Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Homeowner associations in central Indiana are taking steps to prevent an incursion of rental homes in their neighborhoods, as national investment firms eye the purchase of single-family properties, despite rising prices.

At least 200 area homeowner groups have modified their subdivision covenants in the past five years to limit rentals—a number that is based on the work of just one law firm.

More neighborhoods have likely taken action after years of seeing homes once occupied by their owners gobbled up by large investors who want to add them to a stable of rentals. But experts say that it’s difficult to document just how much buying is being done today by so-called institutional investors.

Experts say the region has seen an influx of cash offers on houses. That can be a sign that an investor is behind the purchase—although it’s also a common tactic for other buyers in a hot real estate market, which has been the case for the past two years.

Shelley Specchio, chief executive officer of MIBOR Realtor Association, said it’s “hard to say” whether recent activity has been driven by house-hoarding investors.

That’s because the only way to track ownership is through often-opaque public records that don’t generally require an owner to declare whether a property is being rented. Also, companies that specialize in rentals often use hard-to-trace limited-liability corporations to make purchases.

“We do know that there are a good number of equity firms, hedge funds and institutional investors. … So we do know that a lot of product is being sold that way,” Specchio said. “But I can’t really [share] any good data on how many of those are coming in. We’re watching it and we’re trying to figure out how to study it going through public records.”

The National Rental Home Council estimated in 2017 that only about 0.2% of the U.S. single-family housing stock is owned by institutional investors.

The middle ground

MIBOR generally supports HOAs that take steps to protect neighborhoods when homeowners see an increase in rental activity, Specchio said. But, she added, neighborhood leaders need to find a balance.

“We see both sides of this argument and we’re trying to weave our way through it just like everybody is,” she said. “How do we protect private property rights and the right to have options and opportunities for homeowners and business owners, versus losing the whole market to these large conglomerates? It’s a really complex question.”

Michaela Downey is a residential broker with Indianapolis firm Plat Collective and treasurer of the Ladywood Estates Homeowners Association. The neighborhood of mid-century homes sits near the intersection of 56th Street and Emerson Avenue, south of Fall Creek.

She said institutional buyers became especially active in neighborhoods in the aftermath of the Great Recession, when the housing market dropped and properties were significantly cheaper. That led to larger numbers of rental homes in neighborhoods that had traditionally been all owner-occupied.

But Downey said even in today’s market, with prices jumping, the practice is still common.

Ladywood Estates implemented a limit on rental properties in 2020, shortly after its concentration of such homes hit 10%, which is where the neighborhood set its limit.

Downey said she is not opposed to having some rental properties in her neighborhood, but thinks the numbers need to be limited.

“I think there’s a place in every community where investors are positive—it depends on who the investor is and how they feel about the community and if they’re doing it for merely economic reasons or if there’s some altruistic reason, as well,” she said. “I don’t think it’s a negative to have investors in a community. I think that it needs to be restricted; it cannot be a higher percent than owner occupied.”

She added that the Federal Housing Authority also has a limit on rental property in neighborhoods where it offers low-downpayment financing.

Tom Murray is an attorney with Eads Murray and Pugh, an Indianapolis firm that exclusively works with homeowner associations and condominium groups. He told IBJ that most of his recent work has been with clients looking for legal routes to prevent high rates of rental homes.

The firm has worked with more than 200 homeowner groups on changes to its covenants, which are rules for use of the property that transfer from one owner to the next—for homes in their respective neighborhoods, which is what Ladywood Estates did.

Homeowners associations generally act after several homes have already been bought by institutional renters in the neighborhood or in nearby subdivisions, leading to concerns among other homeowners about crime and property values, Murray said.

How it works

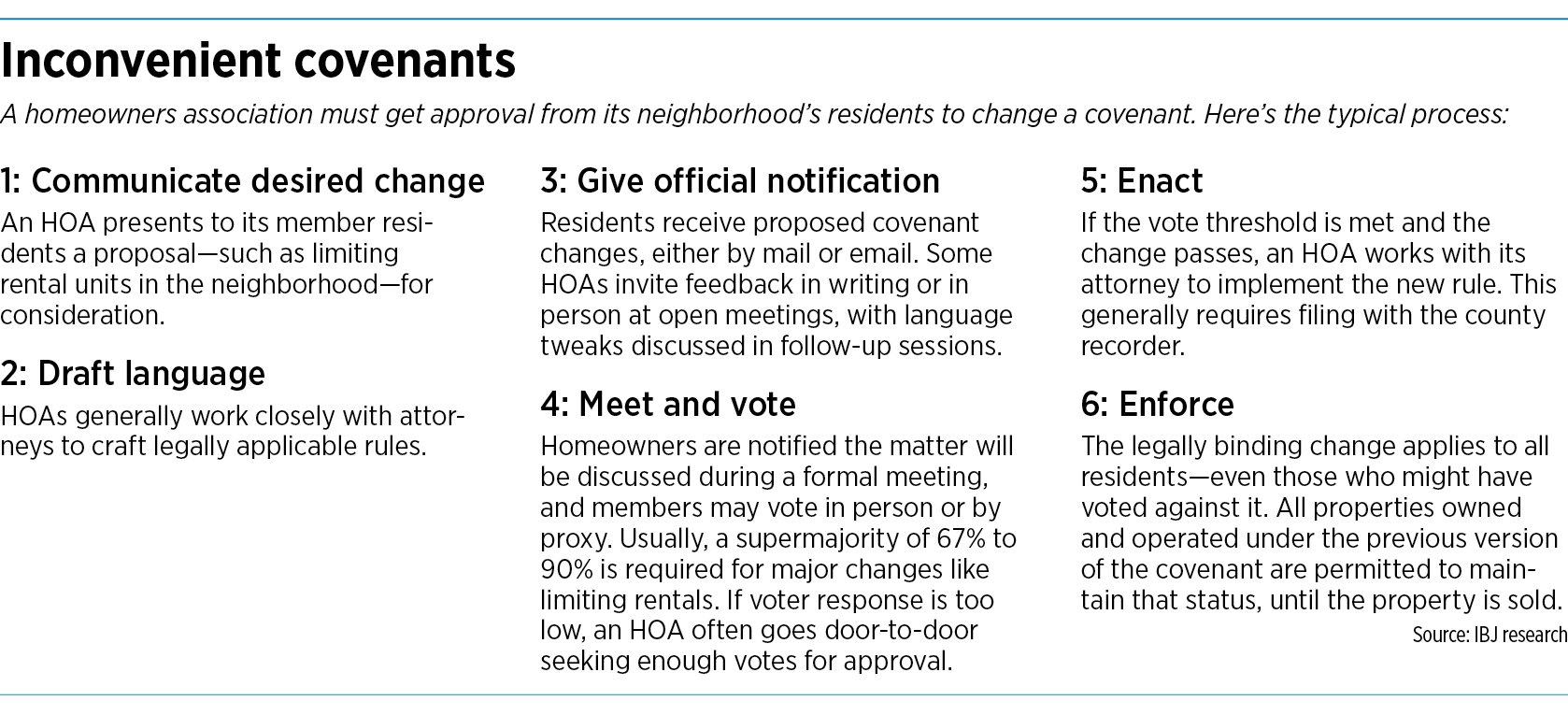

Neighborhood covenants are typically written when a property is developed—and rarely include restrictions on rentals. Those are usually added after a neighborhood starts to see rentals popping up. At that point, changes in the covenants generally require a majority, and in some cases a supermajority, vote among homeowners.

Murray said HOAs generally take one of two routes:

◗ Capping the number of rentals allowed in a neighborhood altogether, either based on a percentage or a fixed number of homes.

◗ Adding an occupancy stipulation that requires property owners to live in their homes for a set number of years before the house can be rented.

Murray said many homeowners—even those who live in the houses they own—have mixed feelings about approving changes to neighborhood covenants, particularly when it comes to rental rules. That’s because they’re often unsure whether they might want to—or need to—rent their own homes someday.

“They don’t want to be too limited, because it could negatively impact them,” Murray said. “Yet at the same time, they will nod their head in agreement that some restrictions are needed, so there aren’t too many rentals in the community.”

Homes that are already rentals are by law grandfathered into the new HOA rules, meaning they can continue operating as such until the home is sold. But experts say most investment firms that buy in a neighborhood maintain those homes indefinitely.

And that ownership gives the institutional owners votes on covenant decisions—one house, one vote, just like those who live in the homes they own.

Downey said it can be a challenge to get the necessary votes for changing covenants, which can sometimes require upward of 90% approval from residents.

“You have to present it to the community as to why you want to have this implemented, and they have to participate—but some people don’t participate in voting in their community at all,” she said. “In many cases, you have to go door-to-door and have conversations with your neighbors to find out how they feel about it” and persuade them to vote a certain way.

MIBOR’s Specchio said HOAs should be transparent as they work to update their covenants.

Would-be buyers should “understand what they can do with a house well before they’ve made that decision to buy in that neighborhood—especially if they think they might want to use it as an investment,” she said.

Responsibilities and ownership

Ross Reller, a broker with the Indianapolis office of commercial real estate firm Bradley Co., is president of the Williston Green Homeowners Association, which represents a subdivision of 85 houses on the north side of Indianapolis.

The neighborhood—which offers residents a heated community pool, a tennis court, a playground and bike path—is considering measures to limit rentals after a few homes were purchased by or through FirstKey Homes, a portfolio company of New York-based investment company Cerberus Capital Management, and other companies.

FirstKey is headquartered in Marietta, Georgia, and operates in 20 U.S. markets, managing some 24,000 single-family homes nationwide.

Marion County records list FirstKey as the owner of more than 200 properties in Indianapolis. But it owns or manages many more throughout the region.

On Tuesday, the FirstKey website listed 119 homes that are currently available for rent across central Indiana, ranging from $1,025 per month for a home at 3605 N. Sadlier Drive to one with rent of $2,795 per month at 5707 West Port Drive in McCordsville.

“We are not against homes ultimately being rented as an alternative to sale—it’s a decent investment and we’re fine with that,” Reller said. “Where some of us take issue is when the rights and privileges of homeownership are being taken from other people by the out-of-town investors who don’t care about the community. And because we’re a small community, the more homes that are acquired with that money and that mentality concerns us.”

Reller said the effort to enact new covenants in the Williston Green neighborhood is specifically intended to curb institutional investments.

But a spokesman for FirstKey said it takes “great pride in having a positive and professional relationship with HOAs to better the community while providing our family of residents with safe, affordable, and high-quality homes they can call their own.”

Still, Reller said rentals bring “a whole different set of circumstances that the subdivision didn’t anticipate when its bylaws were created.”

“But we have a lot of diversity in our neighborhood—we think that’s part of the positive energy of our community,” he said. “So, it’s not at all about trying to keep any group out; it’s more trying to limit the number of homes that can be held by out-of-town and out-of-state investors.”

Patricia Shuhilo, president of The Woods at Grassy Creek Homeowners Association, said her organization is also considering efforts to prevent more rentals from entering the neighborhood on the far east side of Indianapolis, but hasn’t yet made any final decisions.

She said many homeowners in the neighborhood are concerned about the long-term effects rental properties could have on their property values, particularly if those homes are not properly maintained.

There are also concerns about how an HOA can effectively reach property owners or management companies to discuss violations or damage to one of their properties, she said.

“If I felt a comfort level in that it’s very clear as to who owns a property and who I need to contact to have something dealt with … I wouldn’t have as much concern,” she said. “I wouldn’t mind renters or homeowners that rent their properties as long as there was transparency and communication, and that I knew the people there know what their responsibilities are.”•

Please enable JavaScript to view this content.

Median single family home prices in the Indianapolis metropolitan area are increasing at an annualized double digit rate. The effect (besides making current homeowners wealthier) is to price more people out of the detached single family home market thereby increasing one of two populations in the community: (a) renters or (b) the homeless. There is little evidence to support the argument that renters are any less inclined to maintain the residence they occupy than are, for example, homeowners who have very little equity in their home thanks to low down payment purchases financed with VA or FHA loans. Moreover, institutional investors are not well known for allowing their assets to depreciate through lack of maintenance. The concerns of homeowners reflected in the article are understandable, but someone needs to consider the long-term effect of rental restrictions on housing opportunities, particularly for young singles or families who can not scrape together a large down payment on homes that are ineligible for VA or FHA financing. If maintenance of rental homes is the true concern, HOAs could more directly address that issue if they focused on covenant changes that make it easier for them to enforce the maintenance requirements specified in their subdivision covenants. The most persuasive and non-discriminatory argument in support of rental limitations is that by buying homes in a subdivision, a large institutional investor obtains the same HOA voting rights that an occupying homeowner would have. There are a number of issues unrelated to home maintenance that are important to occupying owners that investors could be inclined to oppose if they entailed an increase in HOA dues. This is, however, a problem that could be addressed by amendment of the voting rights provisions of the declaration of covenants and restrictions rather than through a restriction on leasing. There is another issue lurking in the shadows relevant to the institutional investor “problem” and that is the likelihood that government at some level (most likely the federal one) will adopt laws or regulations that not only make rental restrictions unlawful, but also invalidate detached single family residential zoning. Regulations effecting what amounts to the federalization of residential zoning are currently working their way through the rule-making process of the Biden administration. The reporter has done a good job here of identifying some of the critical issues related to the rental restriction issue. There is, however, more to the story.

In clause (b) of the second sentence, I intended “renters” to be those renting apartments in multifamily housing projects which will likely have the effect of driving up apartment rents and/or the development of more such multifamily projects to meet rental demand.

https://www.indy.gov/activity/landlord-registration-program was passed so neighbors always know who to contact for rented properties.

Anyone living in a neighborhood with a lot of rentals ought to be concerned, specifically short term rentals. It’s a major problem here in California that cities are trying to get a grip on. Large parties happen in many of these properties, often resulting in vandalism and violence. It also drives housing costs through the roof because big money investors operate them like a hotel. It may not be a problem in Indiana yet, but it could be soon if Indy keeps growing.

I lived in a building where only long-term (1-year+) rentals were allowed when I signed the lease. They got rid of that requirement 4 months before the end of my lease. The “luxury” high-rise building I moved in turned into a college dorm within a couple months. I was 23 at the time and didn’t really mind, but dealing with drunk people in the elevators when I went to work at 6am was annoying. Thank God I rented, but many people who owned condos could not sell or rent them (long-term) anymore. I think they’re still suing the management company. They were basically forced to move into apartments elsewhere to avoid the problems, and rent out their condo units to Airbnb to make money on their investments.

Once out of state investors start buying properties to rent short-term permanently, your property value is in trouble. People staying for 3 days generally don’t care about how they maintain the property, or respect the neighbors. It’s good that HOA’s are on top of this. Local government’s should follow with regulations before you end up with the disaster many cities in California have.

I don’t think there’s a problem with renting out houses for 1 year or more. Those of us that rent those properties maintain them for the most part. The problem is when you start operating a house or a condo like a hotel. It shouldn’t be banned, but it needs to be heavily regulated to not decrease property values of your neighbor’s property.

All of the comments regarding this issue here are sound. Like all other issues, there are two or more sides to the story. What is needed in addressing these issues is good old-fashioned common sense and a strong concern for protecting the constitutional rights of citizens. One of my main concerns with the HOA’s is their tendency to overreach and micromanage residents and to also charge excessive fees for the limited services they provide. I have many years of experience working in this field. The right of an individual to own private property and to enjoy it is threatened when heavy-handed management results from associations who have an excessive amount of rules for members of the association. It used to be that folks looking to buy a home in central Indiana were often attracted to neighborhoods with strong HOA’s as many felt this would be a good way to protect property values. That did not prove to be all that effective during the great recession and market downturn when nationally and locally there was a large number of vacant homes due to the foreclosure process that was rampant at the time. Nowadays, there is a trend developing that people want a home in an area without HOA’s and that is advertised in the listing information by sellers and their agents to appeal to those who do not want to live with the restrictions that they have witnessed or heard about from others, that they do not agree with. So it has been interesting to see that piece of the issue evolve in a different direction. Some HOA’s do a great job for the communities they manage but many do not and seem to be more interested in lining their pockets from the dues of the residents than actually doing anything of value for the residents. So there is a lot to consider in this issue and one would be wise to do their due diligence in the home search process.

The assumption that the existence of rental properties would result in a decrease in property values is highly flawed and not back by data. I would contend that, over the long term, having such a restriction would actually result in a decrease in property values compared to allowing buy and sell transactions to operate based on normal economic conditions.

If you restrict homes from being rented, that will eliminate investors from the pool of potential buyers on a given property. Therefore, there will be less competition and fewer bidders when a property is offered for sale. These restrictions result in an artificially induced decrease in demand. Basic economics would suggest that a decrease in demand (will all other factors remaining constant) will result in decrease in prices.

In the short term, this will not likely be an issue, given that the current economic conditions consist of demand which is far in excess of supply. However, the long term implications are that prices will be negatively impacted by such restrictions.

Furthermore, the general thought that a rental house would not be as maintained as an owner occupied house is not necessarily true. For a rental house, you have two separate parties who have ability to maintain and/or improve the property. Many renters are very motivated to keep their residences looking nice. The owners are also responsible to keep the houses in proper condition. In many cases, having both an owner and a renter involved in keeping the house in good condition can result in the rental property to be well maintained.

Additionally, each time the rental property is turned over to a new renter, the owners will likely perform certain repairs and maintenance to make the house marketable to a new renter. Often times, this includes things such as repainting of the interior and sometimes replacing carpet, or repairing other mechanically items that do not function properly. How many homeowners are doing a full repaint of their house every 3-5 years or replacing carpet in 5-7 years, etc?

Many neighborhoods that have no known problem of rental properties not being properly maintained, have explored these type of restrictions. Adding such restrictions can ultimately create the opposite result from what the homeowners are attempting to do.

@BradM “Additionally, each time the rental property is turned over to a new renter, the owners will likely perform certain repairs and maintenance to make the house marketable to a new renter. Often times, this includes things such as repainting of the interior and sometimes replacing carpet, or repairing other mechanically items that do not function properly.”

This is a giant leap. “likely”?