Subscriber Benefit

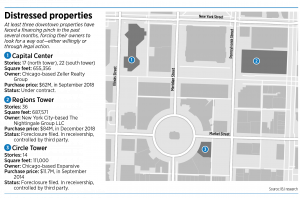

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowForeclosure is looming for a pair of downtown office towers after their owners failed to meet payment deadlines last year, while another property is set to be acquired property for only a fraction of what its owner paid in 2018, after that group encountered similar financial straits.

It’s a challenge hitting urban centers across the United States. Downtown office buildings are seeing their values plummet and vacancy rates climb due to space consolidation and a continued hesitancy toward renewals and new leases following the pandemic.

Experts say that despite favorable lending terms for most properties acquired or refinanced before the pandemic—a time when office buildings were largely viewed as a sound investment by commercial banks—the Indianapolis office market likely has a difficult few years ahead.

That’s because more defaults and a swell of distressed properties—buildings where the owner can’t make payments on time—are predicted for this year and next as debt comes due for more tower owners.

“The owners of these downtown properties are in a very tough predicament because the values have been trending down and are likely to continue declining for office properties in general,” said Andrew Urban, senior vice president of occupier services for the Indianapolis office of Toronto-based commercial brokerage Colliers International.

Last August, Merrillville-based Centier Bank filed a foreclosure lawsuit against Circle Tower owner Expansive alleging the Chicago company defaulted on its payments for the property at 55 Monument Circle earlier in the year.

And in February, Cleveland-based KeyBank sued the owner of Regions Tower, The Nightingale Group LLC, after the New York City company allegedly failed to pay a $75 million balloon payment that came due in October on the building at 211 N. Pennsylvania St.

Capital Center, at 201 and 251 N. Illinois St., managed to elude foreclosure, after its Chicago-based owner, Zeller Realty Group, chose to put the two-building property on the market in December following talks with its lender. Now the buildings are under contract for purchase by a partnership of Indianapolis firms KennMar LLC and The Ghoman Group, according to two sources familiar with the matter who spoke on the condition of anonymity.

While the sources said they could not disclose deal terms until the sale is finalized—likely within a month—both sources told IBJ the property is being purchased for a fraction of the $62 million Zeller paid in 2018. Part of the plan for the property could involve developing a hotel inside one of the towers, the sources said.

While the sources said they could not disclose deal terms until the sale is finalized—likely within a month—both sources told IBJ the property is being purchased for a fraction of the $62 million Zeller paid in 2018. Part of the plan for the property could involve developing a hotel inside one of the towers, the sources said.

Representatives for Zeller and Expansive did not return an email message requesting comment for this story, while Nightingale could not be reached for comment at all due to a faulty contact form on its website. Brent Benge, CEO of KennMar, declined to say whether his company is involved in a purchase of Capital Center.

‘A lot more distressed sales’

Downtown’s office vacancy rate was 23.6% in the first quarter of this year, according to the local office of Chicago-based brokerage Cushman & Wakefield. That’s an increase of nearly 2 percentage points from the previous quarter and 4 percentage points higher than the same period a year ago. It’s also a stark increase from five years ago; the downtown office vacancy rate was 13.4% in the first quarter of 2019.

John Robinson, managing director for the Indianapolis division of Chicago-based JLL, said “capital markets right now are just in utter disarray” for commercial real estate—and office space in particular.

He pointed to Zeller, which spent more than $18 million to revamp Capital Center in recent years, with upgrades to the complex’s conference space, a fully renovated lobby with an expanded bar and coffee area, a new outdoor patio, and improvements to the complex’s fitness center. Zeller also modernized the buildings’ elevators and built out multiple move-in-ready spaces for prospective tenants.

But the company’s loan term is set to expire midyear, and the building is only 61% leased, according to JLL.

A property owner’s ability to pay on a loan is closely tied to the building’s occupancy, Colliers’ Urban said, and IBJ research shows few commercial buildings downtown have vacancies lower than 15%.

Commercial loans usually last five to 20 years and generally involve a balloon payment at the end of the loan, often accounting for 60% to 80% of the loan’s value.

The reduced need for office space since the pandemic has made it more difficult for office-tower owners to pay for their properties and has made refinancing debt a near impossibility. As a result, Urban said, it’s no surprise that downtown has seen two office-tower foreclosures and an increase in distressed properties.

He predicted further challenges for Indianapolis and other markets in the next 12 months.

“All these owners have outstanding balances that they need to either roll forward with new financing or pay back in full,” Urban said. “So, if you can’t get new financing, you have to come up with the cash to pay off that balance, but in many cases, the cash value for what a building would trade at today is below that amount.”

He said some banks have moved to foreclosures as they look for ways to recoup their money quickly after seeing a loan go into default; they are less inclined than in the past to work with companies by delaying repayment or refinancing loans.

Other banks, Urban said, are working closely with building owners to determine whether a better option would be a short sale, through which a lender accepts a payoff amount lower than what’s owed to get the property off its books.

In either scenario, he said, banks are getting back just a fraction of the original loan’s value.

“I anticipate through 2024 and into 2025, across [central Indiana], we’re going to see a lot more distressed sales,” Urban said. “The sheer number of them is going to create something of a storm, but it happens in slow motion. … It’s kind of one building at a time, and then it starts to snowball and compound—that’s the reality of it.”

Robinson said lenders generally value office space at 30% to 50% lower than it was pre-pandemic.

“All these lenders want these commercial loans off their books at all costs,” Robinson said. “But then you have the headwinds of increased vacancy and lower demand creating this self-perpetuating storm that just keeps eating itself, and that’s where we are.”

What comes next

Carmel-based REI Real Estate Services has owned the 27-story office tower at 300 North Meridian St. for more than 30 years. Company CEO Mike Wells said that, of all the company’s office holdings, that property is “of most concern.” Still, he doesn’t have qualms about REI’s ability to withstand the challenges facing office space downtown over the coming years.

REI secured multiple long-term leases for the property in recent years, along with a long-term refinance in 2021 as part of renovations that were completed in the wake of the pandemic. Wells said he expects the building to be financially stable for years.

“We don’t see ourselves in [a bad] position,” he said. “Are we concerned? Yeah, I think anybody that owns office today in the United States needs to be concerned. But we’re not overly concerned because of our position. You’ve basically got OneAmerica Tower, 300 North Meridian and Salesforce tower as the three preeminent buildings downtown, in my mind.

“I think all three of those will weather the storm a lot better than the rest of the properties,” Wells said.

Benge, the leader of KennMar, said the Indianapolis office market “certainly isn’t alone” in its struggles.

In St. Louis, a vacant 44-story office tower that sold for $205 million in 2016 was purchased for just $3.5 million on an auction exchange this month. Benge said while St. Louis is a cautionary tale, he doesn’t expect a similar fate for any of Indianapolis’ properties because downtown here is overall in healthier than downtowns in many U.S. cities, in terms of both activity and city leadership.

“The great thing about downtown Indianapolis is, we’ve got great leadership, and there are great corporate leaders that have sustained the momentum of the area,” he said, nodding to the convention and sports industries, as well as efforts to revamp properties like the Diamond Chain manufacturing site and Circle Centre Mall.

“It’s a collection of great leaders coming together to figure out, ‘How do we make this work?’ And I don’t know that you see that in a whole lot of other cities.”

JLL’s Robinson agreed.

“The St. Louis office market and downtown [are] catastrophic,” he said. “Indianapolis fundamentally has a great downtown … that is surviving as well as any in the country, and it’s going to excel in the future.”

Robinson said the increase in downtown residents in the mid-2010s created a solid built-in population to supplement a drop in office workers as the city came out of the pandemic. More than 29,000 people live downtown, according to Downtown Indy Inc., a 46% increase since 2010.

Last September, Robinson told IBJ he expected at least three of downtown’s 10 largest office towers to experience foreclosure or take big losses in a sale over the next few years. So far, two—Regions Tower and Capital Center—are on that track.

But Robinson said he is hopeful that Wisconsin-based Hendricks Commercial Properties’ announcement in December that it plans to spend $600 million to reimagine Circle Centre Mall will help stop the downtown office market hemorrhaging.

“The Circle Centre Mall renovation will be, if not the main thing, one of the drivers that [gets] things coming back, from an office-market perspective,” he said. “I do think it’s going to be somewhat tied to the success and breadth of what Hendricks is going to do at the mall—that’s going to liven up and reenergize the downtown office market. So, the sooner those plans are out and that’s underway, the better.”•

Please enable JavaScript to view this content.

Prediction: 20 years before downtown(s) return to pre-Covid status. More focus should be on residential and mixed/uses in downtown areas. The office-centric CBD is and should be be a thing of the past. Whereas downtowns may continue to have a significant office share, the decentralization of offices and office nodes has been well established. Commuting, roadways, and transit needs to be defined accordingly. Perhaps replace the urban intra-I-465 segment of I-65, in particular, with boulevards, parkways, and housing. And implement a planted median along the entirety of that hideous West Street between I-7- and 11th Street.

As much as I wish that Indianapolis would have worked with INDOT to tear out the downtown interstates, let’s be realistic. The Aaron Freeman’s of the world would have never allowed it to happen, regardless of how much sense it might make or regardless of how well it’s worked throughout the country.

As much as a tough situation that this is for the CBD, Carmel in particular, has invested heavily in many suburban office buildings. From what I understand that infrastructure is even more at risk as they are not particularly well suited for conversion to apartments due to the type of construction. I know of at least 4 large scale leases in these suburban office parks that were vacated recently in Carmel alone in favor of office consolidation or work from home.

Carmel undoubtedly has a lot of redevelopment work ahead on its older suburban office parks – although it presently has the lowest vacancy rate of the major submarkets. However, Carmel’s office parks can be retrofitted by infilling the parking lots, which will potentially happen with Parkwood (look up the articles on it). Also, simply scraping a suburban office development and starting over is feasible.

I’m not so sure the two are particularly linked. I’m not even convinced the added residential units will be sufficient to support the new commercial space and the vacant store fronts.

“Downtown office properties are facing tough financial years” City Council: “Let’s impose another tax on Mile Square businesses to (Try to) solve a nationwide issue”