Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIncoming President Donald Trump’s pledge to impose tariffs on goods from Canada and Mexico has caught the attention of Indiana companies, which stand to experience a significant impact if new or expanded tariffs are imposed.

“People are very nervous,” said Andrew Berger, chief operating officer and incoming CEO at the Indiana Manufacturers Association.

That’s because, though China gets a lot of attention when it comes to international trade, America’s neighbors to the north and south are among the country’s most important trading partners.

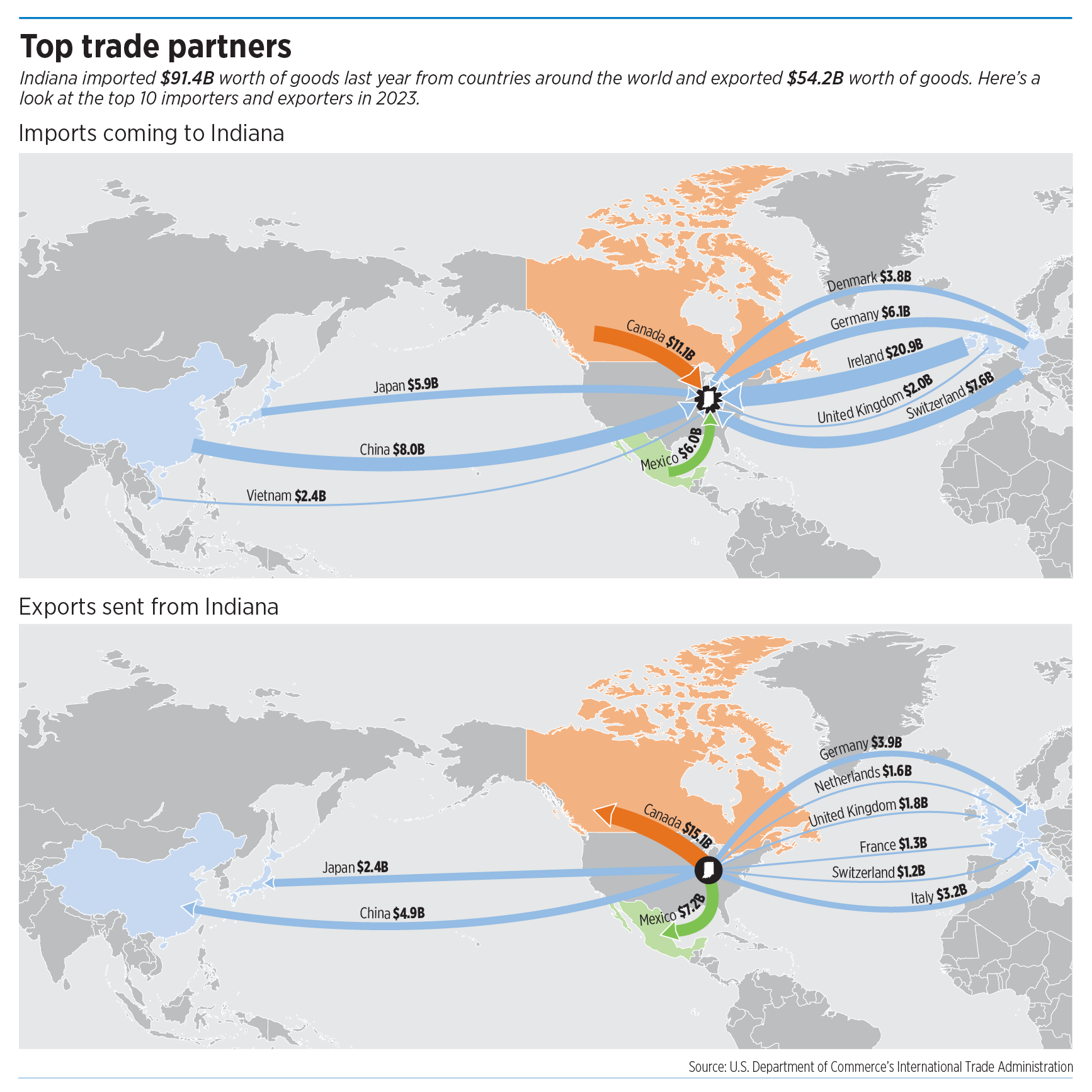

In 2023, Indiana imported $11.1 billion in goods from Canada and $6 billion in goods from Mexico, making those countries the state’s second- and sixth-largest trading partners, respectively, according to data from the U.S. Department of Commerce’s International Trade Administration.

For context, Ireland was Indiana’s top source of imported goods last year, at $20.9 billion. China came in third, at $8 billion.

In a post on the social media site Truth Social late la

st month, Trump threatened to impose 25% tariffs on “ALL products” coming into the United States from Canada and Mexico unless those countries take action to stem the flow of drugs and migrants into the United States.

That impact could be especially felt by manufacturers, who typically source at least some of their raw materials and components from international suppliers. According to the National Association of Manufacturers, the manufacturing industry contributed $121.9 billion to Indiana’s economy last year, making up nearly 26% of the state’s gross domestic product. And 18.3% of the state’s workforce is employed in the manufacturing sector, second only to Wisconsin’s 18.4%.

In a fireside chat earlier this month at Goldman Sachs’ annual Industrials and Autos Week, Stellantis NV Chief Financial Officer Doug Ostermann described the proposed Canada and Mexico tariffs as “not ideal for us, as it won’t be for any of the automakers.”

Based in the Netherlands, Stellantis has about 11,000 U.S. workers at 20 plants, including four Kokomo facilities that employ more than 6,000 people.

Ostermann said a significant portion of Stellantis’ production takes place in Canada and Mexico, but that the company has flexibility to adjust its operations if necessary. “I think when I look at our footprint, we have available capacity in the United States that will allow us to adjust if and when those types of tariffs come into place,” Ostermann said at the Goldman Sachs event.

Other companies have not been as forthcoming with their views on Trump’s proposed tariffs.

Multiple Indiana companies contacted by IBJ, including Subaru of Indiana Automotive Inc., Cummins Inc. and several others, declined to talk about how they might be impacted.

“Since it’s too early to tell what policies will actually be put in place, we will refrain from making any comments at this time,” Subaru spokesman Craig Koven told IBJ via email.

Subaru of Indiana’s Lafayette facility, which produces vehicles for the North American market, is Subaru’s only manufacturing plant outside of Japan.

Natalie Guzman, a spokeswoman for Columbus-based Cummins, told IBJ via email, “It’s a bit premature to comment on the topic broadly.” The manufacturer has operations around the world, including Mexico and Canada.

“We have worked with all past administrations to educate them about the opportunities and challenges our industry faces, and we look forward to working with the new administration on policies that can unleash American manufacturing and international competitiveness by leveraging our global scale,” Guzman wrote.

Kyle Anderson, an economist at the Indiana University Kelley School of Business in Indianapolis, is not convinced that Trump will follow through with his threat of 25% tariffs on Canadian and Mexican imports. “I think a lot of this may just be posturing,” he said.

Even so, Anderson added, “If this is implemented, even if it’s not as drastic as what has been said, it’s likely to have a negative impact on the economy.”

Anderson said he’s not aware of any definitive studies on the impact of the tariffs Trump imposed during his first term in office. And he said the significant tax cuts that Trump also established in his first term make it harder to measure the tariffs’ impact specifically.

In general, though, economists regard tariffs as something that hinder economic growth, Anderson said. Tariffs result in price increases that get passed along to consumers, and in response, consumers buy fewer goods.

Compounding the issue: In addition to being major importers of goods to Indiana, Canada and Mexico are also top destinations for Indiana exports.

Canada received $15.1 billion in Indiana exports last year, and Mexico received $7.2 billion, making those countries the top two markets for Hoosier exports. In comparison, China came in third, receiving $4.9 billion in goods from Indiana.

Though Trump’s tariffs would apply only to goods entering the United States from Canada and Mexico—not exports to those countries—it’s likely they would respond in kind, said Berger, who will take over at the manufacturers association on Jan. 1 when current CEO Brian Burton retires. “We would expect some retaliatory tariffs,” he said.

Companies can potentially mitigate the effect of tariffs imposed on a specific country by adjusting their supply chains and finding suppliers in other places.

This happened when Trump enacted tariffs on Chinese imports during his first term—tariffs that the Biden administration left in place. An article published in 2022 in the Journal of Indo-Pacific Affairs, a publication of the U.S. Air Force, concluded that Vietnam had been the biggest winner in the U.S./China trade war because its exports to the United States had increased so much since 2018.

Andrew Krop, the chief financial officer at Indianapolis-based Spot Freight Inc., said the company’s customers haven’t adjusted their behavior in response to Trump’s proposed Canada and Mexico tariffs. But, he added, “from what we’ve heard, customers are definitely thinking about it.”

Spot offers freight brokerage and logistics services and helps clients think through supply chain problems.

When Trump imposed tariffs on China, Krop said, some Spot customers routed their shipments through a third-party country like Vietnam or Thailand to circumvent the tariffs. But that’s not as easy to do when the shipments are coming from Canada or Mexico.

“The transit, in most of those cases, is either a truck or rail coming across the border,” Krop said.

Berger offered other reasons why a company’s experience dealing with China tariffs might not be useful in facing a new set of tariffs.

In the years since the China tariffs went into effect, Berger said, companies might be using new suppliers or even making different products that use different raw materials.

“You may be dealing with a whole new fact set today than you were six or seven years ago,” he said.•

Please enable JavaScript to view this content.

A trade war is exactly what we need right now. Said no one ever.