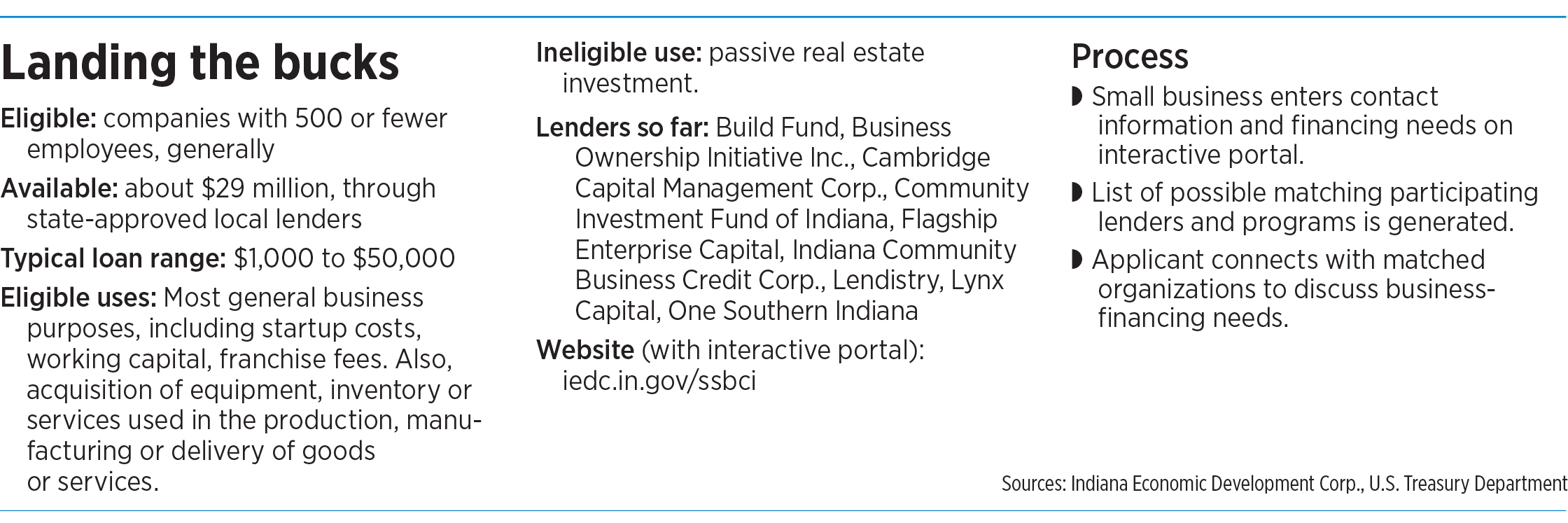

A total of $29 million is available statewide to a group of local lenders to distribute, with a focus on historically underserved owners. Eligible lenders could have a portion of the loans they issue purchased by the IEDC, freeing up capital to support more entrepreneurs and small businesses.

“This is one of the first, at least in recent history, times that the IEDC is taking an active role in helping people at the earliest stage of that pipeline get started, and hopefully grow at the very early stages before they go work with a traditional bank,” said David Watkins, the IEDC’s senior vice president of entrepreneurship and small business.

Entrepreneurs and small businesses looking to take advantage of the loan program can connect with approved lenders by visiting the Legend Fund website at iedc.in.gov/ssbci. The IEDC has already approved nine lenders through the program.

The funding was awarded to Indiana through the federal State Small Business Credit Initiative, a program overseen by the U.S. Treasury Department.

Watkins answered IBJ’s questions about the program. His answers have been edited for length and clarity.

Can you give me some background on this program? Is there a shortage of capital for startups in Indiana?

That’s a great question. And really, this program is designed to target the early stage underrepresented entrepreneurs, and the gap that exists, if you will, for those entrepreneurs trying to seek capital at the early stage of their business formation. And then even as they get to some initial growth, the growth opportunities could just be working capital or a new machine.

But community development financial institutions are U.S. Treasury-supported, mission-based lenders. Indiana has several of them here. They’re the primary partner that we’re working with throughout the state, and they are tasked with ensuring that capital gets into the hands of underrepresented entrepreneurs throughout the state.

These CDFIs, as we call them, receive support from local banks and other lenders and corporate and philanthropy to do that kind of work. So we’re trying to support more of that activity happening in the state.

What’s the typical amount of loan amount available for early-stage entrepreneurs? Would it be a few million dollars?

Much smaller. I think generally we’re thinking that anywhere from $1,000 up to $50,000 is about the sweet spot before we start to then make introductions to partners in the community banking sector or traditional banking sector.

You mentioned using these funds for working capital or for buying new machinery as examples. I’m just wondering if $50,000 is going to go very far toward either.

It depends on the scale of the business that you’re talking about. We’ve had conversations with one mission-based lender who runs a local revolving loan fund where the piece of equipment that they’re looking to buy is a new lawn mower, because they got a new contract to mow an additional facility. So that type of equipment may be different than, say, new life sciences machinery.

A lawn mower? So we’re talking about a pretty low-tech kind of business then?

It can run the gamut really. The community development financial institutions are targeting entrepreneurs and small businesses in typically underrepresented areas of the state. And so there are absolutely some technologically advanced businesses that they’re lending capital to, but it could also be as straightforward as a new lawn mower for a landscaping business.

When does this program go online? When do you start taking applications?

The website is live now. The first cohort of lenders are signed up. We actually have our first couple of loans coming through the pipeline for the program as we speak.

I notice that these lenders are not traditional commercial banks. Is this a new kind of funding program?

We’re focused on those mission-based lenders or non-traditional lenders. The source of the funds that the IEDC is deploying here [is] U.S. Department of Treasury funds.

So these lenders have a guaranteed federal backstop from the Treasury Department?

No, it’s slightly different. I think the program you’re referencing is a Small Business Administration program, where the federal government drops a guarantee on the loan that a lender is making. These CDFIs are actually provided investment funds by Treasury that they can then lend, and they have different facilities that they can leverage.

But you know, then the private sector, what we might call traditional banks, comes in, and they provide lending capital to these mission-based lenders, as well, or very-low-interest-rate, long-term loans.

How much money is being provided to this initial cohort of lenders through this program? Is there is a total dollar amount that’s available?

For our program at the IEDC, we’re making $29 million available through this loan participation program. For the sum total of all CDFI funding across the state, I don’t have that number. But I imagine the U.S. Department of Treasury tracks that.

Do you have an estimate for how many jobs will be created as a result of this program?

This is a relatively new program structure for us, not something that we’ve done, I think ever, at least in this type of structure. We’ve done some direct lending but not this type of activity. We will be tracking information like new businesses started and jobs created or retained.

The CDFIs are also tracking that data. We’ve had conversations with other states that have deployed their federal funds in this way. But we’re excited to see what type of impact we can have in a sector that traditionally is not a place that we’ve explored state support for capital access.

The IEDC rebranded its slogan last year to “For the Bold.” How bold is this program in terms of creating thriving startups in Indiana?

I do think this is bold in the sense that it is new for Indiana. There are 537,000 small businesses in the state of Indiana. And the vast majority of them—in order to grow and, [for] many of them, to get started—will need to access debt capital of some sort.

A lot of that happens through our banking partners here in Indiana. There’s $8 billion, give or take, of small-business lending that happens in the state each year. This is one of the first, at least in recent history, times that the IEDC is taking an active role in helping people at the earliest stage of that pipeline get started, and hopefully grow at the very early stages before they go work with a traditional bank.

The IEDC set a record last year for the seventh year in a row for committed capital investments—worth a total of about $28 billion. But I also see that median household income, which is a bottom line of sorts for economic prosperity, doesn’t seem to be growing in Indiana. In fact, it seems to be a bit stalled and decreasing in some recent years. Is this program one more effort to push the needle on household income?

We certainly look at the data when it comes to entrepreneurial activity writ large. Seventy-four percent of net new jobs in the state of Indiana come from firms under 5 years old. So we know that focusing on early-stage entrepreneurship is the place for us to make an impact on the creation of new jobs in the state.

We also know that that even just one new business start in any community across the state of Indiana does have a positive effect on raising household income. There has been a lot of reporting. I believe the original report came from a partnership that GoDaddy had put together that looked at entrepreneurship from side hustle to full-blown business based on URLs.

And one of the data points that came out of that study was how even just one new business started in a neighborhood or in a town or community saw household income or household wealth increasing in that community, just from that type of activity taking place, regardless of what kind of business it was. They saw positive impacts across the board from new business activity.

So those are kind of guiding principles for us when we think about addressing capital access in the state of Indiana, particularly for traditional small businesses who are trying to get started and especially those in traditionally underrepresented communities.

Any other thoughts?

This is probably one of the more complicated programs that we’ve attempted to launch in recent years, but we’re really excited to take on that challenge.•

Please enable JavaScript to view this content.

Nothing good can happen from letting IEDC run this.