Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

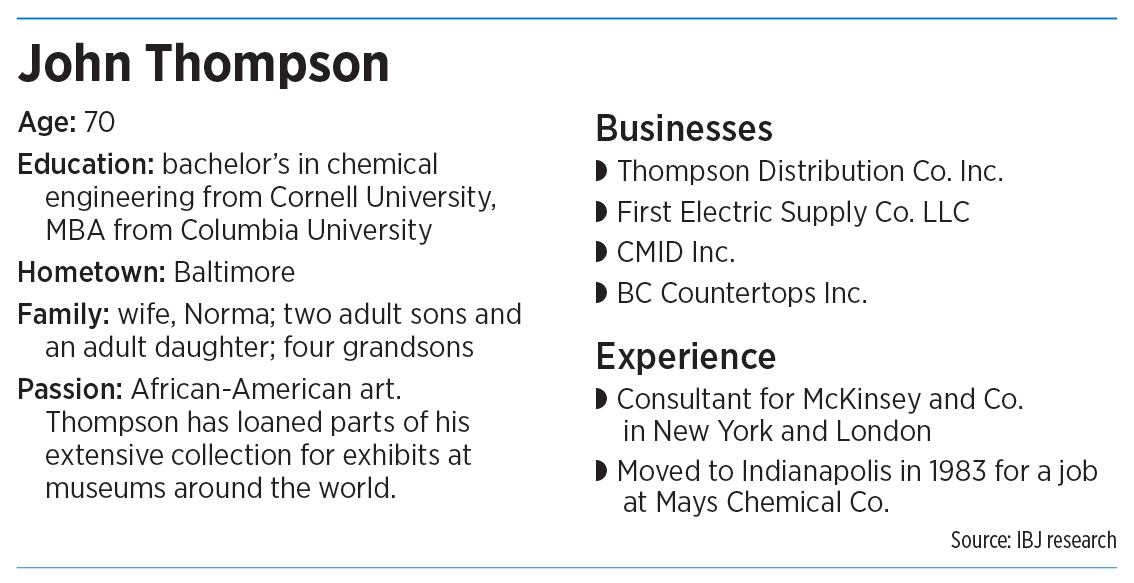

John Thompson is well known as both a business executive and a community leader: He’s the CEO of four Indianapolis construction-related companies and a board member for numerous organizations that range from the Indiana Economic Development Corp. and The National Bank of Indianapolis to the Eskenazi Health Foundation.

For the past decade or so, Thompson has also been an active angel investor. He’s currently invested in a handful of companies, including Metaimpact, MakeMyMove and Scale Computing, all based in Indianapolis, and Spokenote, which is based in Fishers.

Thompson spoke with IBJ last week about his angel investing—why he does it, how he chooses investment targets and how the angel investments fit in with his larger financial portfolio.

This interview has been edited for length and clarity.

When did you become an angel investor?

I did my first angel investment in 1991. A friend of mine started a gospel music label, and I invested in that gospel music label, TM Records, and we had some really nice gospel music. His son bought all of us out just recently. So that was a long-term holding. I did that one investment in 1991 and never did another until about 2013, but since 2013 I’ve done, oh, seven or eight.

Besides TM Records, have you had any exits yet?

I had one exit, OurHealth. That company was sold to a private equity firm, General Atlantic. That’s the only real exit that I’ve had. The others are all still active and growing.

Why do you make angel investments?

First off, there’s an opportunity for a return on your investment. So it’s certainly not philanthropic, like donating to nonprofits, right? Which I do a fair amount of that, too. So I’m looking for a return. And then secondly, I do have some impact investing goals there. One is to build an entrepreneurial ecosystem in Indiana. … And Indiana has a growing angel investment community. I [invest] individually, but I’ve since formed an investment company [Padi LLC]. It’s four of us. We all do investments individually, and then we do them jointly.

Why invest as part of a group? Why not just invest individually?

You can take a decent, meaningful position without stressing your capital. So let’s say we’re going to invest $500,000. That’s a meaningful investment, but I just have to put in $125,000. It gives you better access to the entrepreneur, gives you the ability to invest in more entities and do it in a meaningful way.

How do you choose which companies to invest in?

The first thing I look at is the founder, and it may be multiple founders. The first thing I look at there is character. You know, are they honest, and are they going to be transparent with their investors? And then the second thing, are they a good leader that can build a team? Because it takes a team. And then thirdly, do they have a good product or service? Being coachable is another requirement. You have to listen to others. [Also,] I like moats—something that makes it difficult for competitors to implement and execute the same thing. So I like some moat—whether it’s a patent, whether it’s an idea, whether it’s the way things are done—that’s important. Having a moat is a competitive advantage.

Could the founder’s particular area of expertise be an example of a moat?

It could.

Another good skill I like an entrepreneur to have—it certainly doesn’t rank as high as the others—is ability to pivot. An entrepreneur that could pivot really well was the late Bill Oesterle, co-founder of Angie’s List. And Bill started the company TMap in 2018, kind of a talent mapping company. … And then this remote-work thing took off, and Bill pivoted that company to MakeMyMove [an online platform that has attracted national attention by helping communities showcase their offerings to attract new residents]. … And that is—man!—that’s quite an accomplishment. And Bill Oesterle pivoted like you wouldn’t believe while he was fighting ALS.

How does angel investing fit in with your other personal investments?

I’m a portfolio guy, so I build a portfolio of investments that’s going to achieve a certain return over time on a risk-adjusted basis. That means you’re investing in different asset classes. So I don’t mind taking risk as an angel investor, but I’m not going to put all of my family’s money in.

What else do you invest in?

I’m an art collector, and fortunately, my art collection has really grown faster than any of my other asset classes in value. And so that’s one asset class. I [buy art] because I like it, right? But with the kind of money that I put into buying artworks, even in the 1990s when I bought most of my artworks, it was substantial enough that I had to have return in mind. I never dreamed that I would see the kinds of returns that I see. I never dreamed that, but I had to have an investment return in mind; it was too much money to put in without that. So if I bought a painting for $10,000, I was looking [at] if I ever wanted to sell it, I could get $50,000 or $100,000. But I never knew that I would get millions. The stuff we collected just absolutely went through the roof, but [the pieces] were undervalued.

What type of art did you acquire?

African American artists—the best in the country. You could buy them for a fraction of what their white counterparts were selling for. And I knew that that gap would one day close. … African American artists were underappreciated, and fortunately, in America today, around the world today, they’re not. They’re very much appreciated. I had other social reasons for doing it. I wanted my kids and other young people to know that African Americans had work of high, high quality—worthy of a museum.

What about other investments?

Public equity is another big asset class—stocks and bonds. Many of the stocks that I bought have gone up significantly. … Real estate does very, very well. So in addition to real estate that I own and sell and use in my business, I’ve sold quite a bit, too. I’m an investor in a lot of real estate across the country.

Are the angel investments the most risky part of your portfolio?

By far, yeah. By far.

What would you advise someone to do who is interested in becoming an angel investor but isn’t sure how to start?

The best thing for them is a fund … you can invest in a fund, and then if you invest in a fund, they’re invested in 30 different companies or 40 different companies. I don’t do funds, because I’m on the IEDC board, and I chair the entrepreneurship committee, so I’d be recusing myself for everything that came across the desk. And so I try to limit how many companies I invest in in the state. I don’t want to create those conflicts. There’s a mode of resolving them, and that’s recusal, right? And not lobbying for the company or voting on any of their investments. But I don’t want to recuse myself for every single investment, right? And if you’re in a fund, you’re going to recuse yourself on an awful lot.•

Please enable JavaScript to view this content.