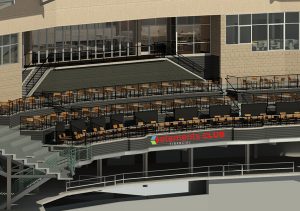

Indians announce naming-rights partner for new club space

The 4,500-square-foot club, to be constructed between the 2019 and 2020 seasons as part of $8.3 million in Victory Field improvements, will be sponsored by Indianapolis-based Elements Financial Federal Credit Union.