Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowMall shoppers know how exhausting it can be to visit store after store in search of something specific: size 10 men’s brown dress shoes, for instance, or fluffy bath towels in a certain shade of blue.

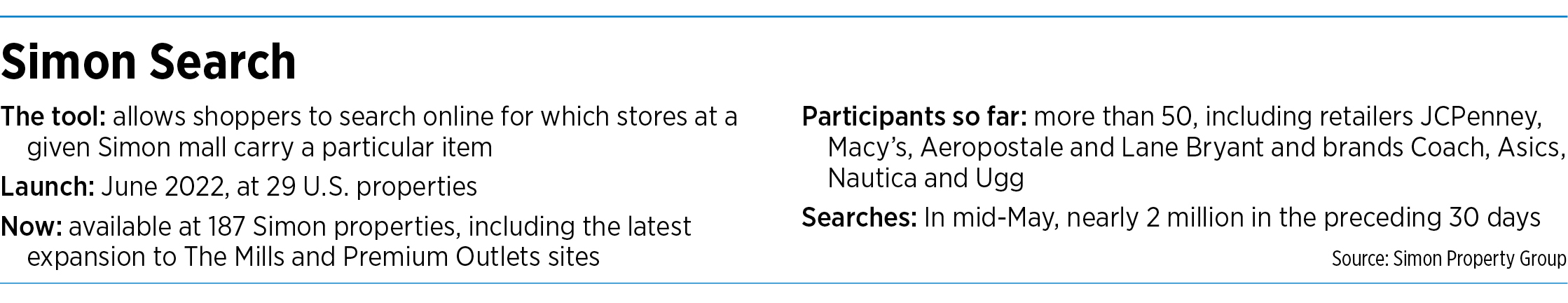

Over the past year, Indianapolis-based Simon Property Group has been rolling out an online shopping tool, Simon Search, that aims to streamline such quests.

The tool, which is accessible via Simon’s website and app, and at in-mall digital directories, allows users to browse multiple stores’ inventories at once. A shopper looking for those dress shoes or towels can see which participating stores at a particular mall carry the desired item, as well as the brand, price and sizing. Shoppers can also search for sale items.

Simon launched Simon Search in June 2022, testing it at 29 properties across the country, including Castleton Square Mall, Greenwood Park Mall and The Fashion Mall at Keystone. The company has since rolled out the tool more broadly, including at all nine of its Indiana properties.

Last month, Simon announced it had added Simon Search at all its outlet malls, which operate under The Mills and Premium Outlets brands. Including the outlet malls, Simon Search is now available at 187 Simon properties—the vast majority of its U.S. portfolio. (As of the end of last year, Simon had 196 U.S. properties and another 34 international properties.)

“Consumer interest in Simon Search has far exceeded our expectations,” Simon Chief Marketing Officer Mikael Thygesen said in a prepared statement May 22. In that news release, Simon said its Simon Search tool had been used for nearly 2 million searches over the past 30 days.

Simon Search’s participating tenants include more than 50 retailers and brands, with others in the works. Some of the participants, including JCPenney, Aeropostale, Forever 21, Lucky Brand and Nautica, are companies in which Simon has an ownership stake. Other participants include department stores Macy’s and Nordstrom; shoe-sellers Asics, Journeys and Ugg; brands Levi’s and Lilly Pulitzer; and more.

The number and mix of participating retailers vary at each property. The Fashion Mall at Keystone has 14 participating stores, including Banana Republic, Brooks Brothers, J. Crew and Saks Fifth Avenue. Greenwood Park Mall has 13 participants, including Helzberg Diamonds, JCPenney, Macy’s and Old Navy.

The Simon Search tool lists several other retailers—including Finish Line, GameStop and Lenscrafters—as “coming soon” to the platform.

Simon did not respond to requests for comment left via phone and email

Going ‘phygital’

But retail experts say Simon Search is part of a larger retail phenomenon—the blending of brick-and-mortar and online shopping experiences.

“Pure-play e-commerce, while it is convenient, is no longer the most cutting-edge way to shop,” said Charles Aaron Lawry, assistant professor of consumer science at Purdue University. “I think, over time, retail’s learning to converge to this middle place.”

COVID helped accelerate this trend, Lawry said, because it forced stores to create new ways for customers to shop. One example of this is curbside pickup of online orders.

“During the pandemic, a lot of shopping ended up moving into the online space, or this in-between, mixed space that we actually refer to as phygital—it’s like a combination of physical and digital retailing,” he said.

After climbing consistently for decades, and then jumping dramatically in the early months of the pandemic, e-commerce as a percentage of total U.S. retail sales has plateaued.

According to the U.S. Census Bureau, in the fourth quarter of 2019—the last full pre-pandemic quarter—e-commerce sales represented 11.2% of all retail sales, up from 9.9% a year earlier. By the second quarter of 2020, that had jumped to 16.5%, as pandemic fears and local restrictions pushed shoppers online to an unprecedented degree.

While e-commerce hasn’t receded to pre-pandemic levels, neither has it grown. Since that all-time high of 16.5%, e-commerce has hovered between 14.5% and 15.1% of total retail sales, breaking the nearly continuous string of quarter-over-quarter increases it had seen from 1999 to 2019.

Other players

Simon is not the first mall operator to launch a mall-wide shopping tool.

The nation’s largest enclosed mall, Mall of America in Bloomington, Minnesota, launched an e-commerce site, Shop MOA, in late 2021.

And a year before that, Dallas-based Centennial Real Estate Management LLC launched its online shopping tool, ShopNow, in October 2020. Centennial operates six mixed-use developments and 32 malls and shopping centers, including Green Tree Mall in Clarksville. The company worked with a third-party vendor, Toronto-based tech firm Adeptmind, to develop ShopNow.

Centennial initially launched ShopNow at seven properties. The tool is now available at 16 Centennial properties, with a 17th expected to come online this month.

At any given ShopNow shopping center, 40% to 60% of retail tenants participate in the platform, said Centennial’s executive vice president of marketing, Colleen Heydon.

The ShopNow tool, Heydon said, turns a mall’s website into “a mini Amazon” where people can browse a number of stores at once.

Centennial’s tool allows shoppers to order from the mall’s retailers online and have the items shipped to their home. But shoppers also use the tool to plan their shopping trips before they head out to the mall, Heydon said. “Initially, there was some concern about whether we were promoting online shopping—and, in fact, it has had the opposite effect.”

Advances in technology are what make a tool like ShopNow possible, Heydon said. “As the retailers get better with their digital back end and point-of-sale technology, it allows us to kind of tap into those advancements so that we can have accurate inventories and product visibility on the website.”

Centennial’s retail tenants don’t have to pay anything to participate in ShopNow—but they do need to have a certain level of sophistication in their point-of-sale systems in order to take advantage of all the tool’s features.

Retailers with the most advanced point-of-sale systems, Heydon said, have the ability to showcase their local inventory items actually in stock at a particular store. Retailers with less advanced systems can showcase their online inventory: items that are available on the retailer’s website and that might or might not be in stock at a particular location. Small, local retailers, whose systems might not allow for either of these capabilities, can choose to participate by manually uploading information to the platform—perhaps a selection of the store’s most popular items.

Simon Search is now available at 187 Simon properties. (IBJ photo/Eric Learned)

The benefits

Search tools such as Simon Search and ShopNow can benefit mall operators and their tenants in several ways.

For one thing, the tools provide another way for retailers and brands to encounter customers.

A shopper who might not visit a retailer’s website might still see that retailer’s merchandise—and decide to buy it—if that retailer participates in a mall-level search tool.

“It’s a different form of communication, and it’s a different form of searching,” said Alexander Goldfarb, a senior research analyst at investment bank Piper Sandler Cos.

The approach is appealing to Macy’s, said P. J. Singh, the retailer’s vice president of stores strategy and product management.

“Simon Search creates another avenue for our existing and potential new customers to find styles at Macy’s while browsing the mall’s catalog of brands,” Singh said in an email.

Goldfarb, who covers the retail industry, said tools like Simon Search also send a signal that a mall operator is invested in its tenants’ success.

That, in turn, can help the mall operator attract tenants. “The retailers love when the landlord invests, because that’s why [the retail tenant is] at the mall.”

Another benefit of mall-wide search tools is the data that they can generate.

“When you do deep dives into the analytics and understand how the shopper is using the tool, what they’re searching for, it allows you to be more strategic, if you will, in your marketing and communications to the customers, because you’re understanding their behavior more and what they’re looking for and how they’re searching for it,” Heydon said.

Centennial does not share its ShopNow data directly with its retail tenants, she said, but the company does use the data to generate actionable insights that it shares with tenants.

Currently, Heydon said, Centennial’s ShopNow platform sees more than 140,000 new users each month, and the platform has seen its month-over-month usage increase consistently since its 2020 launch.

Heydon said she does not view Simon Search as a competitive threat but as a positive development.

“When I saw what Simon was doing in expanding to the outlet centers, I was applauding, because I think this is an industry-wide trend that will help the industry grow. It helps make that brick-and-mortar shopping experience more meaningful to the shopper, and I think every developer, every management company and every retailer wants to do whatever they can to make that shopping experience more relevant and more meaningful.”•

Please enable JavaScript to view this content.