Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

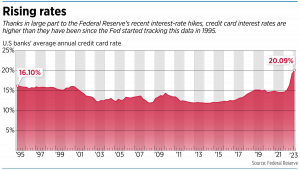

Credit card interest rates are at their highest in decades, and some small businesses are feeling the pinch.

According to the Federal Reserve, the average credit card interest rate charged by commercial banks was 20.1% at the end of the first quarter—the highest since the Fed began tracking this statistic in 1995. In comparison, that rate stood at 14.6% during the same period a year earlier.

The rising rates aren’t a surprise—the Fed’s interest-rate hikes over the past year or so have affected everything from mortgages to certificates of deposit.

But for a variety of reasons, credit card interest rate increases can affect small businesses more than large ones.

Cindy Dunston Quirk, founder and CEO of Anderson-based pet products company Scout & Zoe’s, said she prefers to pay off her credit card balances each month, but a series of events has made that impossible the past year or so.

“I’ve relied more on the credit cards now because, sometimes when you have a cash crunch, you have to,” Quirk said. “COVID kind of caught up with us in 2022.”

Nicole Kearney, founder of Indianapolis-based Sip & Share Wines, said her business is working to pay off a greater percentage of credit card balances each month to lower its interest costs.

Scout & Zoe’s sells food, treats and chews for dogs, cats and other pets. Quirk founded the company in 2010 and currently has two independent contractors who work with her, with two others she can call on during busy periods as needed.

After its two best years ever in 2020 and 2021, Scout & Zoe’s saw its orders decline last year. Then, in February, a customer that owed Quirk’s company $15,000 filed for bankruptcy. Quirk said she’s considering that debt a total loss. “When that happened, along with everything else, it seriously messed with my cash flow.”

In an effort to cut costs, Quirk recently transferred a $15,000 balance to a new credit card that offers 0% interest for the first year. The transfer came with a nearly $800 fee, but Quirk said it was worth it. “That gets me 0% for a year, vs. $250 a month in interest.”

Quirk is not alone. Small businesses are more likely than large companies to use credit cards in their operations.

“Credit card usage is going to be a bit more concentrated among smaller enterprises that don’t have as much access to other forms of credit,” said Aaron Hedlund, associate professor of economics at the Mitchell E. Daniels Jr. School of Business at Purdue University.

In a survey released in May by the National Federation of Independent Business Inc., credit cards were by far the most popular source of business financing.

Of 699 small-business owners polled by email April 14-18, 70% said they had used credit cards for financing within the last 12 months. Lines of credit were a distant second, with 33% of respondents saying they had used them in the past 12 months. Rounding out the options, 32% said they had tapped into personal savings, 26% used a business loan, 4% had taken a loan from friends and/or family, and 4% tapped into their home’s equity.

In a separate small-business survey released in May by J.P. Morgan Chase & Co., 58% of respondents said they paid off their credit card balances every month last year. Another 17% said they carried a balance every month, and the remaining 25% said they carried a balance for at least part of the year.

Kearney, the Sip & Share Wines founder, said she uses three different credit cards to pay for goods for her business, a boutique winery that launched in 2018 and specializes in vegan wines. The company has three local employees, with another eight contractors across the country.

A year ago, those cards carried interest rates between 10% and 12%. Now, the rates are between 13% and 16%, Kearney said.

Until now, her goal has been to pay 40% to 50% of her balances each month, but she’s now working to get those balances paid down. Her current goal is to pay 70% to 75% of each month’s balance.

Paying down credit-card debt will reduce the company’s interest expenses, Kearney said, but at the same time she also needs to preserve some cash. “It’s that tricky balance.”

Kearney said she’s also being “much more mindful” of her purchasing, including looking for lower-cost vendors and holding off on purchases when possible. “It’s definitely something we have to think twice about,” she said.

When credit card interest rates go up, Hicks said, small companies might see their expenses go up and their revenue go down at the same time. “Smaller businesses feel it on both sides of the ledger—both on the buying side and the spending side.”

To deal with the situation, Quirk is looking for ways to boost her revenue. Right now, the majority of Scout & Zoe’s revenue comes from wholesaling—selling products to retailers who then sell to consumers. But Quirk is looking to change that, and said she has “a laser focus” on growing her direct-to-consumer online sales. “I’ve got to go where the people are buying—and that’s [pet retail website] Chewy, and Amazon, and our own website.”

Kearney said she’s working with a community development financial institution to secure financing that would allow her to consolidate debt and finance business expansion.

As a piece of advice to other small-business owners, Kearney said it pays to do business with multiple banks, because they all offer slightly different products and have different policies, increasing the chance that you can find the best fit for your needs. And those banks might even be willing to compete with one another to win your business, she said.

Kearney also advises getting to know the people at those banks. When she was getting started with her business, she said, she made a point to conduct her banking at different branches as a way to meet more of each bank’s employees.

If your bank knows you better, “they’re willing to negotiate better rates with you,” Kearney said. “Building that relationship way before you ever need it is key.”•

Please enable JavaScript to view this content.