Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe Indianapolis City-County Council plans to re-introduce a proposal to create a downtown tax district next week, it announced Tuesday, with changes to conform to tweaks made to the framework legislation at the state level.

Funds raised from the tax district, called the downtown economic enhancement district, would pay for cleaning and beautification efforts, public safety initiatives, homeless outreach and costs associated with a planned low-barrier shelter on the southeast side of downtown. Republican state lawmakers codified limits and restrictions for the district earlier this year, resulting in the need to tweak the tax district first approved by the Democrat-led Indianapolis City-County Council in December.

Key changes involve the number and type of property owners that pay into the district, its boundaries, and the planned use of the funds.

Who will pay for the district?

The largest change from the state Legislature was the exemption of apartments and single-family homes from the pool of taxable properties.

Under an initial budget for the district framework approved late last year, apartment owners would have paid $1.87 million of the $5.5 million leaders wanted the district to generate annually. The Indiana Apartment Association, which represents 280,000 rental units throughout the state, including 5,000 in the Mile Square, opposed and lobbied against that initial plan, leading to the legislative change.

Under the old plan, single-family homeowners who would have paid a flat fee of $250. Under the new framework, those parties would be exempt.

State lawmakers also codified the $5.5 million budget presented last year as the maximum amount the district could raise.

Leaders from the Indy Chamber and Downtown Indy Inc. told IBJ in May that they had to create a new financing model that maintains the services but doesn’t overburden remaining mandatory payers.

The formula maintains one element of the fee structure passed in 2023, capping the fee for non-residential property at .168% of its assessed value.

What areas are included?

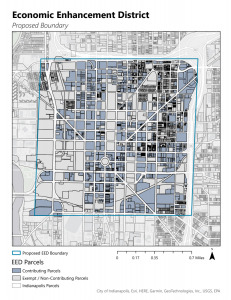

Changes to the state law removed the Mile Square boundary requirement but requires any newly drawn district to remain an equal square on all sides.

In the newly drawn map, Interstate 65 serves as both the northern and eastern boundary. South Street serves as the southern boundary. Blackford Street is the primary western boundary.

State lawmakers also added a provision that the district cannot exceed two square miles.

What can funds be used for?

According to a release from Downtown Indy Inc., the Indy Chamber and the Indianapolis City-County Council, the following are proposed projects that the district could fund:

- Seven-day-a-week cleaning crews to perform tasks such as power washing, graffiti removal, litter abatement, etc.

- Beautification initiatives including plantings, painting, and mulching

- Off-duty foot and bike patrols to supplement police presence and provide direct outreach resources to property owners

- Safety ambassadors for additional street-level presence

- Homeless Street Outreach team members, dedicated to connecting individuals to services, addressing issues, and coordinating with public safety agencies

- Investments in downtown crime-fighting public safety technology

- Last dollar in funding for a low-barrier shelter.

State law removed “activating and promoting public events,” “creating innovative approaches to attracting new businesses,” and “planning improvement activities” from the list of permitted uses of downtown tax district dollars.

A nine-member board would make decisions about the budget at public meetings. State lawmakers added a provision giving the governor an additional appointee to that board, making it a 5-4 state-local board. The framework requires that six members vote in favor of a proposal for any action.

What are the next steps?

The proposal will be introduced at the July 8 full council meeting, which will be held at the City County Building Public Access Room at 7 p.m. These introductions are typically brief. The council will refer the proposal to the Metropolitan and Economic Development Committee, which will hold a public hearing on July 15 at 5:30 p.m. in the Public Assembly Room.

The Republican-led state Legislature also mandated that the city give a notice to affected property owners within 60 days of a public meeting. Because of that requirement, property owners within the boundaries will receive that notice in the mail.

If the city’s legislative body approves the new framework, eligible property owners would see the fee on property tax bills beginning April 2025.

IBJ reporter Mickey Shuey contributed to this report.

Please enable JavaScript to view this content.

I’m frustrated by the IGA’s insistence of participating in something that they otherwise have no business with, but that’s just how the Indiana GOP works. It’s pay to play, either through money or power. In any case, I won’t let the perfect be the enemy of the good, we can work to make legislative adjustments later. This is long overdue.

Only the state legislature can make and impose taxes. Pretty simple!

and how many properties do you own in this new taxing district? I’m betting none.

Kevin – Well, no. Indiana is technically a home rule state (though we operate more like a Dillon’s Rule state). Indiana localities can pass local option tax legislation as outlined by the State legislature, which makes the tax imposed by the locality but authorized by the State.

Can we remove the permanent downtown TIF?

Running an interference! Damn weirdos at the State level! They need to hurry up and,,drop off!! Embarrassing the state while smoking crack and taking bribes behind closed doors, allegedly.

“Hurry up and,,,drop off”? What’s wrong with you, Micah?