Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Increasing numbers of borrowers are falling behind on their credit-card and auto-loan payments, but banking and economic experts say this is not necessarily a sign of economic troubles ahead.

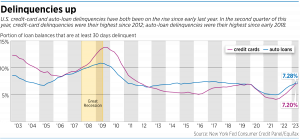

Delinquency rates have been rising on both credit-card and auto-loan debt since early last year, according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit. The most recent report, released in August, shows that 7.28% of auto-loan balances in the United States were at least 30 days delinquent—the highest the rate has been since early 2018. And 7.2% of credit-card balances were at least 30 days delinquent—the highest since early 2012.

In a report issued late last month, S&P Global Ratings said credit conditions for North American borrowers “look set to slowly deteriorate,” citing in part the rise in subprime auto-loan and credit-card delinquencies.

Several experts say the situation has more to do with the lingering economic effects of the pandemic than anything else.

Scott Siefers, a senior research analyst at Minneapolis-based financial firm Piper Sandler Cos., said the decline in credit quality is “worth watching,” adding, “what we’re seeing, I would characterize at this point as normalization rather than deterioration.”

As part of his job, Siefers monitors numerous banks that have a presence in the Indianapolis market, including Old National Bank, Fifth Third Bank, PNC Bank, Bank of America, J.P. Morgan Chase & Co. and Huntington Bank.

Credit quality was extremely strong during the pandemic, Siefers said, in part thanks to federal stimulus programs that helped consumers add to their savings. Most consumers have spent that extra savings by now, Siefers said, which helps explain the increase in delinquencies.

“So you’re starting to see a return to normal levels of credit quality, meaning modest deterioration off of extraordinarily strong levels,” Siefers said.

As points of comparison:

◗ In the fourth quarter of 2019, just before the pandemic began, auto-loan delinquencies stood at 6.91% and credit-card delinquencies were at 6.95%. Two years later, in the fourth quarter of 2021, delinquencies bottomed out at 4.96% for auto loans and 4.1% for credit card loans.

◗ During the Great Recession, in 2009, auto-loan delinquencies went as high as 10.85%, and credit-card delinquencies topped out at 13.78%.

Mark Hardwick, CEO of Muncie-based First Merchants Bank, said the bank has seen “modest increases” in its nonperforming assets.

As of June 30, First Merchants had $12.3 billion in loans. Of that, $70.6 million, or 0.57%, was at least 30 days past due. At the end of last year, the bank had $12 billion in loans, and $51 million of that, or 0.42%, was at least 30 days past due.

But to put things in perspective, one can’t ignore the economic impact of the pandemic, Hardwick said.

“It’s important to note that the industry is coming off of historical lows in terms of nonperforming assets,’ he said. “So, at least today, credit problems have been very minimal.”

Hardwick said the economic impact of the pandemic is still unwinding. The $6 trillion in federal stimulus distributed to individuals, businesses and government entities followed by a booming economy, tight job market, inflation and interest-rate hikes has created circumstances that make it hard to predict what’s next.

“There’s fear from the investor base, around bank stocks, that there is a potential credit crisis. And there’s just really, so far, no evidence that significant credit challenges are coming our way,” Hardwick said. “But we’ve never been in this type of environment. So using all of the old metrics [is] really challenging … to try to assume what’s going to happen next.”

First Merchants is primarily a commercial bank—commercial loans make up about 75% of its loan portfolio. Residential mortgages make up another 18.5%, with home-equity and other consumer loans making up the remaining 6.4%.

Like many banks, First Merchants does not issue its own credit cards. Instead, it offers credit cards via a third party—in this case, U.S. Bank—but does not hold any of that business on its own balance sheet.

Gus Faucher is the chief economist at Pittsburgh-based PNC Financial Services Group Inc., the parent of PNC Bank. He said he’s not overly concerned about the rise in consumer-loan delinquencies.

“Generally, consumers are starting from a good point. Job growth is good, wage growth is good,” Faucher said. “And so that is generally supporting consumer credit.”

Faucher said he keeps close tabs on a couple of economic metrics related to consumer debt: the financial-obligations ratio and the debt-service ratio, both of which are tracked by the Federal Reserve.

The debt-service ratio represents total household debt, including both mortgage payments and consumer debt, as a percentage of disposable income. The financial-obligations ratio, which is also expressed as a percentage of disposable income, is a broader measure that also includes rent payments, auto lease payments, homeowner’s insurance and property tax payments.

In the second quarter, the national financial-obligations ratio was 14.45%; the debt-service ratio was 9.83%. These ratios were 14.69% and 9.81%, respectively, in the fourth quarter of 2019.

In the fourth quarter of 2007, leading into the Great Recession, the financial-obligation ratio hit 18%, its highest since recordkeeping began in 1980. The debt-service ratio also set a record in the fourth quarter of 2007, at 13.17%.

“If we start seeing that [financial-obligations ratio] move up towards 16%, I’d be more concerned,” Faucher said.

Evansville-based Old National Bank has actually seen a modest decline in its loan delinquencies.

As of June 30, the most current data available, $137.2 million, or 0.42%, of the bank’s $32.4 billion in loans was at least 30 days overdue. Last December, $186.2 million, or 0.59%, of the bank’s $31.1 billion in loans was at least 30 days past due.

At both of those times, commercial real estate made up the largest category of loans—and the largest category of past-due loans—for the bank.

“We’re watching that portfolio, commercial real estate, very closely but feel good about the credit metrics at this point,” said Jim Sandgren, Old National’s CEO of commercial banking.

Old National is especially keeping tabs on loans related to office space, Sandgren said, given the current dynamics around remote-work trends. But most of the bank’s office portfolio is for suburban spaces and medical offices, he said, which aren’t facing the same level of challenges as downtown office space.•

Please enable JavaScript to view this content.