Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowEarly this century, the NCAA enlisted the accounting firm Deloitte to conduct a risk assessment, one that looked at the seemingly preposterous notion that the NCAA men’s basketball tournament—one of the most lucrative events in sports—would be canceled.

The reason for the exercise was the NCAA’s unusual revenue stream. The vast majority of its budget, which now tops $1 billion, comes from a single source, the TV deal for that tournament.

As Chief Financial Officer Kathleen McNeely told IBJ in 2014, “Predominantly, our money comes from one contract. It is logical you would create a risk-mitigation plan if something would happen to that revenue stream. Certainly, none of us expect anything to happen.”

Well, now the unthinkable is here—the cancellation of the marquee tournament, along with all other winter and spring NCAA championships, officially axed March 12 as the coronavirus pandemic swept through the United States.

The NCAA isn’t ready to publicly discuss plans for how it intends to bounce back from the monumental setback. NCAA spokeswoman Stacey Osburn told IBJ the organization’s leadership and membership committees “are identifying and working through the considerable implications” of the championship cancellations.

Added NCAA President Mark Emmert: “We know that the financial implications are all negative, and we’re going to have to deal with those.”

The shocking turn of events has left a trail of questions, including how much the NCAA will have to forgo under its massive men’s tournament TV contract, and how much, if anything, it might collect in the form of event-cancellation insurance.

The tournament’s cancellation also has raised the specter of job cuts at one of Indianapolis’ premier employers. The NCAA has 515 full-time workers, and 112 employees earn more than $100,000 annually, according to an Internal Revenue Service filing. In 2018, its 16 highest-paid executives collectively earned $11.6 million.

Yet amid all the uncertainty, longtime observers of the not-for-profit say its risk-mitigation plan, its formidable balance sheet and the billions of dollars it is on track to collect from the TV contract when the tournament returns in future years leave it well-positioned to withstand the cancellation of this year’s March Madness.

Neither of the two bond-rating agencies that track the NCAA’s finances have announced intentions to downgrade the organization’s debt. Both Moody’s Investors Service and S&P Global Ratings rate the NCAA highly, a shade below AAA.

“Obviously, this is a significant event for them,” S&P analyst Ken Rodgers said. “But they do have that financial flexibility, and we don’t think something like this would impair the organization.”

Financial firepower

The NCAA balance sheet would be the envy of most private businesses.

The NCAA balance sheet would be the envy of most private businesses.

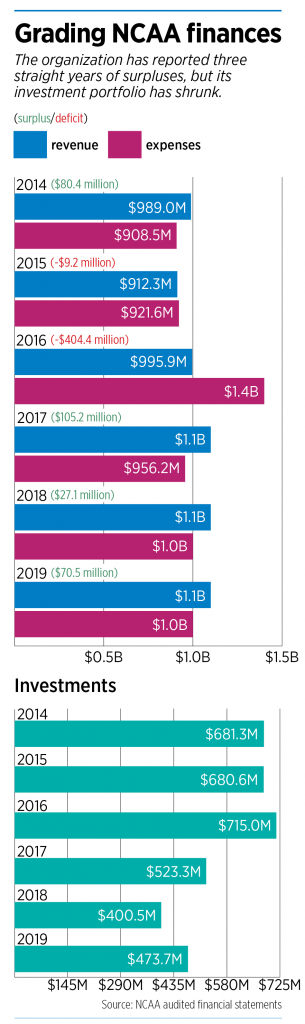

In the 2019 fiscal year, which ended Aug. 31, the NCAA brought in $1.12 billion in revenue and had expenses of $1.05 billion, leaving it with a $70.5 million surplus.

The lifeblood of those financial statements is the contract the NCAA cut in 2010 with CBS and Turner Broadcasting System, which covers TV, internet and multimedia broadcast rights. The pact mandates $10.8 billion in payments to the NCAA through 2024.

In 2016, the NCAA extended the agreement for an additional eight years—through 2032—in return for $8.8 billion more in payments over the contract term.

In 2019, the NCAA received $804 million under the contract, plus an additional $75 million in prepayments on future years, most of which will be recognized on future financial statements.

The NCAA had expected the contract to generate $827 million in 2020. It’s unclear what CBS and Turner actually will pay. The NCAA and CBS did not respond to that question by IBJ deadline, and a Turner spokesman declined to comment.

But David Ridpath, an NCAA expert who serves as an associate professor in Ohio University’s business college, said that because the networks and NCAA are long-term business partners they have an incentive to help each other overcome this misfortune.

“This is purely speculative, but it is so valuable on both sides that they are going to be as good as they can to each other,” Ridpath said.

On the other hand, CBS, which is part of ViacomCBS, and Turner, which is part of AT&T’s WarnerMedia, are nursing their own wounds. Their two sales teams had booked more than $900 million in advertising throughout the 67-game tourney, according to Ad Age.

How the financial blow reverberates through the NCAA will have implications for Division I schools across the country—whose annual distributions suck up the bulk of the NCAA’s revenue. In 2019, the schools received $611 million.

Notably, the NCAA has only $11.9 million in debt, a minuscule obligation for an organization of its scale. That debt is the remaining balance owed on bonds issued to fund the NCAA’s $56 million purchase of the National Invitation Tournament in 2005 and the expansion of its headquarters campus at White River State Park in 2010.

In fiscal 2018, the most recent financial statements Standard & Poor’s analyzed, cash and investments totaled $415 million, which equated to 40% of operating expenses.

“Forty percent is a pretty nice cushion,” Rodgers said.

Insurance infusion?

The NCAA has event-cancellation insurance on the men’s basketball tournament, according to the rating agencies, but they didn’t disclose the amount. As of 2016, when an NCAA official discussed the policy with IBJ, its coverage totaled $225 million.

In an interview with Bloomberg in early March, as disruption of this year’s tournament was becoming a possibility, NCAA Chief Operating Officer Donald Remy offered no specifics when he said the organization had insurance he believed would partly cover losses.

But Zach Finn, a risk management professor at Butler University, told IBJ earlier this month that most cancellation policies exclude pandemics and he would be “shocked” if the NCAA’s policy included them.

Through the years, as the NCAA planned for the potential cancellation of the men’s tournament as part of its risk-mitigation planning, it never intended insurance to bear the full brunt of losses.

That planning involved creation of a special endowment, which had grown in value to $336 million by 2013. At that point, if the NCAA had been unable to stage the men’s basketball tournament, its “financial recovery plan” called for chopping $46 million from operating expenses, drawing $225 million from event-cancellation insurance and drawing $215 million from the endowment.

But in a reversal of course, the NCAA’s board of governors in 2016 decided to make an extra, $200 million distribution to Division I schools, drawing from the endowment to do so. As part of that change, it did away with the endowment structure and increased operating reserves from three months to six months.

Thinner financial cushion

That shift in strategy is one reason the NCAA’s investments have fallen from $681 million in 2014 to $474 million in 2019.

Another is that the NCAA has anteed up high-dollar settlements to resolve lawsuits in recent years, a reflection of growing concern about the safety of football and growing controversy over the fair treatment of athletes.

For example, the NCAA in 2014 settled concussion-injury litigation for $70 million and in 2016 settled litigation alleging tens of thousands of athletes were owed larger scholarship payments for $208 million.

As Moody’s Investors Service wrote in a 2017 report, “While the NCAA’s role in intercollegiate athletics is well established, it faces multi-faceted pressures including the enforcement role for complex safety and other rules and the perceived disconnect between the amateurism of student-athletes, as codified by the NCAA, and the increasing commercial success of high-profile college sports.”

Even so, Moody’s continues to rank the NCAA at AA2, its third-highest rating. The rating agency cites the NCAA’s “healthy unrestricted liquidity, relative to debt and fixed expenses”—as well as the lucrative March Madness contract.

Ohio University’s Ridpath said the existence of that contract will help the organization weather this year’s red ink.

“Even with this most recent issue, they have access to a lot of money,” he said.

Further, he said, the lack of a tournament this year will escalate excitement about next year’s March Madness, which is set to culminate with Indianapolis’ hosting the Final Four.

“The revenue on both sides might be massive because interest would be quadrupled,” he said.•

Please enable JavaScript to view this content.

I booked a cruise with travel insurance back in November, about the first of February I started getting worried and checked my policy. After a lot of reading about what it did cover, I finally had to call the company because it looked like a pandemic was excluded. Sure enough it was.

Luckily my cruise line waived the normal cancellation policy so I am still OK, but insurance is a tricky thing.