DeLaney calls for property tax reform in wake of increases

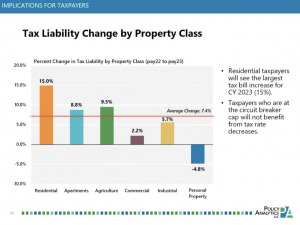

Many Hoosier homeowners have already received their latest property tax bill—or will in the coming days–and discovered the jump, which ranges from zero change in one county to more than 20% in four counties around the state.