Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowProperty owners could get temporary tax relief under a top Indiana lawmaker’s bill that seeks to stymie the impacts of high assessments last spring.

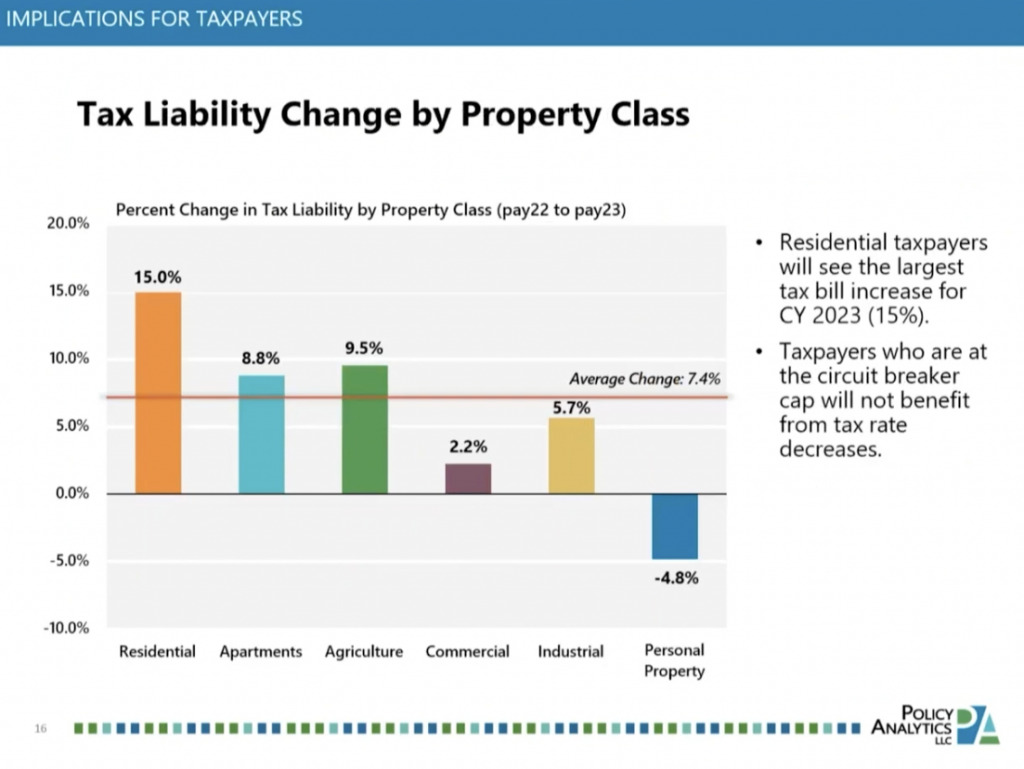

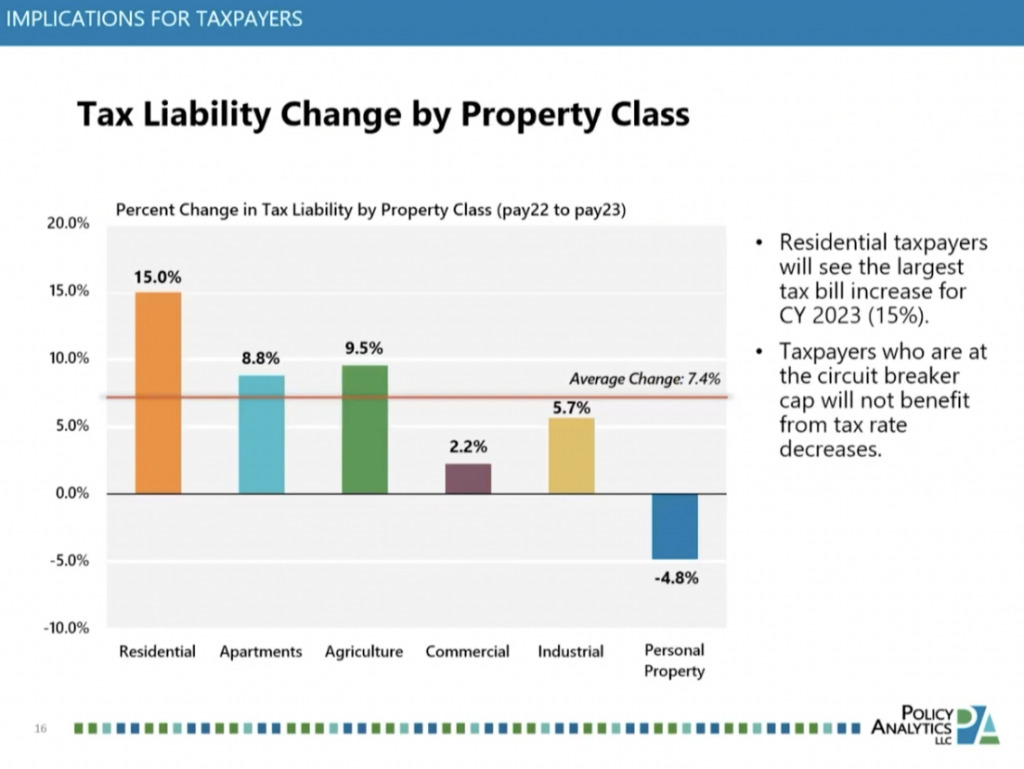

A new study projects homeowners’ bills payable this year could increase as much as 15%. That’s more than double what previous reports estimated for the upcoming bills.

Rep. Jeff Thompson, R-Lizton, filed legislation that would temporarily provide a supplemental homestead credit and lower the 1% cap on residential property taxes. He chairs the House Ways and Means Committee, meaning the bill could get more traction.

Multiple other property tax measures are also floating around the General Assembly.

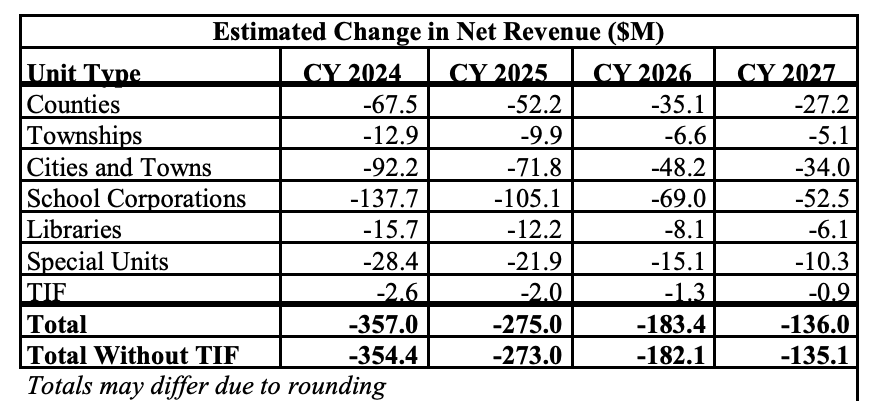

While it could mean relief for property owners, schools are expected to take on the brunt of the tax burden if Thompson’s policy change takes effect.

Between 2024 and 2027 — during which property owners would pay reduced taxes — school corporations are estimated to lose more than $364 million in revenue.

That’s significantly more than cities, towns, counties and other units that are also expected to see decreased revenues.

“We’ll look at all that, because some will shift, and some will decrease,” Thompson said about tax burden responsibility. “We’ve got both options, maybe a marriage of both. I don’t know, we’ll see.”

Taxpayer savings in Thompson’s bill

Thompson’s legislation would temporarily reduce the homestead tax cap for taxes payable in 2024 and gradually increase the cap back to 1% in 2028.

Caps would be set at 0.9% for property taxes payable in 2024, 0.925% in 2025, 0.95% in 2026 and 0.975% in 2027.

The bill also creates a supplemental homestead credit to be applied to tax bills after all other credits are applied. The added credit for each homestead would be equal to $100 in 2024, $75 in 2025, $50 in 2026, and $25 in 2027. The credit is not allowed to exceed what a taxpayer owes, however.

The Indiana Constitution states that property tax liability “may not exceed” the 1-2-3% caps, giving lawmakers an ability to establish the lower caps.

The reduced property tax bills for homeowners is estimated to result in $357 million in tax relief in 2024, according to Indiana’s Legislative Services Agency. The tax savings for homesteads is then estimated to drop to $275 million in 2025, $183.4 million in 2026, and $136 million in 2027.

Taxable assessed values shot up 15% from 2021 to 2022 — even after tax abatements, deductions and credits — according to data from the Association of Indiana Counties (AIC). That’s compared to a 5% increase the year before, and increases under 5% in each year since at least 2014.

A new study from the not-for-profit organization paints a daunting picture for taxpayers, though.

Although the average tax increase for all property owners is expected to go up by 7.4%, on average, residential property owners specifically are estimated to see a 15% increase in tax liability, according to an AIC study conducted with Indianapolis-based economic research firm Policy Analytics.

Increases will mostly be dependent on what type of property a taxpayer owns and whether they’re already at the circuit breaker cap.

Homeowners are projected to see the largest increases due to 2022’s higher assessments, and because net assessed values rise faster than gross assessed values according to the study. The fixed standard homestead deduction is what largely contributes to the inflated bills for residential property, but not to other property types.

AIC Executive Director David Bottorff said the group advocates for new policy that would affect taxes in 2024, but not anything that would be retroactive for 2023 property owner bills due in March.

David Ober, vice president of taxation and public finance for the Indiana Chamber of Commerce, said that while much of the conversation at the Statehouse is currently focused on residential property bills, caps for those taxpayers would have “far reaching implications” for business entities.

“It remains to be seen what may happen, but shifting the cost of local government to (businesses) is something that we’re very much concerned about,” he said.

Commercial property taxes are estimated to increase by 2.2% in 2023, and industrial property tax are expected to go up 5.7%, according to the AIC study. Businesses with large amounts of equipment are likely to see the smallest tax liability increases, however.

Where lawmakers stand

A range of other bills filed by lawmakers include those that seek to eliminate or limit annual market-based adjustments, freeze property taxes for certain homeowners and allow local governments to recover lost revenue.

It’s not clear where lawmakers stand on particular bills, or whether there’s enough support to take any action at all on property taxes in the current legislative session.

House Speaker Todd Huston, R-Fishers, said there’s still “a lot of uncertainty around property taxes right now” and emphasized that “our constituents are very concerned about what their property tax bills are going to look like.”

Huston did not comment specifically on the proposal to cap property taxes, and the GOP majority in the Senate isn’t so sure about taking any action to address property taxes during this session.

Republican Senate Pro Tem Rodric Bray said if Thompson’s bill advances to the Senate “then we’ll certainly talk about it,” but he didn’t know whether the proposal would have enough caucus support.

“The challenge with doing anything right now would be that anything that we do would not be able to impact the property tax bills that people are going to get in March, it would be doing something a bit after the fact, which may not be as effective as we would all want,” Bray said Thursday.

He said his chamber is more so focused on a Senate GOP priority bill that seeks to form the State and Local Tax Review Commission to study the feasibility of ending Indiana’s income tax and reforming property taxes for Hoosiers.

Still, if a property tax measure can make it through both chambers, Indiana Gov. Eric Holcomb suggested he would be willing to give the greenlight.

“I wouldn’t be surprised if we do something during the course of this session,” Holcomb said Thursday. “We’re going to get at the root causes of the increases that are occurring. We’re in close conversation with the House and the Senate leadership and members on having the ability to do something that doesn’t change, fundamentally, the advancements we’ve made.”

The Indiana Capital Chronicle is an independent, not-for-profit news organization that covers state government, policy and elections.

Please enable JavaScript to view this content.

If everyone’s taxes go up considerably, where do all the extra dollars go? Don’t they go to all the taxing units and that means they are all getting considerably more across the board? So, if they cut (lower) our tax bills a few dollars, it’s not like they are getting less than in the past. It’s just that their increase would be close to reasonable, rather than extra large. Or, maybe I’m missing something.

Government’s costs have gone up just like everyone else’s.

Why not keep this simple and simply put a cap on how much the assessed value of a property (home) is allowed to be increased in a single year if not changes have been made to that property. Capping an annual assessed increase value at 2 to 5% would help avoid any sudden increases like what has recently happened. This would also be a long-term fix instead of one that goes away in a few years.

Here’s an idea – don’t put things like property tax caps in the state constitution.

It was a dumb over-reaction to some voters blaming Bart Peterson in Indianapolis for their expensive houses in Meridian-Kessler … being forced to pay an appropriate amount of property tax.

^^^This. Except it was based on an early 2000’s Indiana Supreme Court decision up in the region that required Assessors to value property at fair market value for assessments.

MK homeowners got a big break for many years, because the former system depreciated homes for age (without regard for actual condition or resale value). I know…I lived there during the period when my laughably-low property taxes tripled.

Any time you ask a government to manage costs [as a family, or a business must], it becomes an “unreasonable burden” to them. Human nature generally makes it difficult to care as much about other people’s money as your own. The proposed fix (setting a cap on the tax percentage of assessed value) shows the complete stupidity/naivete [pick one] of those who voted for it.

If we look at the formula, where M is the money the government wants, A is the assessed value, and C is the cap percentage, then we see M = the collective sum of all properties’ A x C. Fixing C does nothing to control government spending. The government (who, by the way, controls the process of setting A) merely increases A in order to generate the desired M. Genius!

I’m still amazed the property taxes shown on the IBJ Featured Home of the Week are usually much less than mine, while my house-property is valued at half of the house value shown, especially in Center Township.

Other things affect that. Sometimes the “home of the week” might be a flip into which an investor has put big dollars, but this year’s property taxes represent the value of the house last year since is hasn’t been reassessed with the improvements in it yet. Sometimes the homeowner might be over 65, which gets them an extra exemption amount. And sometimes the former owner might have filed assessment appeals. And maybe your house has been overvalued by the Assessor based on neighborhood increases.

I like the cap on the increase for a single year, but 2-5% is too much! People who own their homes and have retired or living off of disability can’t keep up with that. Not paying their property taxes will eventually cause them to lose their home to someone who pays a fraction of the value. Bad idea. Let’s go with 1%/year.

And yes, government’s costs have gone up just like everyone else’s, but the government has to tighten it’s belt just like the rest of us. Inflation is up 5-7%, but I can promise you very few Hoosiers will get a 5% salary increase to keep up with that.

Then we need TOTAL transparency. Where do all those dollars go? Specifically. When there is extra money, some should be saved in a rainy day fund ($1M max). The rainy day fund should be used for larger public projects that need any additional funding like roads, etc. And there should be and increase freeze if the rainy day fund goes over $1M annually.