Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

With at least $9.5 billion in development projects in the downtown pipeline over the next decade, construction industry leaders are under pressure to find enough qualified workers to ensure the work gets off the ground.

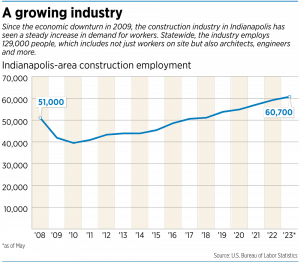

The central Indiana construction labor pool has swelled 48% since the recession in 2009, to more than 61,000 workers. But construction firms and labor leaders told IBJ the industry, which has struggled to find and retain qualified workers post-pandemic, faces continued challenges to replace and grow an aging workforce—and that’s sure to be exacerbated by the activity glut in Indianapolis and elsewhere in the state.

“There is no question about it: It’s a challenge,” John Thompson, an Indianapolis entrepreneur who owns four construction-related companies, said of labor shortages. “We’ll see how it resolves itself in time, but I’m not going to sugarcoat it. This is definitely a problem.”

Thompson’s companies consist of Thompson Distribution, First Electric Supply, CMID Engineering and Beyond Countertops and are among hundreds of firms that work in commercial construction across the state.

Nearly two dozen projects that cost at least $100 million or more each are planned for downtown in the next five years, according to IBJ research. They include developments now under construction—including the new Indiana University Health hospital, Elanco Animal Health Inc. headquarters on the western bank of the White River and the Bottleworks District—along with a planned Signia by Hilton hotel, an Indiana Convention Center expansion and the Eleven Park development on the former Diamond Chain manufacturing site.

to 16th Street and from Capitol Avenue west to Interstate 65. (IBJ photo/Eric Learned)

But the slate of work doesn’t consist only of high-profile developments. Numerous smaller-scale projects, from infrastructure and roadwork to building renovations, also dot the city’s core—each of them sure to account for what trade groups consider precious human and material resources in a strained building environment.

Then there are the countless projects elsewhere in the city and those dotted across the state, including major economic development deals in Boone County, Kokomo and New Carlisle tied to investments in emerging sectors like advanced manufacturing and electric vehicle batteries. The state is also in the running for a semiconductor facility that could mean more than $50 billion in investment, as part of the LEAP Innovation District in Lebanon.

Across the state, the Indiana Economic Development Corp. is tracking $100 billion in potential capital investment from deals still in the works. And that doesn’t count the $5.2 billion the Indiana Department of Transportation expects to spend on the state’s highways in the next two fiscal years.

Bursting with activity

Sean Maloy is a director of project management with the Indianapolis office of Toronto-based brokerage Colliers International, where he monitors the state’s construction pipeline. He said Indiana’s ongoing slate of work—and what’s coming down the pike—is outpacing what’s happening in other markets and could mean Indiana will have to start pulling from outside the area to find workers.

“The concern is definitely in the manpower we’ve got here. It’s a good labor pool here, but with so much activity, it’s causing some of these projects to stress,” he said. “We’re going to continue to see some of these labor challenges as we continue to grow our pipeline.”

He said strong activity in nearby markets like Chicago, Cincinnati, Columbus, Louisville and St. Louis further strains the construction ecosystem.

When companies pull from other markets to stay on top of a job, Maloy added, “somebody’s going to have to pay for that—the travel, the time and the labor.”

One of the biggest projects underway in Ohio is the $20 billion semiconductor facility for Intel, which is expected to employ 7,000 construction workers by the time it is completed east of Columbus in 2025. Multiple semiconductor and battery projects in Michigan and Kentucky are also pulling workers from across the Midwest.

“I don’t know where the bubble bursts, but I could see sustainability maybe being an issue, especially if Indianapolis kind of keeps at this pace, along with the surrounding markets,” Maloy said.

Staggered staffing

Jason Smith, president of the Indiana State Building & Construction Trades Council, which represents unionized trade groups, said this isn’t the first major construction boom for downtown Indianapolis but the city has “not seen anything of this magnitude” in his memory.

Even so, he isn’t quite ready to sound the alarm bells, nor would he declare that the many developments in the works will cause a worker shortage. Rather, Smith said, construction firms will have to be more creative about how they deal with the strain of increased demand and continue to build up their own employment base.

“It all depends on how exactly those pro-jects hit the schedule,” Smith said. “We’ve definitely been informed of the possibilities of the work that’s coming—as well as some stuff that’s already here. But we think we’ll be able to meet the demands.”

Construction sites are also not always heavily populated, because not all work can be done concurrently.

For example, engineers work a site early, along with concrete pourers and other firms focused on getting foundations set. After that, trades focused on vertical construction come in, followed by workers focused on piping, ductwork, electrical and plumbing that outfit buildings with their internal workings. Then there are finishing trades like painters and insulators.

“Things are going to hit at different times, depending on the trade,” Smith said, adding that the staggered work allows for more jobs to be completed in a given time window.

F.A. Wilhelm Construction is among the largest firms in Indiana. It employs 3,000 workers directly, while also working with numerous subcontractors on projects for needs in certain trades.

Company President Phil Kenney said he believes the Indiana construction workforce is “stretched” but added he remains bullish on the industry’s ability to complete the numerous projects in the pipeline.

“I’m confident that there will be enough people,” he said. “For anybody that wants to work in the industry, there’s a job available. And we’re not seeing the shortages that people elsewhere have been talking about … because we’ve been able to plan ahead for this next wave of construction.”

‘Taking a little longer’

Shiel Sexton Co. President Kevin Hunt said his company doesn’t anticipate delays due to labor shortages—but attributed that mostly to the approach his and other firms are taking now in committing to projects.

As a construction management firm, locally based Shiel Sexton typically oversees projects, hiring subcontractors from across the city. It’s involved in numerous projects, including the Community Justice Campus and the renovation of Gainbridge Fieldhouse, now in its final stages.

“The schedules that we and others are giving our clients, are fair, reasonable and achievable,” Hunt said. “But the ones we were giving our clients three or four years ago were far more aggressive … . Things are taking a little longer to get built these days.”

He said by giving longer lead times, Shiel Sexton and others are creating windows for themselves to ensure projects are still completed on time.

That’s not to say Hunt and others aren’t concerned about the future of the construction workforce.

According to the Indiana Construction Roundtable, a trade group for Indiana’s construction contractors, the average age of construction workers is about 55. As those workers retire, they will be difficult to replace because interest in the industry among young people is low and their numbers aren’t as vast as the baby boom generation.

“The reality is, there’s not the number of qualified candidates coming to our industry that there once was,” said Chris Price, president of the Indiana Construction Roundtable. “Where we are now is that far fewer people have the confidence and skills to jump onto a job site and really know what they’re doing and be effective on day one.”

He said the industry is trying to make construction work more appealing to younger generations by creating more mentorship opportunities, improving worksite culture and increasing pay. Trade groups are also looking to take a more active role in cultivating potential workers from schools and vocational institutions and creating more mentorship paths.

“We can’t lose sight of the workforce-development efforts that are happening, as I do think Indiana has been a leader in that regard,” he said. “There wasn’t a lot of good that came out of COVID, but one of the good things that did come from it was an abundance of federal funding focused on workforce development. A lot of that funding has run its course, so looking forward we need to make sure we’re meeting and filling the demand for workers as it continues to grow.”

According to Smith with the trades council, Indiana’s subcontractors spend $55 million annually on apprenticeships—high-intensity, paid programs designed to help future workers learn their craft and receive accreditation in their field. But just getting people in the door can be a challenge, he acknowledged.

“I believe that if you want to be a construction worker in a union industry … the opportunity is going to be there—it just depends on what trade fits you,” he said. “It’s basically all hands on deck, trying to figure out exactly where the manpower is going to come from [in] the next level of recruiting.”

Thompson, the entrepreneur, said there’s much more being done now to find workers than in years past.

“There’s more communication, to let people know that these jobs exist, and people don’t get laid off in these industries like they would years ago,” he said. “Facilities and job sites are cleaner and more organized than they were, too. But I don’t want to be misleading. There are still some challenges finding skilled workers, even though we’ve found enough so far. But who knows how long that will last?”•

Please enable JavaScript to view this content.

Plenty of manpower at the border in Texas. Perhaps conscientious interviewing can determine those who most appropriately might fill positions in construction and at IndyGo.

Questions: speak English, HS or higher education, past related experience? Apparently, too few exist in IN to fulfill the need, so a broader search may be necessary. Perhaps seek workers from US areas without significant employment opportunities — WV, MS, LA?

IN and Indy offer affordable housing, lower cost of living, water, and reasonable weather. Schools, safety, infrastructure and state governance are poor . . . but the perfect location does not exist.

IN had a major shortage of affordable housing.

Derek C.

+ 1

I’ve thought for sometime that we should set up outreach programs in Houston,

Dallas, Phoenix, and other cities in the deep South and Southwest for the

labor that we need.

Plenty of selling points for the Indianapolis area. Plenty of jobs

and

We are NOT Chicago cold in the winter and NOT Phoenix hot in the summer.

Build more workforce housing.

Indiana has to be proactive and not reactive to a situation that could get out of had if it’s not properly addressed now. As many of you have stated, there’s plenty of labor force to pull from in states like Tx, Phoenix, Arizona, Florida and even as far as Colorado or California. Indiana definitely has the money to build housing for these workers no matter if it’s for temporary or long term stay, the workforce is out there if the state really wants it. With all the private and government projects in the pipeline in Indy and surrounding suburbs, it’s just a matter of when and not if the state will be dangerously short on skilled labor in the construction field. I really hate that law makers wait until it’s at a critical point before the react to things they should be making plans for right now.

Kevin P.

+1

Agreed that our state lawmakers tend to be reactive and NOT proactive.

It’s like they are stuck in the past inside. Stuck in a box.

We need some new young blood running in our institutions that can see things

with foresight. Where we have been bringing in younger blood, they have been

seeing some success.

In Elkhart when the RV Industry needed workers badly. Local corporations and

the city partnered to recruit throughout the nation. They also partnered on

rentals and affordable housing.

Anybody who says construction schedules haven’t been impacted by the labor shortage are turning away from the problem.