Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Now the real weight-loss struggle begins.

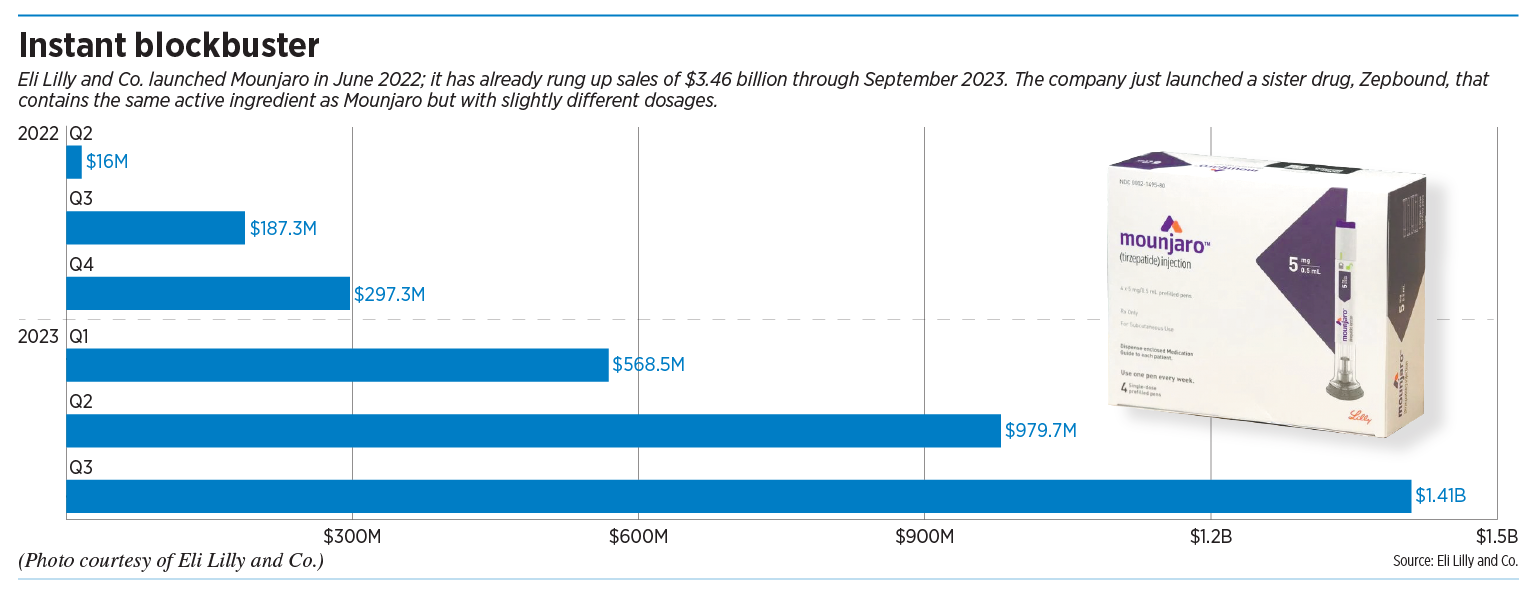

On Tuesday, Eli Lilly and Co. announced that its long-awaited treatment for obesity, an injectable drug called Zepbound, is available in pharmacies—a speedy launch for a product that federal regulators approved just a month ago.

“We can imagine a healthier future for people living with obesity,” the Indianapolis-based drugmaker said on its website. “We’re closer than ever before.”

But the new drug carries a hefty price of $1,059.87 per month, and insurers and health care plans are balking, questioning its affordability. Many employers and government health programs exclude obesity treatments from their coverage.

That leaves the medicines out of reach for many patients, although some discount programs are available.

Fewer than half of large employers cover so-called “GLP-1 medications” for treatment of obesity, although 19% say they are considering it, according to a survey by New York City-based health benefits consultant Mercer.

The situation is shaping up as the latest debate over costs and benefits of a medical treatment, with major campaigns underway to influence public opinion on both sides.

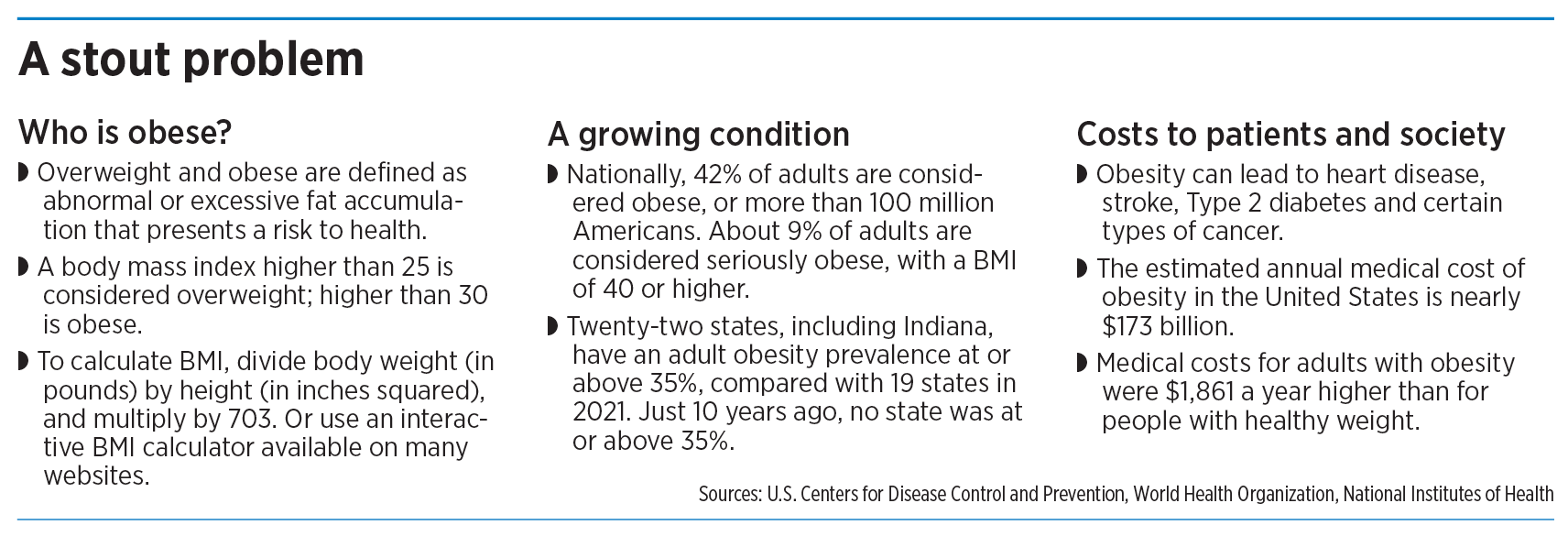

The stakes are high: More than 40% of U.S. adults are classified as obese, which the Centers for Disease Control and Prevention defines as a body mass index of 30 or higher.

Indiana can claim one of the highest rates in the nation, where 37.7% of the population is classified as obese, ranking the Hoosier state the 10th-worst in the nation, according to America’s Health Rankings, published annually by United Health Foundation.

Obesity is linked to heart disease, stroke, Type 2 diabetes and certain types of cancer. The estimated annual medical cost of obesity in the United States is nearly $173 billion.

Around the country, drugmakers, patients and physician groups are pushing for private health insurers to cover the drugs, saying obesity is a serious, chronic disease that poses a major health concern when left untreated.

They say it’s time for obesity care to be a standard health insurance benefit.

“Every patient should have access to the care that they need, regardless of what that care is,” said Kristal Hartman, a software production manager from Bend, Oregon, who said she has battled obesity since she was a teenager and has lost more than 100 pounds through a combination of surgery, medications, diet and exercise.

Her weight has ballooned as high as 275 pounds, classifying her as severely obese, with a body mass index higher than 40. She said she had to deal with a variety of related ailments, including prediabetes, severe asthma and joint pain.

“My primary care physician just kept telling me to put the fork down,” said Hartman, chair of the Obesity Advocacy Coalition, a not-for-profit that advocates on issues related to access to care and weight bias. “‘If you would just walk more and eat less, you’d be able to lose weight.’ … But it does not work for everyone.”

Some states require private health plans and insurers to cover drugs when a physician prescribes them as medically necessary. But it’s unclear if Indiana falls into that category. The Indiana Department of Insurance, which regulates health insurers, did not return several calls and emails to IBJ.

On Capitol Hill, advocates, including Lilly, are asking Congress to pass a bill that would expand Medicare coverage for obesity. Medicare currently doesn’t cover drugs prescribed for weight loss, although it does cover some types of bariatric surgery. Private insurers often follow Medicare’s lead on drug coverage.

‘A disease, not a choice’

In recent weeks, Lilly has overhauled its website to make the case that obesity is a serious medical condition, not a lifestyle choice for those too lazy to exercise or watch their diet.

“For people living with obesity, misinformation, stigma, and bias can stand in the way of comprehensive care,” the web campaign says. “It’s time to change how we see obesity: It’s a disease, not a choice.”

Zepbound, also known by its generic name, tirzepatide, has been shown in clinical trials to help people who are overweight lose at least a quarter of their body weight, or about 60 pounds on average, when combined with intensive diet and exercise.

Lilly, best known for introducing the first commercial insulin in the United States in the 1920s and the anti-depressant Prozac in the 1980s, is now betting that it can help muster enough demand from patients, doctors, heath advocates and competing drugmakers to get insurers to cover the obesity medicines.

“Broad access, obviously, is very important to us,” Rhonda Pacheco, Lilly’s group vice president for diabetes and obesity, told IBJ. “But we can’t do it alone. And so, there’s lots of collaboration between us and health care systems, government, pharmacy benefit managers and the rest of the industry right now.”

Zepbound is the latest in a new class of weight-loss and diabetes treatments, called GLP-1, short for glucagon-like peptide 1. The drugs activate hormone receptors in the lower gastrointestinal tract that regulate appetite and decrease stomach emptying, among other things.

The major competitor to Zepbound is Wegovy, made by Danish drugmaker Novo Nordisk. Unlike Wegovy, which launched last year, Lilly’s Zepbound also acts on a second hormone receptor know as GIP, which helps amplify the weight-loss effect. Even so, Lilly said it is launching Zepbound with a list price that is 20% lower than Wegovy’s.

Novo Nordisk, facing the same pushback as Lilly, is calling obesity a serious, chronic disease that can lead to many complications if left untreated. “Chronic diseases due to obesity and [being] overweight cost the U.S. $1.72 trillion a year in direct health care costs and indirect costs due to lost economic productivity,” Novo said in a statement.

Other drugmakers are jumping into the arena, attracted by high demand and high profits. On Monday, Roche AG, based in Switzerland, announced it was buying a California biotech that is developing GLP-1 weight-loss drugs. The global market for anti-obesity drugs is predicted to generate $100 billion in annual sales by the end of the decade, Reuters reported.

The prospects are so bright that Lilly this year became the most valuable health care company in the United States as measured by market value, and Novo has done the same in Europe.

Is it cost-effective?

Some experts, however, are warning that the cost of Zepbound, Wegovy and other weight-loss drugs has the potential to add 50% to U.S. health care costs, while drugmakers become the big winners.

“You can see this ballooning completely out of control,” Walter Willett, professor of nutrition at the Harvard University Chan School of Public Health, said in July.

But insurers are digging in. UnitedHealth Group, the nation’s largest private health insurer, based in suburban Minneapolis, told analysts in October that the drugs’ prices—with list prices as high as $16,000 a year—are too steep for many of its employer plans.

“The thing we’re most overall focused on [in the] GLP-1 space is, honestly, the pricing,” UnitedHealth Group CEO Andrew Witte said during a recent earnings conference call. “We’re very positive about the potential for another tool in the toolbox to help folks manage their weight. We recognize that it has potential benefits. But we’re struggling. And frankly, our clients are struggling with the list prices.”

He added: “There’s an old adage which I quite like in this context, which is, ‘The innovation that is not affordable is not innovative.’”

Some health benefits administrators say most Indiana employers were not covering weight-loss medications before the release of the GLP-1 class and are still reluctant to do so, even in the face of what is sure to be high demand from employees.

“There is always pressure from the employees to expand coverage,” said Stan Jackson, chief innovation officer for Apex Benefits in Indianapolis. “Bariatric coverage is another example of a procedure that has been argued should be covered, yet most plans do not.”

Employers’ Forum of Indiana, a not-for-profit coalition of employers, physicians, hospitals, consumer advocates, health plans and benefit consultants, said it was still studying the issue, saying much depends on the drugs’ net price that employers have to pay after all discounts offered by the drugmakers.

“I think the verdict is still out on the cost-effectiveness,” said Gloria Sachdev, the group’s CEO.

Nationally, about two-fifths of large employers cover GLP-1 medication for the treatment of obesity and another 19% say they are considering it, said Mercer, the benefits consultant.

Almost half of the public would be interested in taking a prescription weight loss drug, according to a poll released in August from the Kaiser Family Foundation. But that interest “waned significantly” if people heard they might gain weight back if they stopped taking the drug, and also if their insurance didn’t cover it.

The Pharmaceutical Strategies Group, a pharmaceutical management consulting company, surveyed 180 benefits executives representing health plans, employers and unions and found that these drugs are a major concern, according to the website Fierce Healthcare.

“The drugs could produce huge benefits for people with obesity but also present a major cost challenge given the large percentage of the population that is eligible for them,” the report said.

Indianapolis-based Elevance Health (formerly known as Anthem Inc.) said it generally does not cover GLP-1 drugs for weight loss in its fully insured plans. “Self-funded plans can choose to cover weight loss drugs,” company spokesman Tony Felts said.

Diabetes, yes; obesity, no

To make things more complex, some companies, including Elevance, will cover GLP-1 drugs for Type 2 diabetes, with a physician’s diagnosis and if a patient has first tried an older drug for the disease called metformin.

But that means the same drug, sold under different brands, is either covered or not covered depending on a patient’s diagnosis. Lilly’s Zepbound, for example, contains the same active ingredient as Mounjaro, which the company launched last year for Type 2 diabetes, but which some physicians have been prescribing off-label for weight loss.

Same is true for Novo Nordisk’s Wegovy, which contains the same active ingredient as Ozempic, launched in 2018 for diabetes.

Patients who have diabetes are often overweight and can treat both diseases with the same medicine, some say. The American Medical Association said last month it supports health insurance coverage parity for treatment of obesity, including FDA-approved medications, without exclusions or additional carve-outs.

“It is crucial to recognize the urgency of addressing this disease comprehensively and proactively through a range of suitable treatments,” the Chicago-based organization said.

The American Diabetes Association said more than 85% of people with diabetes also have obesity, and more than 50% of new cases of diabetes each year are attributed to obesity. Even so, access to GLP-1 drugs is often restricted by prior authorization and coverage denials for treatments, even with a doctor’s prescription.

“People with obesity face challenges accessing evidence-based treatments, including GLP-1 medications, for obesity,” the association said in a statement.

George Huntley, a Type 1 diabetes patient from Carmel and CEO of the Diabetes Leadership Council, a patient advocacy group based in Lexington, Kentucky, said employers are just beginning to see what obesity truly costs them when left untreated. Those costs include attendance problems, worsening health and sometimes costly operations and lengthy recoveries.

“We’ll pay to rip out their intestines, but not for the drugs and therapies that may have allowed the patient to avoid the surgery,” he said.

Lilly, for its part, said the obesity epidemic shows it is time to try new approaches. It defended its drug’s premium price as something that reflects “current and future value to people with obesity,” Pacheco said.

She added that obesity still carries a huge stigma and is often devastating for patients desperate for a treatment that works.

“When you talk to some patients, they’ve tried 40 different ways [to lose weight],” Pacheco said. “They have been told [to] just diet and eat better. And they’re just frustrated and feeling stuck.”•

Please enable JavaScript to view this content.

Why shouldn’t they get paid for their R&D and success of the product?