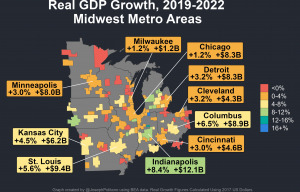

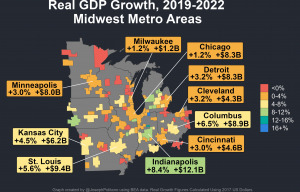

Report: Indianapolis tops Midwestern cities in three-year GDP growth

Indianapolis surpassed its Midwestern peers in gross domestic product growth from 2019 to 2022, according to a report from a Washington, D.C.-based economist.

Indianapolis surpassed its Midwestern peers in gross domestic product growth from 2019 to 2022, according to a report from a Washington, D.C.-based economist.

Respondents to the survey identified persistent inflation, high interest rates, and a continued shortage of workers among the key challenges for the manufacturing industry.

The big concern: whether shoppers will pull back sharply after they get their bills in January.

Inflation is steadily moving down to the Fed’s year-over-year target of 2% and appears to be clearing the way for Fed rate cuts in 2024. That, in turn, could translate into lower rates on everything from mortgages to credit cards.

Americans’ expectations of a recession in the next 12 months have declined to the lowest level so far this year.

The economy keeps growing, defying widespread fears from a year ago that 2023 would bring a recession, a consequence of the much higher borrowing rates the Fed engineered.

The strong retail numbers Thursday were particularly surprising given some of the news coming from major retailers themselves, who say shoppers are being more selective.

The markets have been on a celebratory tear in recent weeks, as signs pile up that the Federal Reserve may be done raising interest rates.

The Fed’s quarterly economic projections showed that its officials envision a “soft landing” for the economy, in which inflation would continue its decline toward the central bank’s 2% target without causing a steep downturn.

Wednesday’s report reinforced the belief that inflation pressures are cooling across the economy.

A new report from the Indiana Chamber of Commerce says Indiana is making good progress toward its economic goals, but that progress isn’t coming fast enough to compete with other states.

When its latest policy meeting ends Wednesday, the Federal Reserve is likely to provide some highly anticipated hints about the extent of rate cuts next year.

The latest data on consumer inflation showed that prices in some areas—services such as rents, restaurants and auto insurance—continued to rise uncomfortably fast.

Tuesday’s inflation report from the Labor Department is expected to show that businesses kept overall prices unchanged for a second straight month. But a closely watched category called “core prices” is predicted to outpace the Federal Reserve’s 2% annual target.

The November jobs report from the Labor Department is expected to show that employers added a still-solid 172,500 jobs last month, according to a survey of economists by FactSet.

The heads of the nation’s biggest banks told Congress there are reasons to be concerned about the health of U.S. consumers—particularly poor and low-income borrowers.

The unemployment rate has come in below 4% for 21 straight months, the longest such streak since the 1960s.

Only 24% of economists surveyed by the National Association for Business Economics said they see a recession in 2024 as more likely than not.

The figures are consistent with expectations that the economy will moderate in the fourth quarter following the strongest growth pace in nearly two years.

Even with the downward revision, consumer spending remained robust, underpinned by a resilient jobs market and a flurry of travel and events.