Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowYou thought you did everything right before getting that cataract surgery or hip replacement. You checked with your insurer to make sure your surgeon and hospital were in your network.

But did you check to see that the anesthesiologist, radiologist and pathologist were in network? How about the laboratory? Or the rehabilitation care afterward?

If not, chances are you will get a nasty surprise in the mail a few weeks later from one of those out-of-network providers: a bill for thousands of dollars—perhaps even tens of thousands of dollars—for the balance of the bill not covered by your insurance company. Insurers often cover out-of-network providers at lower rates than those in network, and sometimes not at all.

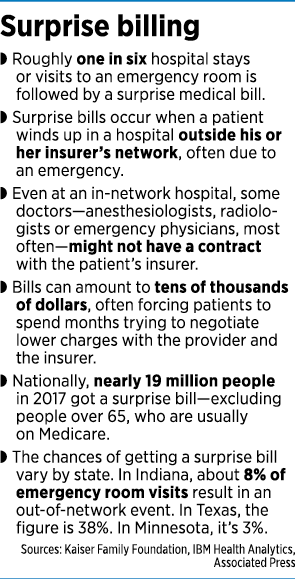

Every day, thousands of Americans get a surprise bill in the mail from a health provider, asking for thousands of dollars for medical services that weren’t covered by the patient’s insurance. Often, that’s because a specialist who works at an in-network hospital is a contractor, not an employee, and outside the patient’s insurance network.

But pressure is building for a federal law that would hold a patient harmless for inadvertently getting the services of an out-of-network provider at an in-network facility. And in Indiana, some lawmakers and patient advocates are pushing for reforms as well.

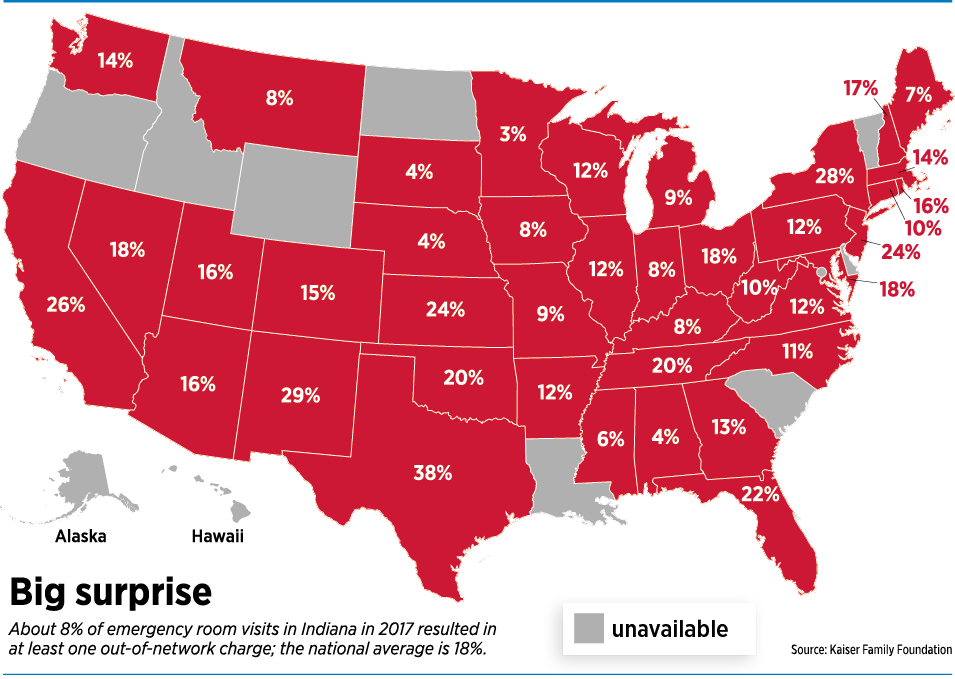

Across the United States, 16% of all in-network hospital admissions result in at least one out-of-network charge, according to the Peterson-Kaiser Health System Tracker. In Indiana, the number is 7%, less than half the national average.

For emergency visits, where the patient often has less choice of hospitals, the figures are even higher. On average, 18% of emergency visits result in at least one out-of-network charge. In Indiana, the figure is 8%.

“But 8% is still a lot,” acknowledged Brian Tabor, president of the Indiana Hospital Association. “It still happens too many times.”

In some states, the figure is much higher. In Texas, for example, 38% of emergency visits result in an out-of-network charge, as do 27% of hospital admissions. Kaiser Family Foundation researchers said the reasons for such wide differences weren’t entirely clear but seem to be related to the breadth of hospital and doctor networks in each state, and the ways in which those networks are designed, the Associated Press reported.

Health care nightmares

In one of the most famous cases, a concert pianist from New York City who needed spinal surgery carefully researched which surgeon to use. The surgeon was listed in the pianist’s insurance plan, and a patient coordinator confirmed the coverage, according to The New York Times. But after the operation in 2012, the insurance company told her the doctor had dropped her plan a few years earlier. She received a bill for $101,000 and her insurance paid only $3,500, leaving her with a surprise balance of $97,000.

The pianist, Claudia Knafo, said she considered bankruptcy and divorce before officials with the New York Attorney General’s Office and the state’s Financial Services Department intervened.

Some health experts say those kinds of stories are not uncommon. Paul Halverson, dean of the Fairbanks School of Public Health at IUPUI, said a friend of his family wound up with an $86,000 bill after surgery, due to an out-of-network surprise.

“And I think that sort of shocks our consciences,” Halverson said at IBJ’s Health Care & Insurance Power Breakfast on Sept. 26. “Something is out of whack and needs to be fixed. I do think we need to provide some fundamental fairness and protection for patients.”

Many patients have no idea of all the back services involved in a procedure, even if their hospital and doctor are in network, said Leesa Ackermann, a patient advocate and registered nurse in Fort Wayne.

“When you go into surgery, you don’t ask, ‘Hey, is the anesthesiologist in my network?’” Ackermann said. “Most people don’t even think about it.”

Legal remedies

Some states offer sweeping protections, including measures that hold patients harmless for surprise bills greater than the patient’s deductibles, co-pays or coinsurance. Others offer a dispute-resolution process.

Some states offer sweeping protections, including measures that hold patients harmless for surprise bills greater than the patient’s deductibles, co-pays or coinsurance. Others offer a dispute-resolution process.

But Indiana offers only the barest of protections. Under a law that took effect in 2018, physicians who refer patients to other providers must provide a notice to the patient stating that an out-of-network provider might be called upon to render services, and those services are not bound by the in-network payment provisions under the patient’s health plan. The notice also must tell the patient he can contact his insurer to obtain a list of in-network providers.

Indianapolis-based Anthem Inc., which has the largest market share among health insurers in Indiana and is one of the largest health insurers nationally, said it supported that law.

“When our consumers go to an in-network hospital, they should not have to worry if the care they are receiving is being performed by a hospital-based physician who is out of network. … This is a step to help them make informed decisions about their care,” Anthem spokesman Tony Felts said in a statement.

He added: “Anthem is constantly working with its in-network hospitals to ensure that all physicians who are performing health care services within those hospitals are in-network providers.”

In June, Anthem cut payments to some California physicians as part of what it called a routine adjustment to fees. California physicians say the move was the result of a 2016 state law that keeps patients from being forced to pay the difference when insurance companies and care providers clash over health costs, Bloomberg reported. Anthem said the reimbursement changes were unrelated to California’s law and that it increased pay for some clinicians.

In June, Anthem cut payments to some California physicians as part of what it called a routine adjustment to fees. California physicians say the move was the result of a 2016 state law that keeps patients from being forced to pay the difference when insurance companies and care providers clash over health costs, Bloomberg reported. Anthem said the reimbursement changes were unrelated to California’s law and that it increased pay for some clinicians.

The Indiana Hospital Association said it favors stronger patient protections, similar to measures recently adopted by New York, Texas and other states, that would hold the patient harmless in such cases, and force the provider and the insurer to agree on a price for the uncovered part of the bill. Tabor, the Indiana Hospital Association’s president, said his members are trying to drum up support in the Indiana General Assembly for such a bill in the next year or two.

“We’ve had numerous conversations,” he said. “We are certainly making it known that we would support such a bill.”

Those discussions included testimony this summer at a legislative study session on how to contain health costs. Also speaking at the session in favor of additional consumer protections over surprise bills were officials with the Employers Forum of Indiana and the Indiana Federation of Ambulatory Surgical Centers.

Play ball

Some groups favor a “baseball-style resolution,” a term borrowed from Major League Baseball’s salary-dispute process, where the player and the team get a chance to name an appropriate salary for the player. An arbitrator picks one of the two numbers without modification, a process that encourages both sides to keep their requests reasonable or risk having the arbitrator pick the other party’s number.

In the case of surprise medical bills in New York and some other states, the arbitrator chooses the number offered either by the provider or the payer, based on a number of factors, including the physician’s level of training and experience, the complexity of the particular case, and usual and customary cost of the service. Arbitrators make their binding determinations within 30 days.

A recent study by Georgetown University of disputed surprise bills in New York found that 618 cases were decided in favor of insurers, and 561 in favor of providers.

“There’s been wide industry support for this model, since it incentivizes the parties to offer reasonable proposals to the arbitrator and it takes the patient out of the middle,” said Lucy Lucido, a health care attorney with Indianapolis-based Hall Render Killian Heath & Lyman, in a September webinar on surprise billing.

Putting a stop to surprise bills has become a priority for the Trump administration, and several bills are making their way through Congress, with bipartisan support, that would offer patient protections.

Insurers and employers favor using an in-network rate as a reference point for how much to pay the out-of-network provider. A bill from Sens. Lamar Alexander, R-Tennessee, and Patty Murray, D-Washington, generally takes that position, requiring insurers to pay out-of-network doctors and hospitals the midpoint rate paid to in-network providers, the AP reported.

But hospitals and doctors want disputed bills to go to arbitration. The Indiana State Medical Association, the state’s largest physician organization, with more than 8,200 members, said it would support federal legislation that includes an independent resolution process for physicians.

The ISMA joined the American Medical Association and more than 100 other U.S. medical organizations in signing a letter in July that requested such a procedure for hashing out disputes. The U.S. House Energy and Commerce Committee has approved a version of the legislation that pegs physicians’ out-of-network reimbursements to local benchmarks, but with a “backstop” arbitration option for amounts of $1,250 or higher if the benchmark resolution isn’t acceptable to both parties in a given case.

Complicating the situation is a highly polarized political landscape in Washington that recently got even hotter as the U.S. House of Representatives kicked off an impeachment inquiry against Trump. That has made it difficult to handicap whether any versions of surprise-billing legislation make it through Congress before the November 2020 election.

“The clock is ticking,” said Andrew Coats, a senior policy adviser for Hall Render, in the webinar to clients and media. “As you know, every day that passes, we get a little closer to the 2020 election.”•

Please enable JavaScript to view this content.

It is hard enough, in some cases, to simply find out if a provider is in network. Directories are not always updated, even online. My wife and I are on different plans, making it more complicated for us. Doctors and staff certainly don’t know; even when you call ahead, you can’t be certain of the answer you receive. My favorite is that every time you go to a provider, they ask for your insurance card, and I am dealing with a situation now where they STILL filed with an insurance provider I had (and they still had on file) from YEARS ago! What was the point of showing my card? The worst part is the provider (the ones who filed with the wrong company-THEIR mistake!) is now threatening to turn the bill over to collection because I refuse to pay it, even after I have given them the correct insurance info. To complicate this matter even further, the provider is my former cardiologist; so I am of the opinion that the bill is not legitimate in the first place! Everyone involved has passed the buck on this; the hospital blames the provider, the provider blames me, my insurance company has never received a claim, and I have yet to receive an itemized bill- just a demand for payment! What a screwed up system!

I forgot to add that the reason I was at the hospital was not related at all to any heart issues; that is why I don’t understand why my former cardiologist would be involved.

I am the President of a large anesthesia practice that provides exclusive services to Indiana University Health. We have a strong partnership with both the insurers and IU Health so that we are in-network with 100% of insurance companies so that, if you come to an IU Health facility in central Indiana, you will never get an out-of-network bill from your anesthesia provider. We know the devastating effects that an unexpectedly large bill will have on a patient whose sole concern should be recovery. I am fully in support of a bill to end surprise bills. However, such a bill without an independent resolution process (IDR) will significantly disadvantage the physician and decrease payments similar to what has happened in California. Without an IDR, the government will set the prices with a median benchmark and this favors insurance companies who can cancel higher paying contracts to artificially reduce the median. This goes very much against the free market system that, while imperfect in healthcare because of a lack of transparency, still has merits to provide a fair and balanced payment for services. So solutions at both the federal and state levels must utilize an independent system rather than arbitrary price setting to provide appropriate payments for services.

The whole concept of “networks” needs to be abolished. This is a scam perpetrated by insurance companies and Medicare to eliminate the options patients have to choose their physicians or hospitals. Think of your auto or homeowner’s insurance policy. If you have an auto accident, you are free to choose any shop to do your repairs including the most expensive option: the dealership (how many times have you heard stories of a minor “fender-bender” becoming 10s of thousands of dollars in repairs?). The auto insurance company is not allowed to tell you which shop to use. There are no “in” or “out” of network repair shops. If you have auto insurance, the company is obligated to pay the bill directly to the shop. Likewise for homeowners insurance. If you have a claim for water damage, snow, fire, etc., you are able to choose any electrician, plumber, framer, roofer, contractor, etc., you believe will do the best job (within your policy limits). The insurance company cannot tell you who to use. However, when it comes to your HEALTH, the insurance company WILL tell you who you can and cannot use for your care. You are not allowed to choose the best neurosurgeon, cardiologist, anesthesiologist, etc. The insurance companies contract with the lowest cost doctor to save the insurance company money and pay outrageous salaries to their CEOs. The American public for years has been so brainwashed into accepting the concept of health insurance “networks” that we no longer even question the concept. The insurance companies are now working tirelessly to convince our legislators of the same thing. The public needs to wake up and battle the “network” issue. If you have health insurance, you should be able to see any doctor or hospital you wish. Eliminate “networks” from health insurance. Your health (and life) are more valuable than car or house.

M.P.- Interesting that you chose to compare auto/homeowners insurance to health insurance. For years, I have wondered how auto insurance would work if it functioned like health insurance. You don’t pay your mechanic; you have him submit a claim. (After a while, you have no idea what basic services cost; you never really see a bill) You do get 4 “free” oil changes each year, a “free” tune-up every year, “free” tires every 2-3 years. Sounds great until you have a major repair; you still pay a $500-$1,000 deductible, and up to 20% of the remainder of the bill, and then your yearly premium could be anywhere from $300 to thousands of dollars, depending on any number of factors, only some of which of which you control. Of course, you still pay these premiums even if your car runs fine, and only needs routine maintenance, which you normally would have paid for anyway.

My point- I would love to have health insurance that only paid for a major medical event (I’ll take care of the routine stuff-flu shots, office visits for minor illnesses, yearly physical, etc) Quit telling me what I have to do, and when I have to do it, and quit giving me “free” stuff…it is costing me too much money!