Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowSixty-one percent of Hoosiers in extremely low-income households can’t find an affordable rental, instead spending more than half of their income on housing with little left for food or other necessities, according to a newly released analysis.

The report from Prosperity Indiana and the National Low Income Housing Coalition, “The Gap: A Shortage of Affordable Homes,” quantifies the affordable housing shortage at 120,796 rental homes for extremely low-income households–meaning families who make 30% or less of their area median income or live below the poverty level.

Roughly one-quarter of renter households are extremely low income, earning less than $26,500 per year for a four-person household.

“Despite an improving state and national economy, this year’s Gap report finds that Indiana is making far too little progress to increase the supply, affordability and habitability of housing to meet demand in all 92 counties,” said Andrew Bradley, the Prosperity Indiana policy director, in a release.

“Indiana’s policymakers at the state, federal and local levels must take advantage of every opportunity to focus efforts on increasing the supply of deeply affordable units; increasing funding for preserving the stock of existing affordable housing and preventing the artificial depletion of supply by strengthening the enforcement of habitability standards.”

Findings from the report

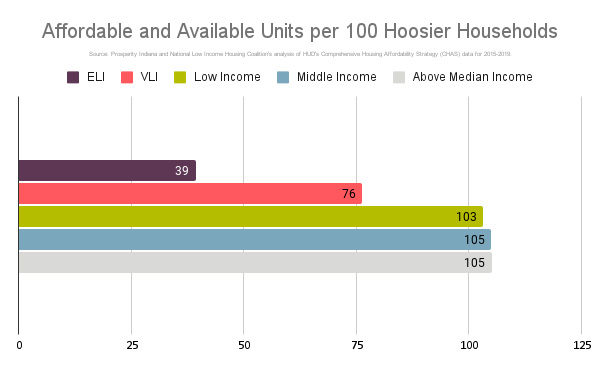

For those making 100% of the area’s median income, or even 80%, the data paints a different story–with slightly more than 100 affordable and available homes for every 100 renters, creating a surplus of 39,223 affordable homes and 16,336 homes, respectively.

But availability sharply decreases as poverty increases, with 76 homes available for those making 50% of the area median income–considered very low income–and just 39 rentals for those with extremely low incomes.

Of those renters, just over one-third are working–at full-time or near full-time hours–while another quarter are senior renters and one-fifth are disabled.

“The housing gap for affordable and available housing in Indiana means that while the highest-earning households have their pick among all rental units, Hoosiers at lower income levels must compete for the remaining available housing stock,” the report said.

The 177,858 households with incomes above the median could afford any of the state’s 813,063 rental units but sometimes choose to rent an even cheaper unit, decreasing the supply for those with lower incomes. While the state has 152,592 affordable homes from extremely low-income households, the spillover of wealthier renters means that there are just 120,796 affordable units available for more than 199,000 families.

Disproportionately, the families in the very low and extremely low brackets are Hoosiers of color, specifically Black Hoosiers. Minorities have long been subject to laws and other hurdles barring them from homeownership, preventing them from accumulating wealth at the same pace as their white counterparts.

Actions in the General Assembly, Congress

The report attributes part of Indiana’s housing problems to landlord-friendly laws, including one that bars tenants from withholding rent or using a receivership should their rental need crucial repairs.

An intensive summer study committee, led by homebuilders, mostly dedicated its efforts to incentivizing construction, rather than addressing the current housing supply. House Bill 1005, the result of that study, would establish a revolving fund to cover infrastructure costs related to housing construction but primarily in areas with less than 50,000 residents.

Several have criticized the bill, saying it encourages construction in parts of the state where few want to live while simultaneously subsidizing developers. Proponents of the fund argue that the investment is needed to boost economic development.

On the federal level, Indiana Senator Todd Young, a Republican, and Maryland Senator Ben Cardin, a Democrat, introduced a $2 billion tax credit proposal to address the affordable housing shortage earlier this month. The federal tax credit would cover the cost between homebuilding/renovating and their sale price, capping their price to ensure they remain affordable.

On his page, Young describes the Neighborhood Homes Investment Act as a way to restore communities and direct private capital into low-income census tracts.

“This legislation also includes important guardrails to ensure that tax incentives target the families that need it most, continuing the work to avoid the negative and lasting consequences that a lack of safe, affordable housing has on Hoosier families,” Young said in a release.

The tax credit is estimated to create $125 billion in development revenue and revitalize 500,000 homes, including 10,000 in Indiana. However, it targets those making less than 80% of the area median income, not just the very low income or extremely low income.

“As this year’s Gap report makes clear, extremely low-income renters are facing a staggering shortage of affordable and available homes,” said Diane Yentel, the president and CEO of the National Low Income Housing Coalition. “In the wake of the pandemic, federal housing investments are more critical than ever for sustaining our communities and helping low-income people thrive.”

The Indiana Capital Chronicle is an independent, not-for-profit news organization that covers state government, policy and elections.

Please enable JavaScript to view this content.

How much federal grant money was wasted to tell them what anyone with an ounce of common sense already knew?

The supply was created for a certain population. However, there are vast numbers of people here who do not pay taxes. And, they disproportionately take up the affordable housing that might otherwise be available.

And, if you will check the IBJ articles from the last 3 years, you will see incredibly renter-friendly decisions that further depleted the supply of affordable housing.

What you need are MORE landlord-friendly laws–such as quick and low-cost evictions for non-payment. Once you have that, more landlords will enter the market, knowing that their investments could pay off. As it is, good landlords leave (or do not enter) the market, investing their money elsewhere. That leaves a higher percentage of almost industrial-level (often out-of-state) investors who have little if any interest in vetting the renters and bettering neighborhoods and the like. This, in turn, engenders dislike of rental units in homeowners associations.

Patrick, you do know Indiana is one of the most landlord friendly states right? We don’t need more laws. We need more supply and a balanced market. It’s a supply shortage combined with buyers who secured super LOW INTEREST RATES. They’re not selling in the next 10 yrs unless they fall on bad times or unemployment starts ticking up. I agree with the corporate landlords (big business) and lack of care for tenants but I’m a landlord myself. Our properties are in C class areas. We self manage and it’s completely different. It’s all about scale. The higher the units the lower the quality of PM.

Why do we have such a supply shortage, Jaron, when birth rates are at an all time low and population growth is generally stagnant? How did this supply shortage emerge so suddenly in just the last three years? How long can we continue to blame the bottlenecks and destabilization of the construction industry? They’d absolutely love to crank out more homes while it’s this lucrative.

At some point we have to recognize that the supply shortage can only accompany a surge in demand, but since there’s not a surge of young people (youngest Millennials, oldest Gen Zers) seeking housing since many are still living with their ‘rents, who is causing that surge in demand?

I could look southward–FAR southward–but that apparently makes me a racist. Oh well.

Jaron, you are right. I should have written my comment better. We do not need more laws. We need to take down the laws that are interfering with the market. It may seem counter-intuitive, but taking down some of the tenant-friendly laws would actually create more supply. For example, my wife and I considered taking some of our savings to buy property in our neighborhood to rent. However, after researching it, I decided that what a bad renter could do to a landlord was not worth the risk. During the pandemic, the executive branch of the government (and less often the legislative branch) literally allowed renters to stop paying rent, and imposed a moratorium on evictions. Meanwhile, for some of these renters, they were making more money with Covid relief than they had made before. It was ridiculous. Meanwhile, I have seen scumbag tenants who literally take appliances, lighting, baseboards, and even flood the units on purpose. No one is prosecuted, because the cops say that is a matter for landlord-tenant court. Even after the moratoria were lifted, the judiciary then inflicted insult after injury by imposing unnecessary, costly mediations on landlords who just wanted deadbeats gone.