Silicon Valley Bank seized by FDIC as depositors pull cash

The bank failed after depositors—mostly technology workers and venture capital-backed companies—began withdrawing their money and created a run on the bank.

The bank failed after depositors—mostly technology workers and venture capital-backed companies—began withdrawing their money and created a run on the bank.

The IU Founders & Funders Network Venture Summit is scheduled May 18-19 at the Indiana Memorial Union. Only 185 tickets will be allocated for the event.

In this week’s edition of the IBJ Podcast, Brown discusses the unusual route that led her to become a first-time entrepreneur in her early 40s.

Local sources see the current slump in venture investing as a correction following a period of overheated activity.

The amount raised last year is roughly 43% larger than the previous record of $433 million, set in 2021, according to BioCrossroads, an Indianapolis-based group that promotes and invests in the state’s life-sciences sector and tracks the funding.

All of the money in the fund came from investments rather than donations, meaning those involved expect a return on their input.

Chelsea Marburger most recently served as senior manager of entrepreneurial programming at venture capital firm Elevate Ventures.

Authenticx offers business communications software that allows health insurers and health care systems to analyze millions of client interactions such as phone calls and emails, helping customers improve their interactions with patients.

The latest investment is the fourth major round of funding for Zylo, which was founded in 2016 and has raised more than $66.5 million to date. The company helps customers manage their software-as-a-service subscriptions.

To date HG Ventures has invested nearly $200 million in a total of 30 companies, eight of which had been participants in The Heritage Group Accelerator.

The Ohio-based venture firm, which gets its funding from Indiana and Ohio companies, invests in tech startups developing products that can benefit those Midwestern investors.

Established in 2017, Woven Brands had been self-funded until now. The company’s software platform helps franchisee operators and multi-unit independent operators more easily manage their staff and operations.

Docket, which launched in 2019, wrapped up its operations in September after the meetings-platform company Zoom hired its team. In 2020, Docket had won Zoom’s annual “Whale Watch” competition, scoring a $1.25 million venture investment as a result.

Structural, which offers an employee-engagement software platform, was launched in 2017 by Indianapolis-based venture studio High Alpha.

Humankind is a software-as-a-service company whose platform allows retailers to make personal connections with online shoppers. Indianapolis-based venture studio launched the company last fall, and it now has 16 employees.

Carmel-based Hageman Group, Indianapolis-based Allos Ventures and Indianapolis-based Elevate Ventures Inc. all participated in the funding round.

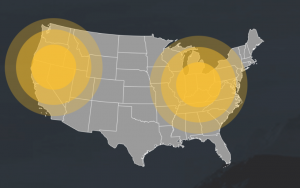

Indiana’s entrepreneurial community has high hopes that the new service will help attract more out-of-state investment in Hoosier startups.

Taranis, which was founded in Israel in 2015 and moved its headquarters to Westfield in 2020, offers a software platform farmers can use to monitor and manage their crops.

The spinoff, Empower Delivery, is targeting independent restaurant chains that have between five and 50 locations in a market but haven’t yet gotten into delivery in a big way.

Indianapolis-based tech startup MetaCX, a High Alpha portfolio company, has attracted more than $30 million in investment since the company’s launch in 2018.